Shifting out of cities and concrete cores appeared like the right determination throughout the pandemic. Till it wasn’t.

With firms more and more demanding

extra time in downtown workplaces

, patrons who fled are actually going through a tough determination to maneuver again to the town — one that might wind up being simply as spontaneous and expensive as their transfer away.

On the peak of the pandemic,

throughout Canada’s largest metropolis, with the Toronto Regional Actual Property Board

reporting an all-time excessive common sale worth

of $1,193,771 for 2022. Simply three years earlier than the pandemic, the typical sale worth for 2019 was $812,996.

Costs rose by almost 50 per cent in a really brief interval as customers, having fun with the flexibleness of

to which they have been confined, moved additional and additional out of cores in a pattern seen throughout the nation.

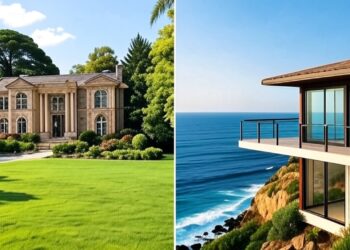

It was the age-old suburban versus metropolis debate, with a twist: you traded an even bigger home for dwelling additional away from the core — however you not wanted to commute to work.

Now that’s altering for a lot of. The Ontario authorities has ordered its employees again to work full-time, together with many municipalities. Monetary companies firms have additionally been saying that they’ll undertake a full-time workplace presence.

Go to an Ontario Public Service on-line dialogue board, and you may really feel the panic. Some folks have relocated their lives away from the town and face commutes of two hours or extra, every approach.

Now what? For starters, don’t panic. It’s the worst factor you are able to do in any monetary state of affairs. Emotional selections are unhealthy selections.

The difficulty with

is that transaction prices can simply add as much as 10 per cent of your asset when you think about realtor commissions, charges, authorized bills, land switch taxes, transferring vehicles, and an extended listing of soppy prices.

Jason Mercer, chief market analyst at TRREB stated the pattern to maneuver to the suburbs or the much more distant exurbs, had began even earlier than the pandemic.

“There have been only a higher proportion of offers being executed exterior the (Better Toronto Space),” stated Mercer. “A few of it simply needed to do with house costs growing very strongly.”

However the flexibility of the place one bodily labored performed a task in pushing the pattern.

Now that that flexibility is being curtailed, there are early indications of an albeit modest uptick in transactions within the Toronto space.

“It’s exhausting to eke out whether or not that’s an enchancment in affordability, however there are folks seeking to change their state of affairs (and) dwelling relative to work,” stated Mercer.

Shifting over to the

, Julian Schonfeldt, chief funding officer at Canadian Condominium Properties, stated the pattern was clear throughout the COVID-19 pandemic: folks moved to secondary markets.

“It’s fully cheap to anticipate that return to workplace mandates would see the inverse occur and produce … rental demand to city markets,” stated Schonfeldt, whose actual property funding belief is the biggest publicly traded residence landlord in Canada.

The influence on pricing and emptiness, nonetheless, stays unclear as a result of a major quantity of provide is being added via the development of flats, he stated.

Schonfeldt famous that liquidity within the housing market stays weak, so anybody a transfer goes to face some powerful decisions in the event that they wish to promote.

A brief determination to lease in city cores is feasible, nevertheless it gained’t come cheaply. In Toronto’s core, a more moderen unit might be a $4 per sq. foot monthly to lease.

A 400-square-foot micro apartment might value $20,000 a 12 months to lease, however no less than you may stall promoting your house till the job market image clears. Or you’ll find a extra versatile work choice to hold that house and keep away from commuter hell.

Phil Soper, chief govt of Royal LePage, one of many nation’s largest residential brokerage companies, stated he is aware of individuals who have moved greater than 100 kilometres from Toronto, and they’re going through tough selections as we speak.

“They’re all now in

,” he stated, including that persons are having to make housing changes on the fly. “One individual, I do know, stays together with her daughter two days per week. One drives, and it’s unhealthy site visitors. All of them went out (to far-flung suburbs) throughout the pandemic, after which the world modified.”

Soper stated there was additionally a pattern that noticed folks transfer out to their leisure properties, as much as two hours away, full-time. “Now they’re discovering the commute untenable,” he stated. “The completely useless Toronto

isn’t completely useless, particularly you probably have a parking spot.”

The one upside may be that apartment costs have dropped dramatically, so if you happen to did determine to purchase a pied-à-terre within the metropolis, it will be at a reduction to the place we have been two years in the past.

Giacomo Ladas, affiliate director of leases.ca, stated the rise of secondary markets helped flatten out lease in metro cores.

“Demand actually decreased in main cities, and we might see it improve just a few hours away,” stated Ladas.

Immediately, his group’s information present that general demand, as outlined by renters on his web site, is down about eight per cent from a 12 months in the past. Individuals are simply not seeking to transfer that a lot.

“It’s a query of what occurs subsequent,” stated Ladas. “We did see a rise in demand for one-bedroom flats, however it’s nonetheless too early to inform.”

TRREB’s Mercer said that buyers might want to conduct a cost-benefit evaluation and study their family funds. “Folks have to take a look at the price of transferring versus the financial and social value of commuting in the event that they lose flexibility,” he stated.

With so many transferring elements and the way forward for work unclear, a serious financial determination that erodes your fairness even additional, corresponding to promoting and shopping for, needs to be pursued with excessive warning.

Figuring an alternate short-term housing answer, an elusive goal, might grow to be a precedence for a lot of within the coming months.