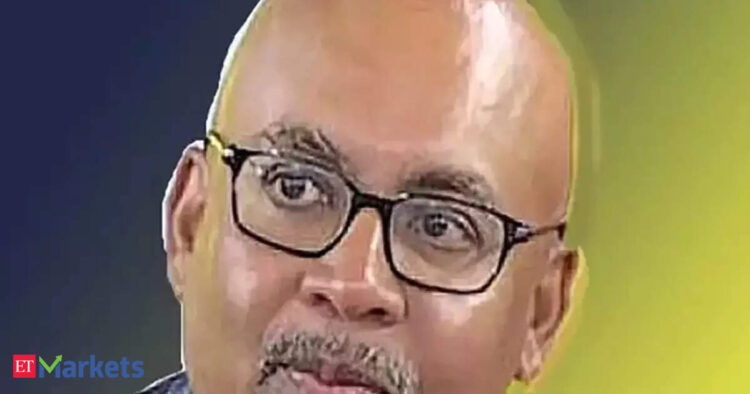

“So, the markets have to date largely ignored Liberation Day and all the pieces that occurred then and now perhaps we’re coming to a minimum of begin to fear in regards to the actuality that tariffs could also be increased than we anticipated and within the background you could have all this speak about him perhaps will he hearth Powell and on the rate of interest coverage,” says Arvind Sanger, Geosphere Capital Administration.

I wish to get your sense on this reiteration of the commerce tariff deadline of 1st August that the US has imposed as soon as once more. What’s your tackle that as a result of nations can proceed to barter after that, however that is once they must begin paying the tariffs. We nonetheless have a number of uncertainty by way of main economies and the place they stand with the US. So, how do you suppose the markets might react within the close to to medium time period?

Arvind Sanger: The market is beginning to realise that perhaps the tariffs are going to maintain at a stage increased than what the market was snug with. 10% tariffs was effective, however in case you are speaking about 15%, 20% 25%, 30% and the fascinating factor is that not one of the main buying and selling companions neither Japan nor the EU nor India all of or Korea each time there’s a speak, oh, now we’re about to signal a cope with India, as we speak it’s oh, we’re about to signal a cope with Japan, a number of weeks in the past it was oh, we’re about to signal a cope with EU. I believe no person desires to be first as a result of no person is assured about whether or not any deal achieved with the US beneath this president is ever last or will he discover some purpose to recut the deal someday within the close to future.

So, this tariff uncertainty has been receded by this acronym taco of Trump at all times backing out, however the concern the market is now beginning to face is that perhaps Trump is making an attempt to show he isn’t taco and there could possibly be some tariff associated turmoil. So, the markets have to date largely ignored Liberation Day and all the pieces that occurred then and now perhaps we’re coming to a minimum of begin to fear in regards to the actuality that tariffs could also be increased than we anticipated and within the background you could have all this speak about him perhaps will he hearth Powell and on the rate of interest coverage. So, there’s sufficient uncertainty on the market that I don’t suppose the markets can hold rallying like they’ve for the final couple of months.Nicely, certainly that’s what the query is about as a result of for main economies the commerce deal just isn’t but by and particularly with respect to India, what we’re getting to grasp is that the commerce deal is on its approach again to India from the US for now, it’s the fifth spherical of talks between India and US which have already concluded however no main announcement or end result from that’s what we’re getting to grasp. How do you suppose markets are going to react to this explicit information circulation as a result of we have now already handed that deadline of ninth of July and even 1st of August is approaching now. But when until 1st of August as properly, if no commerce deal is being introduced, what could possibly be the market response?

Arvind Sanger: It’s unhealthy for all international economies. Allow us to be clear, this isn’t US wins or US loses, and the remainder of the world just isn’t affected. It’s US loses and it’s all the most important economies which might be beneficiaries of worldwide commerce and all main economies are, India is perhaps much less affected as a result of India’s merchandise commerce just isn’t as massive a share of GDP than different nations however no person goes to be unimpacted by that. So, I believe that it’s it’s a unfavorable for India together with all people else.

I wish to get your sense on this reiteration of the commerce tariff deadline of 1st August that the US has imposed as soon as once more. What’s your tackle that as a result of nations can proceed to barter after that, however that is once they must begin paying the tariffs. We nonetheless have a number of uncertainty by way of main economies and the place they stand with the US. So, how do you suppose the markets might react within the close to to medium time period?

Arvind Sanger: The market is beginning to realise that perhaps the tariffs are going to maintain at a stage increased than what the market was snug with. 10% tariffs was effective, however in case you are speaking about 15%, 20% 25%, 30% and the fascinating factor is that not one of the main buying and selling companions neither Japan nor the EU nor India all of or Korea each time there’s a speak, oh, now we’re about to signal a cope with India, as we speak it’s oh, we’re about to signal a cope with Japan, a number of weeks in the past it was oh, we’re about to signal a cope with EU. I believe no person desires to be first as a result of no person is assured about whether or not any deal achieved with the US beneath this president is ever last or will he discover some purpose to recut the deal someday within the close to future.

So, this tariff uncertainty has been receded by this acronym taco of Trump at all times backing out, however the concern the market is now beginning to face is that perhaps Trump is making an attempt to show he isn’t taco and there could possibly be some tariff associated turmoil. So, the markets have to date largely ignored Liberation Day and all the pieces that occurred then and now perhaps we’re coming to a minimum of begin to fear in regards to the actuality that tariffs could also be increased than we anticipated and within the background you could have all this speak about him perhaps will he hearth Powell and on the rate of interest coverage. So, there’s sufficient uncertainty on the market that I don’t suppose the markets can hold rallying like they’ve for the final couple of months.Nicely, certainly that’s what the query is about as a result of for main economies the commerce deal just isn’t but by and particularly with respect to India, what we’re getting to grasp is that the commerce deal is on its approach again to India from the US for now, it’s the fifth spherical of talks between India and US which have already concluded however no main announcement or end result from that’s what we’re getting to grasp. How do you suppose markets are going to react to this explicit information circulation as a result of we have now already handed that deadline of ninth of July and even 1st of August is approaching now. But when until 1st of August as properly, if no commerce deal is being introduced, what could possibly be the market response?

Arvind Sanger: It’s unhealthy for all international economies. Allow us to be clear, this isn’t US wins or US loses, and the remainder of the world just isn’t affected. It’s US loses and it’s all the most important economies which might be beneficiaries of worldwide commerce and all main economies are, India is perhaps much less affected as a result of India’s merchandise commerce just isn’t as massive a share of GDP than different nations however no person goes to be unimpacted by that. So, I believe that it’s it’s a unfavorable for India together with all people else.

So, it’s one thing we have now to begin worrying about. We’ve to date put that on the again burner assuming one thing beneficial would come round, however it’s trying issues are trying unsure and that’s by no means good for international economies and positively not good for India though, once more as I mentioned, India might be one of many much less impacted however once more it’s going to have an effect.