Keep knowledgeable with free updates

Merely signal as much as the Equities myFT Digest — delivered on to your inbox.

Know-how shares tumbled on Monday after Chinese language synthetic intelligence start-up DeepSeek surprised Silicon Valley with advances apparently achieved with far much less computing energy than US rivals.

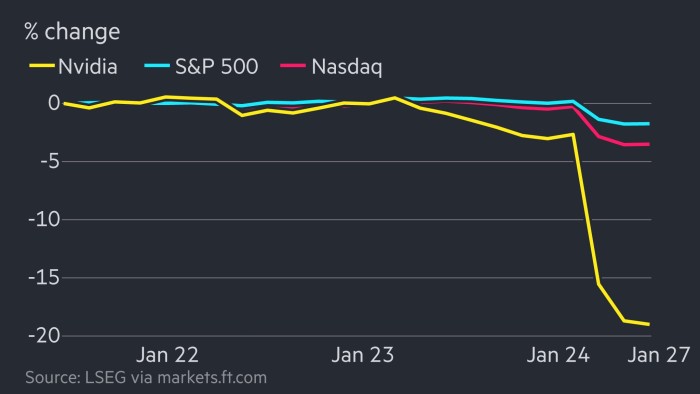

Shares in California-based Nvidia, one of many largest beneficiaries of spending on AI chips, plunged 16 per cent, wiping out greater than $600bn of market worth, a file loss for any firm.

DeepSeek final week launched its newest giant language AI mannequin, which achieved a comparable efficiency to that of US rival OpenAI, though the corporate has beforehand claimed to make use of far fewer Nvidia chips.

Enterprise capital investor Marc Andreessen known as the brand new Chinese language mannequin “AI’s Sputnik second”, drawing a comparability with the Soviet Union beautiful the US by placing the primary satellite tv for pc into orbit.

The outcomes despatched a shockwave by means of markets on Monday, as buyers reassessed the possible future funding in AI {hardware}.

The tech-heavy Nasdaq Composite index had misplaced 3.3 per cent, whereas the S&P 500 index declined 1.8 per cent by afternoon in New York. Microsoft fell 2.2 per cent. Buying and selling exercise was working about 50 per cent increased than common for the shares listed on the US S&P 1,500 Composite index, in an indication of how buyers had been speeding to interpret how DeepSeek will have an effect on Silicon Valley tech teams.

The rout prolonged effectively past conventional tech names. Siemens Vitality, which provides electrical {hardware} for AI infrastructure, plunged 20 per cent. Schneider Electrical, a French maker {of electrical} energy merchandise that has invested closely in providers for information centres, fell 9.5 per cent.

Merchants sought shelter in perceived havens, with shares in shopper staples corporations corresponding to Johnson & Johnson, Coca-Cola, Basic Mills and Hershey posting vital features on Monday.

Apple, which is considered as much less uncovered to the AI race than many Large Tech rivals, was 4 per cent increased.

To some, the sell-off within the corporations making the “picks and shovels” of the AI revolution echoed the share-price crash of IT {hardware} firm Cisco when the dotcom bubble burst.

Nvidia, Broadcom and different chipmakers have benefited from Silicon Valley’s race to construct ever-larger clusters of chips, which the likes of xAI boss Elon Musk and OpenAI’s Sam Altman have argued are wanted to maintain advancing AI’s capabilities.

Nvidia’s chief government Jensen Huang and Broadcom’s Hock Tan have argued in current weeks that they anticipated the information centre constructing frenzy to proceed till the tip of the last decade.

“It reveals how weak the AI commerce nonetheless is, like each commerce that’s consensus and based mostly on the belief of an unassailable lead,” mentioned Luca Paolini, chief strategist at Pictet Asset Administration.

However some Wall Avenue analysts and AI researchers have questioned the hype surrounding DeepSeek’s achievement. “It appears categorically false that ‘China duplicated OpenAI for $5M’ and we don’t suppose it actually bears additional dialogue,” wrote analysts at Bernstein in a word to shoppers.

Some researchers have even speculated that DeepSeek was capable of take shortcuts in its personal coaching prices by leveraging the most recent fashions from OpenAI, suggesting that whereas it has been capable of replicate the most recent US developments in a short time, will probably be tougher for the Chinese language firm to drag forward.

AI funding by large-cap US tech corporations hit $224bn final 12 months, in response to UBS, which expects the whole to achieve $280bn in 2025. OpenAI and SoftBank introduced final week a plan to take a position $500bn over the subsequent 4 years in AI infrastructure.

Even following DeepSeek’s newest launch, Meta chief Mark Zuckerberg mentioned in a Fb submit on Friday that he deliberate to spend as a lot as $65bn on AI infrastructure this 12 months.

Based by hedge fund supervisor Liang Wenfeng, DeepSeek final week launched an in depth paper explaining easy methods to construct a big language mannequin that might mechanically study and enhance itself.

“It appears as if there’s a little bit of actuality dawning that China has not been sitting idle, whilst these tariffs and funding restrictions on tech corporations have been put in place,” mentioned Mitul Kotecha, Asia head of rising markets macro and international trade technique at Barclays.

The US imposed stringent restrictions on chip exports to China underneath former President Joe Biden, banning the sale of Nvidia’s most superior fashions to the nation.

Some analysts argued that DeepSeek’s advances would in the end show optimistic for AI chipmakers corresponding to Nvidia.

Dylan Patel, chief analyst at chip consultancy SemiAnalysis, mentioned slicing the prices of coaching and working AI fashions would over the long run make it simpler and cheaper for companies and customers to undertake AI functions.

“Developments in coaching and inference effectivity allow additional scaling and proliferation of AI,” mentioned Patel. “This phenomenon has occurred within the semiconductor business for many years, the place Moore’s Legislation drove a halving of value each two years whereas the business stored rising and including extra capabilities to chips.”