When each spouses in a married couple retire earlier than 65, they more than likely will purchase medical health insurance from the ACA market until they’ve retiree medical health insurance protection or they solely have a brief hole that may be lined by COBRA. When there’s an age distinction between the 2 spouses, the older partner will begin Medicare at 65, leaving the youthful partner in ACA medical health insurance.

Reader Charlie introduced up this actual state of affairs. Each Charlie and his spouse have ACA medical health insurance now. After Charlie turns into eligible for Medicare subsequent 12 months, his 58-year-old spouse will proceed on the ACA plan. Now, after they change from protecting each of them on the ACA plan to protecting only one individual, how will their ACA medical health insurance premiums change?

Will their premiums drop 50%, as a result of they’ll cowl only one individual as a substitute of two? Or really greater than 50%, as a result of the individual coming off the plan, Charlie, is older and costlier to insure?

Will their premiums keep the identical, as a result of ACA premiums are tied to revenue, and their revenue gained’t change?

Will their premiums really enhance, or drop, however by lower than half, as a result of if it isn’t bizarre and counterintuitive, it wouldn’t make an attention-grabbing topic for a weblog put up?

The reply is — all the above, relying on whether or not they obtain a subsidy and what plan they’ve.

We’re not speaking about premium will increase from the insurance coverage firm or adjustments to the premium tax credit score from adjustments in revenue. Simply altering the variety of folks lined by an ACA well being plan can have bizarre and surprising results.

No Subsidy

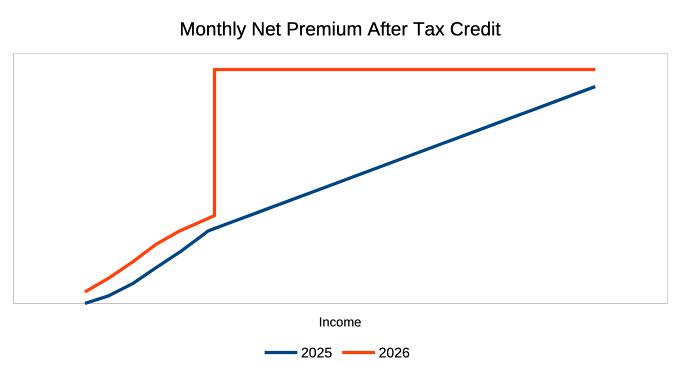

The ACA premium subsidy cliff is scheduled to return in 2026. The current authorities shutdown didn’t push it out. You gained’t obtain any premium subsidy in case your revenue is above 400% of the Federal Poverty Stage (FPL), which is $84,600 in 2026 for a two-person family within the decrease 48 states.

It’s extra intuitive once you don’t qualify for a premium subsidy. Whenever you pay the complete worth, insuring two folks certain prices greater than insuring only one individual. When the older partner begins Medicare, your ACA medical health insurance premiums will drop by half. As a result of it normally prices extra to insure an older individual, it’ll fall by barely greater than half.

Subsidy – 2nd Lowest Value Silver Plan

In case your revenue qualifies you for a subsidy, the subsidy is calculated from the premiums for the Second Lowest Value Silver Plan (SLCSP) in your space. If it occurs to be the plan you select, you may be requested to pay a set share of your family revenue for that plan. The federal government can pay the rest with a premium subsidy. See ACA Well being Insurance coverage Premium Tax Credit score Percentages.

The quantity you’re anticipated to pay towards a second lowest price Silver plan goes by the family dimension and family revenue. It doesn’t matter how many individuals within the family are on the coverage. When one individual goes on Medicare, your family dimension doesn’t change. Nor does your family revenue. Due to this fact, you’re nonetheless anticipated to pay the identical quantity.

Suppose your family revenue is slightly below the utmost that qualifies for the premium tax credit score for a two-person family, and also you select the second lowest price Silver plan in your space. Your web premiums after the subsidy will probably be the identical whether or not you cowl each of you or just one individual. The one distinction is that the premium subsidy turns into smaller when the full premiums earlier than the subsidy drop by half.

After the older partner begins Medicare, additionally, you will need to pay for Medicare Half B and Half D, and probably a Medicare Complement coverage. Your whole spending on well being insurance coverage will enhance. However, as a result of the deductible and co-pay on Medicare are decrease than these on an ACA plan, your whole healthcare spending might lower. And since you’ll nonetheless obtain a subsidy once you cowl only one individual, albeit a smaller subsidy than once you cowl two folks, a subsidy continues to be a subsidy. You’re higher off with a subsidy and never seeing a premium drop than should you should pay the complete worth.

Subsidy – Extra Costly Plan

Whenever you qualify for a premium subsidy and also you select a costlier plan than the second lowest price Silver plan in your space, you pay 100% of the worth distinction along with your regular web premium. The components on your web premiums is:

Revenue * Relevant Proportion + (full worth on your chosen plan – full worth for the Second Lowest Value Silver Plan)

When one individual goes off the ACA plan, the worth distinction additionally drops by half. Your premiums after the subsidy will go down by the lower within the worth distinction.

Suppose you select a Gold plan, and it’s costlier than the second lowest price Silver plan by $500 per thirty days for 2 folks. You pay 100% of this $500 worth distinction. The worth distinction might grow to be $240 per thirty days once you cowl only one individual. Due to this fact you save $260 per thirty days when the older partner begins Medicare.

Subsidy – Much less Costly Plan

The other occurs once you select a inexpensive plan. You obtain 100% of the worth distinction as your price financial savings to scale back your regular web premiums. Your web premiums after the subsidy are:

Revenue * Relevant Proportion – (full worth for the Second Lowest Value Silver Plan – full worth on your chosen plan)

When one individual goes off the ACA plan, your price financial savings drop by half. Your premiums after the subsidy will go up by the lower within the worth distinction.

Suppose you select a Bronze plan, and it’s inexpensive than the second lowest price Silver plan by $400 per thirty days for 2 folks. You obtain 100% of this $400 worth distinction. The worth distinction might grow to be $180 per thirty days once you cowl only one individual. Due to this fact you lose $220 per thirty days in price financial savings when the older partner begins Medicare, and your web premiums will rise by $220 per thirty days.

You pay extra to cowl one individual in a inexpensive plan than to cowl two folks. Such is the punishment for selecting a inexpensive plan.

Impact on HSA Contributions

All Bronze ACA plans are eligible for HSA contributions beginning in 2026. Whenever you select a Bronze plan, you go from household protection to single protection for HSA after one partner begins Medicare, and also you’ll have a decrease HSA contribution restrict. As a result of HSA contributions decrease your Modified Adjusted Gross Revenue (MAGI) for ACA medical health insurance, your MAGI will enhance once you contribute much less to the HSA. The next MAGI means a decrease subsidy, or probably shedding the subsidy altogether when your MAGI goes over the 400% FPL cliff.

***

Right here’s a abstract of all of the situations:

| Change in Internet Premiums | |

|---|---|

| No Subsidy | Lower by 50% or extra |

| Subsidy – 2nd Lowest Silver Plan | No change |

| Subsidy – costlier plan | Lower by 50%+ of the worth distinction between your plan and the SLCSP |

| Subsidy – inexpensive plan | Improve by 50%+ of the worth distinction between the SLCSP and your plan, plus the impact from HSA contributions and MAGI |

Charlie and his spouse qualify for a premium subsidy, and so they need a Bronze plan. Their web ACA plan premiums will go up considerably when Charlie begins Medicare. It’s counterintuitive, however that’s the way it works.

Be taught the Nuts and Bolts

I put all the things I exploit to handle my cash in a guide. My Monetary Toolbox guides you to a transparent plan of action.