Keep knowledgeable with free updates

Merely signal as much as the US inflation myFT Digest — delivered on to your inbox.

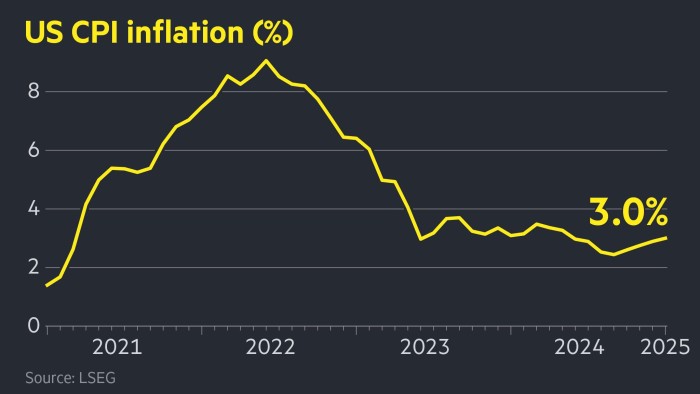

US inflation unexpectedly elevated to three per cent in January, bolstering the case for the Federal Reserve continuing slowly with rate of interest cuts and hitting shares and authorities bonds.

Wednesday’s shopper worth index determine surpassed the expectations of economists polled by Reuters, who predicted inflation would maintain regular at December’s 2.9 per cent.

The month-on-month rise for January was additionally forward of expectations, at 0.5 per cent in contrast with a predicted 0.3 per cent.

The surging worth of eggs contributed tremendously to the rise, rising 15.2 per cent over the month and 53 per cent in a 12 months, partly due to the impression of avian flu.

The figures from the Bureau of Labor Statistics led buyers to wager the Fed would lower rates of interest as soon as this 12 months. Earlier than the information was printed, the futures market had anticipated the primary lower to reach by September, with a 40 per cent likelihood of a second discount by the top of the 12 months.

“I might say we’re shut, however not there [yet] on inflation,” Fed chair Jay Powell informed lawmakers on Wednesday. “At present’s inflation print says the identical factor.”

Powell informed the listening to on the Home of Representatives after the information was printed: “We’ve made nice progress however we’re not fairly there but. So we wish to maintain coverage restrictive for now.”

“Markets should not satisfied that we are going to see disinflation later within the 12 months, and at the moment’s information definitely don’t give proof of that,” stated Eric Winograd, chief economist at AllianceBernstein. He highlighted considerations that “if inflation doesn’t maintain happening, the Fed gained’t lower charges in any respect”.

After the information was printed, the two-year yield on US Treasury bonds, which tracks rate of interest expectations and strikes inversely to cost, was up 0.07 share factors to virtually 4.36 per cent.

The S&P 500 dropped as a lot as 1.1 per cent shortly after Wall Avenue’s opening bell, however in the end closed 0.3 per cent decrease. The tech-heavy Nasdaq Composite closed fractionally increased, whereas a gauge of the greenback towards six different currencies was marginally decrease.

Wednesday’s inflation information additionally confirmed core CPI, which strips out adjustments to meals and vitality costs, rose to three.3 per cent in January from 3.2 per cent in December.

It got here after the Fed defied calls from President Donald Trump to make steep cuts to borrowing prices and as a substitute held its important charge at 4.25 per cent to 4.5 per cent.

On Tuesday, Powell informed Congress the central financial institution would proceed “doing our job and keep out of politics”.

However on Wednesday Trump renewed his calls for on his Reality Social platform. “Curiosity Charges must be lowered, one thing which might go hand in hand with upcoming Tariffs!!!” the US president posted. “Lets Rock and Roll, America!!!”

The CPI information will gasoline considerations amongst economists that the world’s largest financial system is heating up once more, as Trump strikes forward with plans for sweeping tariffs, a crackdown on immigration, and broad tax cuts that many economists worry may set off a brand new rise in inflation.

Since returning to the White Home on January 20, Trump has began implementing mass deportations of undocumented immigrants and imposed 10 per cent extra tariffs on Chinese language imports.

He has additionally introduced that top levies on practically all imports from Canada and Mexico, in addition to on all metal and aluminium imports, would take impact in March.

Powell has stated it’s nonetheless too early to evaluate the impression of the tariffs on the financial system and financial coverage, as a result of this may rely upon the main points of the levies.

Whitney Watson at Goldman Sachs Asset Administration stated that, along with the strong state of the US jobs market, Wednesday’s inflation figures have been more likely to reinforce the Fed’s “cautious strategy to easing”. She added: “We predict the Fed is more likely to stay in ‘wait-and-see mode’ in the interim.”

Regardless of acknowledging that the CPI studying “was above virtually each forecast”, Powell on Wednesday provided lawmakers a few notes of warning.

“One is that we don’t get enthusiastic about one or two good readings and we don’t get excited by dangerous readings. The second factor is we goal PCE inflation, as a result of we expect it’s merely a greater measure of inflation,” he stated on the listening to, referring to the private consumption expenditures index.

Powell stated the Fed would get a greater sense of worth pressures when the producer worth index got here out on Thursday.