Housing is one among life’s basic wants, proper up there with meals, water, and security. For many years, although, housing affordability has develop into more and more out of attain for the common American. With the median U.S. residence worth hovering round $440,000 and the median family earnings roughly $80,000, it’s straightforward to see why homeownership has develop into extra of a dream than a given.

Enter the potential 50-year mortgage, an thought reportedly being explored by the Trump administration. The idea is easy: stretch out the compensation time period to make month-to-month funds extra reasonably priced, and doubtlessly pair it with a transportable mortgage, which might enable owners to switch their mortgage to a brand new property in the event that they transfer. Collectively, these improvements may unlock housing safety for tens of millions of Individuals.

Critics are fast to say that extending debt over half a century is reckless. However I consider it’s a sensible step ahead – a recognition that our lifespans, careers, and monetary realities have advanced. If applied responsibly, a 50-year mortgage could possibly be some of the transformative housing instruments of our lifetime.

On this publish, I’ll additionally introduce a brand new idea referred to as the Mortgage Utilization Price — a easy framework that helps owners borrow extra responsibly.

Housing Safety And Household Formation

For a lot of Individuals, housing safety is the bedrock of household formation. {Couples} understandably need a secure residence earlier than bringing a baby into the world. The very last thing you need, particularly with a new child, is to be compelled out as a result of your landlord desires to promote or increase the lease. This occurs way more usually than most individuals understand.

After you have a child, life turns into a blur of feeding each few hours, pediatrician visits, and emotional and bodily restoration. The mom wants months to heal. The mother and father are working on fumes. Throughout this fragile time, the very last thing you want is uncertainty about your dwelling state of affairs.

Whenever you personal your own home, that stress largely disappears. You’ll be able to give attention to elevating your youngster slightly than worrying about your subsequent lease renewal. Housing safety means that you can channel your vitality towards what issues most: your loved ones. Don’t underestimate this profit.

The issue is, for a rising share of Individuals, homeownership doesn’t even occur till center age. The Nationwide Affiliation of Realtors studies that the median age of first-time homebuyers is now 40 years outdated, an all-time excessive. That’s not only a statistic; it’s a mirrored image of how a lot more durable it’s develop into to afford a house relative to earnings development.

In the meantime, our life expectancy is round 80 years. We could also be dwelling longer, however not by as a lot because the rise in age of first-time homebuyers. Consequently, household formation is being pushed later and later, or deserted altogether. From a organic standpoint, this development carries monumental penalties.

In case you wait till 40 to purchase your first residence and begin a household, the percentages are stacked in opposition to you. A girl’s probability of conceiving naturally after age 40 is underneath 1% per thirty days. That’s like entering into the Indian Institute of Expertise in a land of 1.46 billion folks, getting an H-1B visa, touchdown a six-figure job in America, after which rising as much as develop into a C-level govt. It occurs, however not usually. The outcome? Extra {couples} delaying or forgoing kids altogether.

That’s why the 50-year mortgage and the transportable mortgage could possibly be such game-changers. They don’t simply make houses extra reasonably priced, they promote household stability, financial participation, and nationwide renewal. With out sufficient younger households, we face demographic cliffs that threaten long-term financial development.

The 50-Yr Mortgage Is Nice — If You Don’t Take 50 Years

The loudest criticism of a 50-year mortgage is that it supposedly chains folks to debt perpetually. In case you take out such a mortgage at 40, you’ll be 90 by the point it’s paid off. Sounds grim, proper? However that argument misses a vital level: virtually no person retains a mortgage for its full time period.

Right this moment, 90–95% of mortgages in America are 30-year fixed-rate loans. But the median homeownership tenure is just about 12 years. Earlier than the 2008 monetary disaster, it was even shorter — round seven to eight years.

So why would we assume that debtors would truly maintain a 50-year mortgage for 5 a long time? They gained’t. Most will promote, refinance, or improve lengthy earlier than then.

Getting a mortgage provides you the choice to purchase, and due to this fact, the choice to promote at a revenue (or a loss). Keep in mind, nothing is everlasting in life. We don’t actually personal something in our brief time on earth. However having choices is extra invaluable than being shut out perpetually.

The Mortgage Utilization Price Idea

Give it some thought: when you divide the common 12-year homeownership period by 30, that’s a 40% “mortgage utilization charge.” In different phrases, most individuals use lower than half their mortgage’s potential time period.

Apply that very same charge to a 50-year mortgage and the common house owner would nonetheless find yourself holding it for less than about 20 years — not the complete half-century. However realistically, I doubt tenure would bounce from 13 years to twenty. Extra doubtless, it could enhance by simply 1–3 years at most as a result of life retains taking place no matter mortgage size.

Because of this I’ve lengthy inspired folks to contemplate adjustable-rate mortgages (ARMs), such because the 7/1 or 10/1 ARM. They higher match real-world habits. The 50-year mortgage merely extends this flexibility additional. It’s an choice, not a sentence.

A 50-Yr Mortgage Gives Extra Choices, Extra Freedom

The fantastic thing about a 50-year mortgage is that it lowers your month-to-month fee, supplying you with better buying energy and suppleness. For younger households or first-time patrons, this will make all of the distinction. On the finish of the day, life is finite, and we lease all the things earlier than we die anyway.

Think about you’re 32, newly married, and need to begin a household earlier than 35. You’ve saved diligently, however with out the Financial institution of Mother & Dad, you possibly can’t fairly afford the month-to-month fee on a 30-year fastened mortgage. You take into account ready for residence costs to drop 20%.

Eight years later, you get your want — housing costs fall. However now, one among you has misplaced a job, and fertility is not in your aspect. IVF therapies price $28,000 per cycle, and also you’re emotionally and financially stretched skinny.

If a 50-year mortgage had existed earlier, you would’ve purchased a house in your early 30s, locked in stability, and targeted on beginning your loved ones as a substitute of timing the market. Time waits for nobody, particularly not biology.

The longer amortization interval doesn’t imply you’re trapped. You’ll be able to all the time make additional principal funds or refinance when your earnings rises or charges fall. The secret is that you simply get to higher select when to purchase, as a substitute of ready indefinitely for affordability that will by no means return.

The Downsides To Getting A 50-Yr Mortgage

In fact, there’s not such factor as a free lunch. If the 50-year mortgage had been to be launched, it is vital to be absolutely conscious of the downsides as properly. Listed here are some apparent, and never so apparent downsides.

1. A lot Increased Whole Curiosity Paid

Stretching a mortgage to 50 years massively will increase the whole curiosity expense, even when the month-to-month fee is decrease. You can find yourself paying 2–3× the value of the house over the lifetime of the mortgage. Banks would additionally doubtless worth a 50-year mortgage greater than a 30-year mortgage due to the time worth of cash.

That’s why a savvy borrower would store round and attempt to safe a 50-year charge that’s akin to — and even decrease than — prevailing 30-year charges. It’s not inconceivable. Banks steadily run promotions to spice up enterprise and entice deposits, and people home windows can supply surprisingly aggressive long-term charges.

2. Slower Fairness Buildup

Your principal is paid off very slowly. For the primary 10–20 years, you may barely transfer the needle on fairness until your own home appreciates.

3. Increased Threat of Damaging Fairness

As a result of principal paydown is so sluggish, a small market correction may put you underwater, particularly within the early years.

4. Decrease Mobility

With so little principal paid down, it’s more durable to:

You might really feel “locked in” longer than anticipated.

5. Increased Curiosity Price Premium

Lenders would doubtless cost a greater rate of interest for a 50-year mortgage because of the longer threat publicity.

6. Extending Debt Into Outdated Age

Some debtors would nonetheless be carrying mortgage debt properly into their 70s and even 80s. That’s not very best for retirement safety, until your plan is to by no means absolutely pay it off. If so, these debtors must share their mortgage debt state of affairs with their kids and different family members.

7. Encourages Increased Dwelling Costs

Longer-term loans can artificially inflate costs by boosting buying energy. Extra shopping for energy = sellers increase costs = much less affordability long run. We’ll discuss this extra within the subsequent part.

8. Psychological Weight of Lengthy-Time period Debt

Understanding you’re locked right into a 50-year obligation can really feel:

- heavy

- unending

- restrictive

Even when you plan to promote sooner, it creates a psychological drag. Personally, I’ve by no means regretted paying off a mortgage by promoting or instantly paying down principal. The truth is, there is a triple profit to paying down your mortgage I’ve written about earlier than.

9. Potential for Predatory Borrowing

Some patrons could misuse the decrease month-to-month fee to purchase extra home than they’ll realistically deal with, growing default threat. Therefore, please observe my 30/30/3 rule for residence shopping for. You could possibly stretch to purchase a house as much as 5X your family earnings in case you are bullish in your profession. However I would not transcend that.

10. Restricted Availability or Resale Points

If 50-year merchandise stay area of interest:

- fewer lenders could supply them

- refinancing to a regular mortgage later is likely to be more durable

- future patrons could also be cautious

A 50-Yr Mortgage Is Music To A Actual Property Investor’s Ears

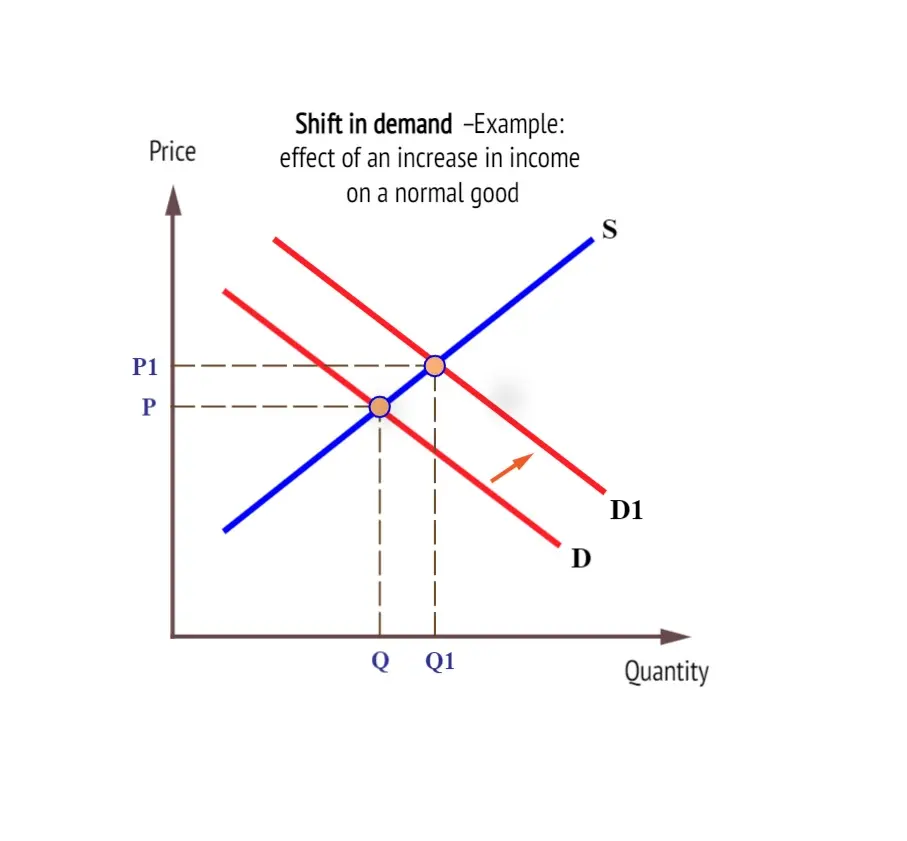

In case you’re an actual property investor, you by no means struggle the federal government — you experience with it. A 50-year mortgage expands the pool of potential patrons, which naturally helps property costs. In different phrases, it shifts the demand curve to the fitting, inflicting costs to go from P to P1 within the chart under.

Traditionally, housing coverage has all the time leaned towards pro-ownership. The federal government is aware of that about 65% of Individuals personal houses, and people owners type a strong voting bloc. That’s why federal insurance policies — from mortgage curiosity deductions to capital good points exclusions — are constantly designed to assist owners.

Keep in mind the 2008–2009 monetary disaster? The federal government bailed out banks and owners alike. That set a precedent: when push involves shove, the federal government will step in to stabilize the housing market.

I nonetheless keep in mind when Financial institution of America voluntarily lowered my fixed-rate mortgage from 5.75% to 4.25% on a trip property — unprompted. It boosted my money movement by $500 a month in a single day. That’s the facility of coverage alignment between lenders and the federal government.

And now, with the SALT cap raised from $10,000 to $40,000 underneath the One Massive Stunning Invoice Act and speak of a transportable mortgage system that allows you to take your charge with you once you transfer, the momentum is clearly pro-housing.

When the federal government indicators that it desires extra Individuals to personal houses, you don’t resist — you make investments.

Moveable Mortgages: Unlocking Extra Freedom To Transfer

Whereas the 50-year mortgage is getting many of the consideration, the transportable mortgage may very well be the extra revolutionary idea. Roughly 70% of house owners have a mortgage charge underneath 5%, and residential gross sales is at a 3 yr low, which implies individuals are placing their lives on maintain.

Underneath a conveyable system, owners may switch their present mortgage (and rate of interest) to a brand new property. They’d nonetheless must qualify and give you any money distinction given monetary conditions have a tendency to alter additional time.

Nevertheless, Think about locking in a 3.5% charge and carrying it with you once you transfer. This innovation would clear up the “golden handcuff” drawback that’s frozen the housing market since 2022.

Proper now, tens of millions of Individuals are reluctant to maneuver as a result of they don’t need to lose their low fixed-rate mortgages. A transportable mortgage would unlock stock, enhance mobility, and make housing markets extra environment friendly — all with out driving up default threat.

Mixed with the 50-year choice, the housing system turns into way more adaptable to real-world circumstances. Younger households should purchase earlier. Retirees can downsize with out penalty. Staff can transfer for jobs with out monetary pressure.

Make investments In The Development, Don’t Combat It

As an investor, the important thing to long-term success is aligning your self with coverage and demographic developments, not combating them.

If the federal government desires to make housing extra reasonably priced via longer mortgage phrases and portability, then housing demand will enhance. And when demand will increase, costs observe.

For homebuyers, the 50-year mortgage generally is a bridge to stability when used responsibly. For traders, even when these new mortgage merchandise by no means materialize, their mere dialogue indicators enduring assist for the actual property market.

Having optionality is an excellent factor. A 50-year mortgage isn’t for everybody, and that’s effective. However for many who use it strategically, it might imply a long time of housing safety and better flexibility to take a position elsewhere.

Think about when you may safe your loved ones’s housing for half a century whereas nonetheless having the liquidity to construct wealth in shares, companies, or schooling. That’s not a burden. That’s empowerment.

When you have any options to growing housing affordability in America, I might love to listen to them!

Make investments In American Actual Property Passively

Proudly owning actual property instantly isn’t for everybody. Between rising insurance coverage premiums, clogged bathrooms, and random HOA assessments, being a landlord can put on you down quick. However when you nonetheless consider — as I do — that actual property is likely one of the most dependable methods to construct long-term wealth, there’s a better, extra passive strategy to play the development: Fundrise.

Fundrise enables you to put money into diversified portfolios of residential and business actual property initiatives nationwide — with no need an enormous down fee or taking over a lifetime of mortgage debt. You get publicity to actual belongings, managed by professionals, when you sit again and acquire potential dividends and appreciation.

You don’t should be a millionaire or accredited investor. You can begin with simply $10 and personal a slice of America’s housing market. The platform handles the acquisitions, renovations, and tenant complications for you.

If 50-year and transportable mortgages develop into actuality, the housing market may expertise a strong second wave of demand. Extra patrons means extra liquidity and doubtlessly greater property values. Fundrise traders can profit from that very same macro tailwind with out ever signing a 600-month mortgage.

You’ll be able to both be the one paying off a mortgage for 50 years or the one accumulating lease and appreciation throughout these 50 years. Try Fundrise right here and begin investing passively in America’s housing future.

Concerning the Writer

Sam Dogen based Monetary Samurai and kickstarted the modern-day FIRE motion in 2009. Each article relies on firsthand expertise and deep monetary evaluation.

Sam has been a home-owner since 2003 and manages a diversified rental property portfolio that generates roughly $150,000 a yr in semi-passive earnings. By way of Monetary Samurai, he shares sensible insights on constructing wealth, attaining monetary independence, and dwelling life in your phrases.

Decide up a replica of his USA TODAY nationwide bestseller, Millionaire Milestones: Easy Steps to Seven Figures. He is distilled over 30 years of monetary expertise that will help you construct extra wealth than 94% of the inhabitants—and break away sooner.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Monetary Samurai publication. You can too get his posts in your e-mail inbox as quickly as they arrive out by signing up right here.