Discover out which banks are providing the finest CD charges proper now. In case you’re on the lookout for a safe place to retailer your financial savings, a certificates of deposit (CD) could also be an amazing alternative. These accounts typically present greater rates of interest than conventional checking and financial savings accounts. Nonetheless, CD charges can differ extensively.

Be taught extra about the place CD charges stand at this time and the best way to discover the very best charges out there.

CD charges are comparatively excessive in comparison with historic averages. That stated, CD charges have been on the decline since final yr when the Federal Reserve started slicing its goal price. The excellent news is that a number of monetary establishments supply aggressive charges of 4% APY and up, notably on-line banks.

Immediately, the very best CD price is 4% APY. This price is obtainable by Marcus by Goldman Sachs on its 1-year CD.

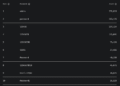

Here’s a take a look at among the finest CD charges out there at this time from our verified companions:

The Federal Reserve started lowering the federal funds price in mild of slowing inflation and an general improved financial outlook. It reduce its goal price 3 times in late 2024 by a complete of 1 share level.

In December, the Fed introduced its third price reduce of 2025 and extra cuts may very well be on the horizon in 2026. Nonetheless, it is unsure when that can occur and what number of cuts the Fed plans to make.

The federal funds price doesn’t immediately impression deposit rates of interest, although they’re correlated. When the Fed lowers charges, monetary establishments usually observe swimsuit (and vice versa). So now that the Fed has lowered its price, CD charges are starting to fall once more. That’s why now could also be a superb time to place your cash in a CD and lock in at this time’s finest charges.

The method for opening a CD account varies by monetary establishment. Nonetheless, there are a number of normal steps you may count on to observe:

-

Analysis CD charges: Probably the most essential components to contemplate when opening a CD is whether or not the account gives a aggressive price. You may simply evaluate CD charges on-line to search out the very best provides.

-

Select an account that meets your wants: Whereas a CD’s rate of interest is a key consideration, it shouldn’t be the one one. You also needs to consider the CD’s time period size, minimal opening deposit necessities, and charges to make sure a selected account matches your monetary wants and targets. For instance, you wish to keep away from selecting a CD time period that’s too lengthy, in any other case you’ll be topic to an early withdrawal penalty if you could pull out your funds earlier than the CD matures.

-

Get your paperwork prepared: When opening a checking account, you will have to offer a number of items of data, together with your Social Safety quantity, deal with, and driver’s license or passport quantity. Having these paperwork available will assist streamline the applying course of.

-

Full the applying: Lately, many monetary establishments can help you apply for an account on-line, although you may need to go to the department in some instances. Both method, the applying for a brand new CD ought to solely take a couple of minutes to finish. And in lots of instances, you’ll get your approval determination immediately.

-

Fund the account: As soon as your CD software is permitted, it’s time to fund the account. This will normally be completed by transferring cash from one other account or mailing a test.

Learn extra: Step-by-step directions for opening a CD

Discover out which banks are providing the finest CD charges proper now. In case you’re on the lookout for a safe place to retailer your financial savings, a certificates of deposit (CD) could also be an amazing alternative. These accounts typically present greater rates of interest than conventional checking and financial savings accounts. Nonetheless, CD charges can differ extensively.

Be taught extra about the place CD charges stand at this time and the best way to discover the very best charges out there.

CD charges are comparatively excessive in comparison with historic averages. That stated, CD charges have been on the decline since final yr when the Federal Reserve started slicing its goal price. The excellent news is that a number of monetary establishments supply aggressive charges of 4% APY and up, notably on-line banks.

Immediately, the very best CD price is 4% APY. This price is obtainable by Marcus by Goldman Sachs on its 1-year CD.

Here’s a take a look at among the finest CD charges out there at this time from our verified companions:

The Federal Reserve started lowering the federal funds price in mild of slowing inflation and an general improved financial outlook. It reduce its goal price 3 times in late 2024 by a complete of 1 share level.

In December, the Fed introduced its third price reduce of 2025 and extra cuts may very well be on the horizon in 2026. Nonetheless, it is unsure when that can occur and what number of cuts the Fed plans to make.

The federal funds price doesn’t immediately impression deposit rates of interest, although they’re correlated. When the Fed lowers charges, monetary establishments usually observe swimsuit (and vice versa). So now that the Fed has lowered its price, CD charges are starting to fall once more. That’s why now could also be a superb time to place your cash in a CD and lock in at this time’s finest charges.

The method for opening a CD account varies by monetary establishment. Nonetheless, there are a number of normal steps you may count on to observe:

-

Analysis CD charges: Probably the most essential components to contemplate when opening a CD is whether or not the account gives a aggressive price. You may simply evaluate CD charges on-line to search out the very best provides.

-

Select an account that meets your wants: Whereas a CD’s rate of interest is a key consideration, it shouldn’t be the one one. You also needs to consider the CD’s time period size, minimal opening deposit necessities, and charges to make sure a selected account matches your monetary wants and targets. For instance, you wish to keep away from selecting a CD time period that’s too lengthy, in any other case you’ll be topic to an early withdrawal penalty if you could pull out your funds earlier than the CD matures.

-

Get your paperwork prepared: When opening a checking account, you will have to offer a number of items of data, together with your Social Safety quantity, deal with, and driver’s license or passport quantity. Having these paperwork available will assist streamline the applying course of.

-

Full the applying: Lately, many monetary establishments can help you apply for an account on-line, although you may need to go to the department in some instances. Both method, the applying for a brand new CD ought to solely take a couple of minutes to finish. And in lots of instances, you’ll get your approval determination immediately.

-

Fund the account: As soon as your CD software is permitted, it’s time to fund the account. This will normally be completed by transferring cash from one other account or mailing a test.

Learn extra: Step-by-step directions for opening a CD