Till a couple of weeks in the past, there was a consensus available on the market about 2025, with most analysts coming into line with the Financial institution of Israel’s forecasts: One or two rate of interest cuts in the midst of the 12 months, and annual inflation of two.6%. However in latest weeks, optimistic information on the economic system have begun to build up, and analysts at the moment are divided. Forecasters now anticipate extra rate of interest cuts, maybe beginning as early as April, and the vary of inflation forecasts has widened.

The ceasefire and hostage launch deal that got here into drive on Sunday have strengthened expectations that 2025 can be good for the Israeli economic system. The Tel Aviv 35 Index has risen by almost 6% because the begin of the 12 months. Israel’s danger premium, as mirrored within the 10-year credit score default swap (CDS), has declined prior to now few weeks. In actual fact, since final October and the UAV assault by Iran, Israel’s CDS has fallen by 30%. Yields on Israeli authorities bonds have correspondingly declined.

The shekel has been impressively sturdy, with the shekel-US greenback change price falling 7% since August, and the shekel is at a two-year peak towards the basket of the currencies of Israel’s important buying and selling companions. Yesterday, the consultant shekel-dollar price fell to NIS 3.58/$. The stronger shekel means cheaper imports and, probably, decrease inflation.

The Shopper Value Index studying for December, launched final week, confirmed annual inflation operating at 3.2%, which compares with a forecast of three.4%. The specialists are unanimous that, within the coming months, we will see the inflation price rising, and even approaching 4%, following rises in arnona (native property tax), water and electrical energy, the 1% hike within the price of VAT, larger buy tax on vehicles, and different authorities measures that can hit Israelis’ pockets. Inflation might due to this fact rise, however disposable earnings will fall, which is liable to result in decreased non-public consumption.

Three rate of interest eventualities

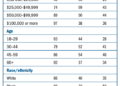

These primarily optimistic figures have pressured analysts to replace their predictions, each for inflation and for rates of interest. The consensus inflation price forecast for 2025 has now grow to be a 2.4-2.8% vary, and the vary of forecasts for the variety of rate of interest cuts has additionally broadened, from 1-2 to 1-3.

Three attainable eventualities emerge from a comparability of the analysts’ forecasts. The primary, that of the Financial institution of Israel, sees one or two rate of interest cuts in the midst of the 12 months, and annual inflation of two.6%; the second, shared by Financial institution Hapoalim, Low cost Financial institution, and insurance coverage firm Harel, envisions two rate of interest cuts and inflation of two.4-2.8%; the third situation is widespread to Mizrahi Tefahot Financial institution, Chief Capital Markets, and Meitav, which see three rate of interest cuts and inflation of two.4-2.7%.

RELATED ARTICLES

Essentially the most optimistic forecast comes from Chief Capital Markets chief economist Jonathan Katz. He estimates that the Financial institution of Israel may reduce its rate of interest thrice over the 12 months, to three.75%, and sees the primary reduce coming in April.

“The principle shift is within the timing of the primary reduce,” Katz says in his up to date forecast. “It now appears to be like as if the Financial institution of Israel goes to make a primary discount not earlier than April, as soon as it sees components of inflation moderating after the taxation rises at the start of the 12 months.”

Katz expects the Israeli economic system to enhance steadily due to the strengthening forex and easing of constraints on the availability facet, together with the return of overseas airways and an increase in job vacancies. “Inflation at current is especially from authorities measures and housing parts. The Financial institution of Israel may be very involved that there can be extra demand because the economic system recovers from the battle, however on the similar time we will see the assorted danger premiums falling, and these had been the primary standards on account of which the Financial institution of Israel has not decreased rates of interest.”

In contrast, Financial institution Hapoalim chief markets strategist Modi Shafrir says that there’s nonetheless “very nice uncertainty about inflation and geo-political developments.” Shafrir factors to the truth that inflation can be larger than was thought at first. “The rise in rents has accelerated, and enter costs have risen sharply recently. Along with these components, wages proceed to rise at 5-6% yearly, and the labor market may be very tight.”

Shafrir due to this fact estimates that inflation can be 2.8% this 12 months. On rates of interest, he sees simply two cuts over the 12 months. “The market at the moment expects a reduce in July, and that the Financial institution of Israel will make two rate of interest cuts altogether in the midst of the 12 months.”

Inflation will shoot up, then fall

Katz stresses that present expectations may change if the Shopper Value Index studying for January is decrease than projected. “The month-to-month rise within the index is predicted to be 0.4-0.5%, placing the twelve-month inflation price at 3.7-3.8%. If the studying is on the low finish, even with out upsetting the forecasts, individuals will begin to see an rate of interest reduce coming in April,” he writes.

In Shafrir’s view, for an rate of interest to come back early, we must see a optimistic shock in inflation. “The Financial institution of Israel will need to see to what extent inflation accelerates in January and what occurs following the value rises, that means that the following Shopper Value index readings will even be vital.”

Revealed by Globes, Israel enterprise information – en.globes.co.il – on January 21, 2025.

© Copyright of Globes Writer Itonut (1983) Ltd., 2025.