Retirees on Social Safety obtain a rise of their Social Safety advantages every year often called the Value of Dwelling Adjustment or COLA. The COLA was 3.2% in 2024. Retirees on Social Safety will as soon as once more obtain a COLA in 2025 however it received’t be as huge because the one in 2024 as a result of inflation has cooled down.

Computerized Hyperlink to Inflation

Some retirees suppose the COLA is given on the discretion of the President or Congress and so they need their elected officers to care for seniors by declaring a better COLA. They blame the President or Congress once they suppose the rise is simply too small.

It was achieved that approach earlier than 1975 however the COLA has been robotically linked to inflation for practically 50 years. How a lot the COLA will likely be is set strictly by the inflation numbers. The COLA is excessive when inflation is excessive. It’s low when inflation is low. There’s no COLA when inflation is zero or damaging, which occurred in 2010, 2011, and 2016.

CPI-W

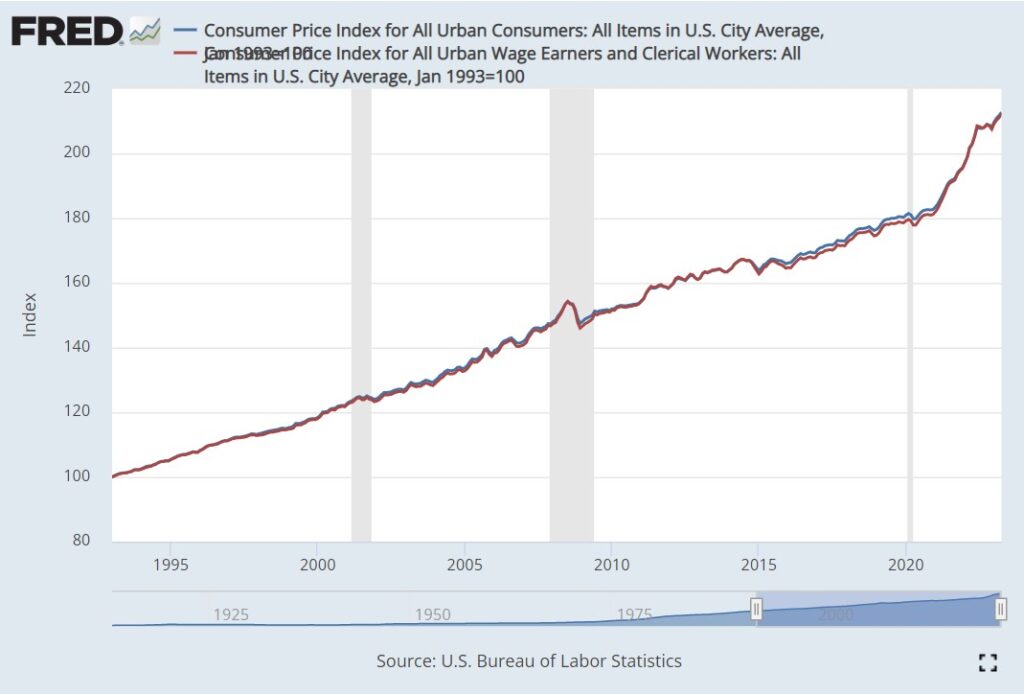

Particularly, the Social Safety COLA is set by the rise within the Shopper Worth Index for City Wage Earners and Clerical Employees (CPI-W). CPI-W is a separate index from the Shopper Worth Index for All City Customers (CPI-U), which is extra usually referenced by the media once they speak about inflation.

CPI-W tracks inflation skilled by staff. CPI-U tracks inflation skilled by customers. There are some minor variations in how a lot weight completely different items and providers have in every index however CPI-W and CPI-U look virtually similar while you put them in a chart.

The purple line is CPI-W and the blue line is CPI-U. They differed by solely smidges in 30 years.

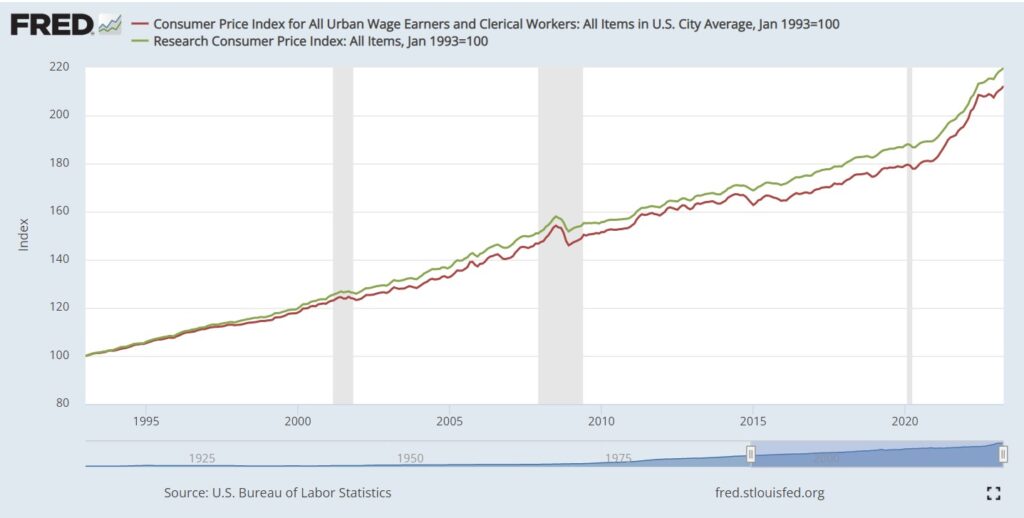

There’s additionally a analysis CPI index known as the Shopper Worth Index for Individuals 62 years of age and older, or R-CPI-E. This index weighs extra by the spending patterns of older Individuals. Some researchers argue that the Social Safety COLA ought to use R-CPI-E, which has elevated greater than CPI-W within the final 30 years.

The inexperienced line is R-CPI-E. The purple line is CPI-W. R-CPI-E outpaced CPI-W in 30 years between 1993 and 2023 however not by a lot. Had the Social Safety COLA used R-CPI-E as a substitute of CPI-W, Social Safety advantages would’ve been greater by 0.1% per yr, or a little bit over 3% after 30 years. That’s nonetheless not a lot distinction.

No matter which precise CPI index is used to calculate the Social Safety COLA, it’s topic to the identical total worth surroundings. Congress selected CPI-W 50 years in the past. That’s the one we’re going with.

Q3 Common

Extra particularly, Social Safety COLA for subsequent yr is calculated by the rise within the common of CPI-W from the third quarter of final yr to the third quarter of this yr. You get the CPI-W numbers in July, August, and September. Add them up and divide by three. You do the identical for July, August, and September final yr. Examine the 2 numbers and around the change to the closest 0.1%. That’ll be the Social Safety COLA for subsequent yr.

2025 Social Safety COLA

We received’t have all of the CPI-W information for Q3 2024 till October 10, 2024 however we will make projections primarily based on the information we’ve got now.

If client costs in August and September 2024 keep on the similar degree as in July 2024, the 2025 Social Safety COLA will likely be 2.4%.

If client costs in August and September 2024 go up at a tempo of three% annualized (roughly 0.25% in every month), the 2025 Social Safety COLA will likely be 2.7%.

I estimate that the 2025 Social Safety COLA will likely be between 2.4% and a pair of.7%. That is decrease than the three.2% Social Safety COLA in 2024 as a result of inflation has come down.

Medicare Premiums

In the event you’re on Medicare, the Social Safety Administration robotically deducts the Medicare premium out of your Social Safety advantages. The Social Safety COLA is given on the “gross” Social Safety advantages earlier than deducting the Medicare premium and any tax withholding.

Medicare declares the premium for subsequent yr across the similar time Social Safety declares the COLA however not essentially on the identical day. The rise in healthcare prices is a part of the price of dwelling that the COLA is meant to cowl. You’re nonetheless getting the complete COLA although part of the COLA will likely be used towards the rise in Medicare premiums.

Retirees with a better earnings pay greater than the usual Medicare premiums. That is known as Earnings-Associated Month-to-month Adjustment Quantity (IRMAA). I cowl IRMAA in 2024 2025 2026 Medicare IRMAA Premium MAGI Brackets.

Root for a Decrease COLA

Folks intuitively need a greater COLA however a better COLA can solely be brought on by greater inflation. Greater inflation is dangerous for retirees.

Whether or not inflation is excessive or low, your Social Safety advantages may have the identical buying energy. You need to suppose extra concerning the buying energy of your financial savings and investments outdoors Social Safety. When inflation is excessive, although your Social Safety advantages get a bump, your different cash loses extra worth to inflation. Your financial savings and investments outdoors Social Safety will last more when inflation is low.

You need a decrease Social Safety COLA, which suggests decrease inflation and decrease bills.

Some individuals say that the federal government intentionally under-reports inflation. Even when that’s the case, you continue to need a decrease COLA.

Suppose the true inflation for seniors is 3% greater than the inflation numbers reported by the federal government. In the event you get a 3% COLA when the true inflation is 6% and also you get a 7% COLA when the true inflation is 10%, you’re a lot better off with a decrease 3% COLA along with 6% inflation than getting a 7% COLA along with 10% inflation. Your Social Safety advantages lag inflation by the identical quantity both approach, however you’d relatively your different cash outdoors Social Safety loses to six% inflation than to 10% inflation.

Root for decrease inflation and decrease Social Safety COLA if you end up retired.

Say No To Administration Charges

In case you are paying an advisor a proportion of your property, you’re paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.