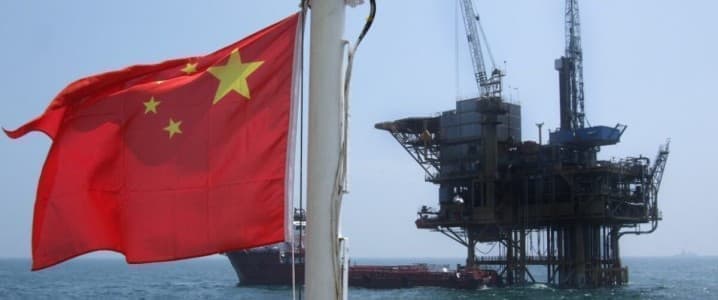

China is closing 2025 with the strongest home crude output in its trendy historical past, ending its Seven-12 months Motion Plan (2019–2025) with measurable good points. Nationwide manufacturing has risen from 3.8 million b/d in 2020 to a mean of 4.3 million b/d in 2025, a roughly 12% improve, pushed by accelerated drilling exercise, rising unconventional output, and probably the most vital restructuring of its upstream sector in a long time. The growth displays Beijing’s strategic goal to strengthen power safety by means of home provide, at the same time as total demand continues to develop.

The present reshaping of China’s upstream started in 2020, when the federal government changed administrative allocation of mining and hydrocarbon rights with a market-oriented bidding and public sale framework, later codified below the 2025 Mineral Assets Legislation. That reform signalled a break from legacy state task practices and opened the door for China’s privately owned home corporations to take part in exploration acreage alongside nationwide champions. In 2025, the Ministry of Pure Assets held six licensing rounds protecting 23 blocks, marking probably the most intensive launch of acreage to non-state Chinese language operators up to now.

These structural adjustments and rising funding capital have had seen regional results. Tianjin lifted output from 632,000 b/d in 2020 to 785,000 b/d in 2025, the only largest regional improve, whereas Xinjiang superior from 571,000 to 649,000 b/d as deep and tight-reservoir testing expanded. Heilongjiang eased barely decrease from 604,000 to 579,000 b/d, underscoring the maturity of Daqing-era legacy fields and the strain to interchange declining manufacturing.

Regardless of the coverage opening to personal corporations, the business stays dominated by state-owned enterprises. PetroChina is the most important oil producer, averaging 2.5 million b/d in 2025 and holding round 1.2 million km2 of onshore acreage throughout the Sichuan, Tarim, Ordos, Junggar, Songliao and Qaidam basins, spanning standard, tight, and shale developments as the corporate intensifies unconventional exploration.

Associated: EIA: US Crude Inventories Sag As Oil Merchandise Develop

CNOOC (China Nationwide Offshore Firm) has been the standout in output progress, increasing manufacturing from 690,000 b/d in 2020 to about 900,000 b/d in 2025, supported by 650,000 km2of offshore acreage throughout the Bohai Gulf and South China Sea. Though traditionally an offshore-focused producer, CNOOC has moved to broaden its onshore presence as new performs emerge and the corporate positions itself towards useful resource focus threat. In the meantime, one other Chinese language oil and gasoline state-owned main Sinopec (with 600,000 b/d of manufacturing in 2025) maintains substantial upstream weight in Sichuan, Tarim, Subei and the onshore Bohai Basin, supported by round 700,000 km2 of onshore acreage and 100,000 km2 offshore, consolidating its function throughout oil and gasoline corridors within the nation’s southwest and much west.

China is closing 2025 with the strongest home crude output in its trendy historical past, ending its Seven-12 months Motion Plan (2019–2025) with measurable good points. Nationwide manufacturing has risen from 3.8 million b/d in 2020 to a mean of 4.3 million b/d in 2025, a roughly 12% improve, pushed by accelerated drilling exercise, rising unconventional output, and probably the most vital restructuring of its upstream sector in a long time. The growth displays Beijing’s strategic goal to strengthen power safety by means of home provide, at the same time as total demand continues to develop.

The present reshaping of China’s upstream started in 2020, when the federal government changed administrative allocation of mining and hydrocarbon rights with a market-oriented bidding and public sale framework, later codified below the 2025 Mineral Assets Legislation. That reform signalled a break from legacy state task practices and opened the door for China’s privately owned home corporations to take part in exploration acreage alongside nationwide champions. In 2025, the Ministry of Pure Assets held six licensing rounds protecting 23 blocks, marking probably the most intensive launch of acreage to non-state Chinese language operators up to now.

These structural adjustments and rising funding capital have had seen regional results. Tianjin lifted output from 632,000 b/d in 2020 to 785,000 b/d in 2025, the only largest regional improve, whereas Xinjiang superior from 571,000 to 649,000 b/d as deep and tight-reservoir testing expanded. Heilongjiang eased barely decrease from 604,000 to 579,000 b/d, underscoring the maturity of Daqing-era legacy fields and the strain to interchange declining manufacturing.

Regardless of the coverage opening to personal corporations, the business stays dominated by state-owned enterprises. PetroChina is the most important oil producer, averaging 2.5 million b/d in 2025 and holding round 1.2 million km2 of onshore acreage throughout the Sichuan, Tarim, Ordos, Junggar, Songliao and Qaidam basins, spanning standard, tight, and shale developments as the corporate intensifies unconventional exploration.

Associated: EIA: US Crude Inventories Sag As Oil Merchandise Develop

CNOOC (China Nationwide Offshore Firm) has been the standout in output progress, increasing manufacturing from 690,000 b/d in 2020 to about 900,000 b/d in 2025, supported by 650,000 km2of offshore acreage throughout the Bohai Gulf and South China Sea. Though traditionally an offshore-focused producer, CNOOC has moved to broaden its onshore presence as new performs emerge and the corporate positions itself towards useful resource focus threat. In the meantime, one other Chinese language oil and gasoline state-owned main Sinopec (with 600,000 b/d of manufacturing in 2025) maintains substantial upstream weight in Sichuan, Tarim, Subei and the onshore Bohai Basin, supported by round 700,000 km2 of onshore acreage and 100,000 km2 offshore, consolidating its function throughout oil and gasoline corridors within the nation’s southwest and much west.