When you’re feeling broke, there’s no have to panic! It’s possible you’ll simply have to conduct a monetary wellness checkup. With just a few straightforward suggestions, you possibly can enhance your monetary image and get to a extra snug place. Listed here are 9 methods to get again on observe.

1. Revenue and Insurance coverage Evaluation

When you’re feeling strapped for money, have you ever taken a have a look at your earnings not too long ago? This is step one in your monetary wellness checkup. If there are areas the place you may make changes, corresponding to your medical insurance elections, this might help you retain extra money in your pocket. You’ll must calculate if one other plan would fit your wants higher and wait until open enrollment to make adjustments. However, these small adjustments to maximise your earnings might help you’re feeling safer.

2. Evaluation Your Funds

A part of a monetary wellness checkup is to guage how your finances is working for you. When you’re feeling broke, it’s possible you’ll be saving too aggressively. You additionally might be overspending in sure classes that may be reduce on. Easy issues like reducing subscriptions or decreasing payments might help tremendously.

3. Examine Your Credit score Rating

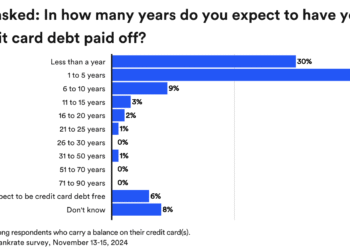

How are you doing with bank card debt? In case you are totally paying off balances every month, or engaged on paying down debt this may result in feeling like you don’t have anything left on the finish of the month. By reviewing your credit score rating, you may make needed enhancements to spice up your rating, right any errors, and qualify for a greater mortgage if wanted sooner or later.

4. Evaluation Monetary Targets

Do you’ve got too many monetary targets that you simply’re working towards? A monetary wellness checkup might help you streamline your targets and prioritize what’s most vital. Whereas having monetary targets is vital, tackling too many without delay could be counterproductive. Guarantee that your targets are reasonable to your earnings and finances to remain on observe.

5. Assess Your Debt

Does paying off your debt imply massive month-to-month funds? It might be time to look into debt consolidation, refinance your loans, switch bank card balances, prolong the time period of your mortgage, or attempt to negotiate decrease rates of interest. This will take a number of the stress off of you if funds are leaving you feeling broke.

6. Consider Your Financial savings

Do you’ve got a wholesome emergency fund and financial savings? Possibly you’ve been saving aggressively for some time. It might be time to reevaluate your technique and make your cash be just right for you.

7. Evaluation Your Retirement Plan

How a lot of your earnings are you contributing to retirement financial savings? It might be time to run the numbers and see in case you are saving sufficient for retirement, or if you happen to can afford to readjust your retirement planning.

8. Reevaluate Investments

Are your investments on observe and rising? When you aren’t seeing dividends, it’s a good suggestion to regulate your technique. Possibly you should discover new funding avenues like cryptocurrency to diversify. It might be time to seek the advice of an funding supervisor to get again on observe.

9. Get Artistic

When you conduct a monetary wellness checkup, you should use what you’ve discovered to regulate. However, if you happen to nonetheless haven’t discovered methods to really feel much less broke, you’ll have to search out artistic methods to enhance your monetary scenario. For instance, higher using cashback affords and rewards can put extra cash in your pocket. It’s possible you’ll even want so as to add in additional earnings from a aspect hustle. Possibly couponing will make it easier to really feel like you’ve got extra whereas spending much less. It’s all about feeling safe and discovering out what feels snug for you.

Have you ever executed a monetary wellness checkup earlier than? How do you overcome feeling broke? Tell us within the feedback.

Learn Extra

How you can Purchase Meme Cash With out Shedding Your Shirt: 8 Easy Ideas

9 Underrated Monetary Newsletters That Will Make You Smarter

Teri Monroe began her profession in communications working for native authorities and nonprofits. At present, she is a contract finance and life-style author and small enterprise proprietor. In her spare time, she loves {golfing} along with her husband, taking her canine Milo on lengthy walks, and enjoying pickleball with pals.