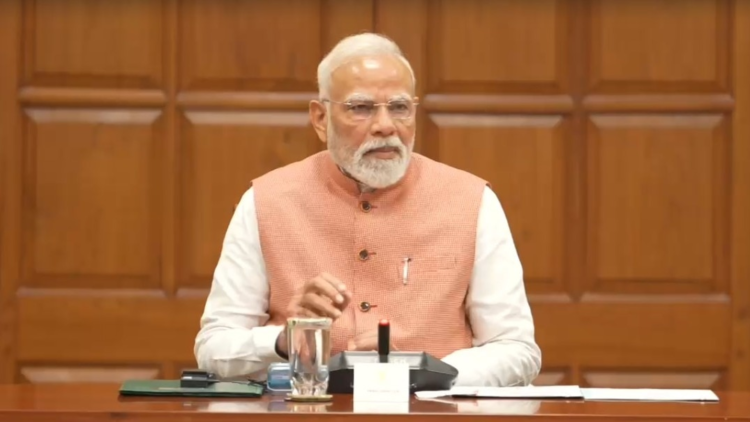

Prime Minister Narendra Modi held a high-level session with main economists and senior secretaries on August 18, the place the agenda revolved round boosting progress, creating jobs, and enabling small companies to scale up, sources have instructed Enterprise At the moment.

Based on folks accustomed to the discussions, consultants advisable a contemporary wave of liberalisation to draw funding and drive competitiveness. They urged the federal government to simplify rules, scale back pink tape for credible companies, and strengthen banking reforms to make sure smoother credit score circulate.

Strategies additionally included rationalising fertiliser subsidies to unlock fiscal area, ramping up authorities spending to spur demand, and creating coverage incentives to crowd in personal sector funding.

There was additionally a dialogue on having a 100-day agenda, which the federal government is engaged on, the supply stated.

Sources additional added that the Prime Minister keenly heard the inputs and emphasised that job creation and the enlargement of small enterprises, particularly MSMEs, will stay central to India’s financial technique. Modi is learnt to have underlined the necessity for a supportive ecosystem the place small companies can develop into bigger, globally aggressive gamers.

“The clear message is that India should push the following wave of reforms, reduce pink tape, strengthen banks, and provides small companies the instruments to scale up. The PM may be very targeted on jobs and MSMEs,” a senior authorities official instructed Enterprise At the moment on situation of anonymity.

The assembly comes after PM Modi’s Independence Day handle, the place he introduced “next-generation” Items and Companies Tax (GST) reforms for implementation by Diwali 2025. Pitched as the largest revamp for the reason that introduction of GST in 2017, the strikes purpose to simplify slabs and ease prices on daily-use items and small vehicles whereas holding the next fee for sin and luxurious objects. The Centre has circulated a draft to states and sought their cooperation, with ultimate adjustments contingent on approval by the GST Council. Early outlines level to fewer core slabs—doubtlessly two—with a 40% particular fee.