All of us ought to assume by now that our names, addresses, cellphone numbers, and Social Safety Numbers are all on the market within the open after all of the hacks. We are able to solely shield ourselves by including two-factor authentication to all our accounts (ideally with safety {hardware} or Google Voice numbers protected by safety {hardware}).

ChexSystems Safety Freeze

Freezing our credit score helps stop identification thieves from making use of for credit score in our names. Getting an IP PIN from the IRS helps stop thieves from submitting a fraudulent tax return utilizing our info.

It’s much less identified that we also needs to place a safety freeze with ChexSystems. ChexSystems is a credit score reporting company that gives details about the usage of financial institution accounts. Banks and credit score unions could report you to ChexSystems in the event you bounce checks or in any other case trigger a unfavorable stability in your checking account. If you open a brand new account at one other financial institution or credit score union, they might examine your repute with ChexSystems. In response to Wikipedia, 80% of economic banks and credit score unions within the U.S. use ChexSystems to display functions for checking and financial savings accounts.

If somebody opens a checking account in your identify and defrauds the financial institution, the financial institution will report the incident beneath your identify and Social Safety Quantity. It should make it tougher while you wish to open a brand new account. Inserting a safety freeze at ChexSystems helps stop fraud by somebody opening a checking account in your identify.

Opening a faux account in your identify can be typically step one in stealing cash out of your actual accounts. Banks scrutinize switch requests much less once they see the cash goes to a different account in your identify (however the receiving account is definitely managed by the thieves). You make your accounts safer by blocking that exit path while you stop thieves from opening a faux account in your identify.

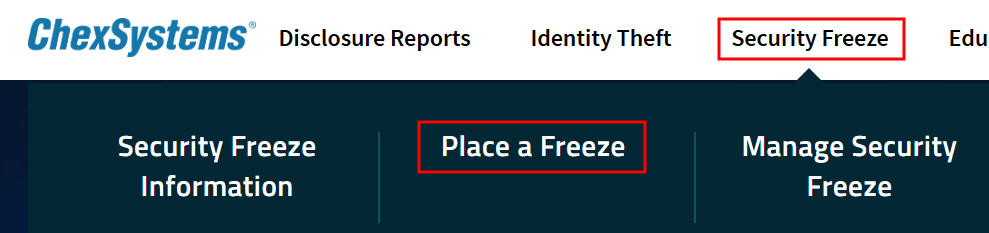

To position a safety freeze with ChexSystems, go to chexsystems.com, click on on “Safety Freeze” on the prime, after which click on on “Place a Freeze.” You’ll be requested to register with ChexSystems. You’ll obtain a 12-digit Safety Freeze PIN after you place the freeze. This PIN is required to thaw the freeze earlier than you open a brand new checking account.

Client ID from the Previous

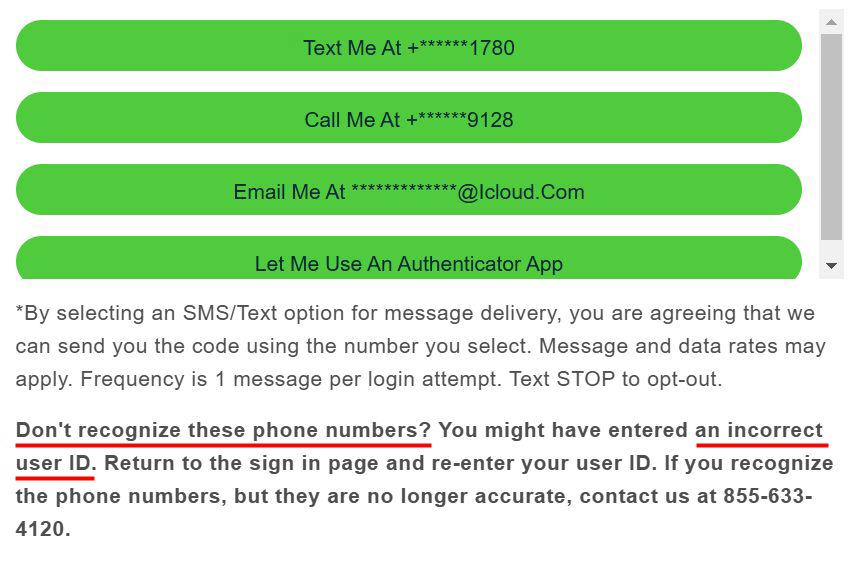

I positioned a safety freeze with ChexSystems a number of years in the past. ChexSystems despatched me an 8-digit Client ID and a 12-digit Safety Freeze PIN by mail at the moment. I noticed one thing like this once I tried to make use of the 8-digit Client ID to log in at ChexSystems:

It threw me off for a minute as a result of I didn’t acknowledge the displayed cellphone numbers or the e-mail tackle. Then I learn the footnote and realized it solely meant that I couldn’t use the 8-digit Client ID to log in. ChexSystems modified its system. The brand new client portal requires a username and a password separate from the Client ID. It shows random cellphone numbers and e mail addresses when it doesn’t acknowledge the username.

I wanted to re-register with the brand new client portal and create a username and a password once I solely had an 8-digit Client ID from the previous. The prevailing 12-digit Safety Freeze PIN continues to be good.

Disclosure and Rating

Banks and credit score unions solely report unfavorable suggestions to ChexSystems. They don’t say how good you might be. They solely offer you a black mark once they don’t like one thing. You need to see nothing has been reported to ChexSystems.

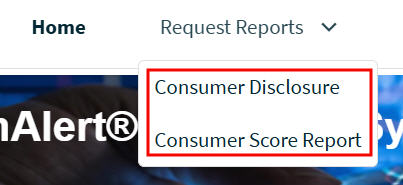

You possibly can examine your information after you place the safety freeze. You see these two choices on the highest beneath “Request Studies”: Client Disclosure and Client Rating Report.

If both the Client Disclosure or the Client Rating Report doesn’t show immediately, ChexSystems will e mail you in a couple of days when it’s prepared for you within the portal.

The Client Disclosure report lists any unfavorable info ChexSystems obtained from banks and credit score unions. A clean part is an efficient report. You need to file a dispute in the event you see one thing inaccurate there. This disclosure report additionally reveals who inquired about your repute with ChexSystems within the final 5 years.

The Client Rating Report reveals a rating just like a credit score rating. The buyer scores vary from 100 to 899. The next rating signifies a decrease threat. My rating was 648. It sounds low however it’s apparently a adequate rating. I by no means had any issues with opening financial institution accounts. I discovered one other blogger saying his ChexSystems rating was 652 and he had by no means been declined for a checking account both. It feels like I’m in good firm.

Verify your ChexSystems report and rating in the event you’re curious however crucial half right here is to put the safety freeze.

Say No To Administration Charges

If you’re paying an advisor a proportion of your property, you might be paying 5-10x an excessive amount of. Discover ways to discover an unbiased advisor, pay for recommendation, and solely the recommendation.