Michael Saylor has had fairly the 12 months. MicroStrategy (NASDAQ: MSTR), the corporate he co-founded roughly 35 years in the past, is up greater than 500% in 2024. The billionaire has additionally seen his web value climb by about $1 billion, in response to Fortune.

Bitcoin (CRYPTO: BTC), the world’s largest cryptocurrency, is behind Saylor’s luck, as MicroStrategy is its largest publicly traded holder, and Saylor additionally owns a variety of Bitcoin personally. Whereas the positive factors have been huge, Saylor thinks the nice occasions are simply beginning to roll, and believes one BlackRock index fund may rise greater than 13,760% over time.

Are You Lacking The Morning Scoop? Get up with Breakfast information in your inbox each market day. Signal Up For Free »

Saylor is certainly one of Bitcoin’s largest bulls. MicroStrategy held the token via harder occasions and is now reaping the rewards. Nevertheless, Saylor sees a a lot brighter future for Bitcoin. In September, Saylor mentioned he may see Bitcoin hitting $13 million by 2045.

Saylor’s logic is twofold. His first argument is that Bitcoin is just 0.1% of the world’s capital. By 2045, this quantity will improve to 7% of world capital, he predicts.

Saylor’s second argument considerations the expansion charge of Bitcoin’s value. He mentioned that Bitcoin has put up annual returns of 46% for the final 4 years. His base case assumes 29% annual returns shifting ahead, which is how he arrives at his $13 million goal by 2045.

One exchange-traded fund (ETF) that tracks spot Bitcoin costs is the iShares Bitcoin Belief (NASDAQ: IBIT). BlackRock, the biggest asset supervisor on the earth, launched the fund earlier this 12 months as soon as the Securities and Change Fee (SEC) gave the inexperienced mild for spot Bitcoin ETFs.

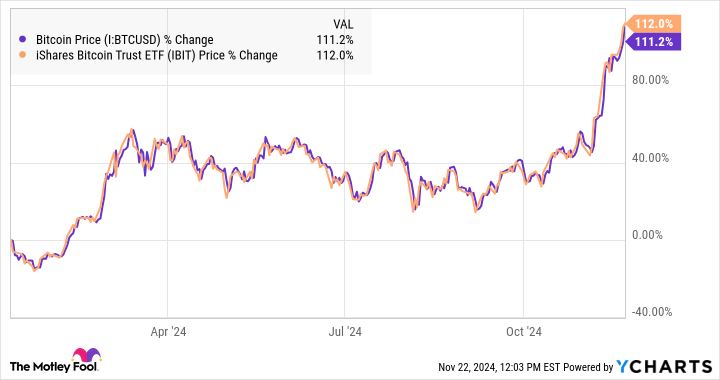

Spot Bitcoin ETFs try to mirror the value of Bitcoin by shopping for precise Bitcoin tokens to carry in reserve. Every ETF share is straight backed by a fraction of a Bitcoin, held in a custodial account on behalf of the fund supervisor. As anticipated, iShares Bitcoin Belief has virtually precisely matched Bitcoin’s returns in 2024.

Buying a Bitcoin ETF helps buyers keep away from the operational, tax, and custody difficulties of buying precise tokens. ETFs have small charges buyers should pay, which assist cowl issues like advertising for the fund. The payment for iShares is 0.12% of every investor’s holdings till Jan. 11, 2025, or when iShares reaches $5 billion in belongings, at which level the payment will double to 0.25%.

It is not possible to know whether or not Saylor’s prediction will come true. Making value predictions is troublesome for steady blue chip shares, not to mention unstable cryptocurrencies, and this value goal is ready greater than twenty years sooner or later. Moreover, the regulation of huge numbers means that as Bitcoin’s value grows, will probably be tougher to understand the identical unimaginable positive factors.