(Bloomberg) — Asian equities rose Thursday after their US friends set a recent excessive forward of inflation knowledge that will outline Federal Reserve coverage easing within the coming months.

Most Learn from Bloomberg

Shares in Japan, South Korea, Australia and China all superior. Positive aspects for Hong Kong and mainland China equities adopted the discharge of particulars for a Individuals’s Financial institution of China liquidity device institutional buyers can use to buy shares, a measure initially unveiled final month. The positive factors in China prolonged risky buying and selling that included the largest drop in additional than 4 years for a benchmark of mainland shares on Wednesday.

Treasuries have been regular in Asian buying and selling after yields drifted increased in New York on Wednesday. The Bloomberg Greenback Spot Index was little modified after rising in its eight prior periods. The yen was regular in opposition to the dollar after slumping to the bottom stage since mid-August to round 149 per greenback on Wednesday. South Korean bond futures rose following information of inclusion in FTSE Russell’s World Authorities Bond Index.

Few indicators of additional assist for China’s economic system and monetary markets appeared, indicating additional gyrations for the nation’s equities. A gauge of volatility for Hong Kong shares was a contact decrease Wednesday however remained properly above traditionally averages. One sticking level for buyers is whether or not there shall be extra fiscal stimulus. Authorities mentioned Wednesday a press convention on the subject shall be held over the weekend.

“Main into that assembly there’s positively lots of optimism and hope” round fiscal readability, mentioned Yuting Shao, macro strategist for State Avenue International Markets, on Bloomberg Tv. The broader themes of decrease US borrowing prices and official assist for China’s economic system will act as tailwinds for threat sentiment, she added. “Any readability from China goes so as to add one other layer on prime.”

The bar is excessive for China’s Ministry of Finance to persuade the market that its reflation pivot is again on extra firmly on the press convention on Saturday, in accordance with Morgan Stanley.

Elsewhere in Asia, Taiwan Semiconductor Manufacturing Co. posted a better-than-expected 39% rise in quarterly income on Wednesday. Markets are closed in Taiwan on Thursday.

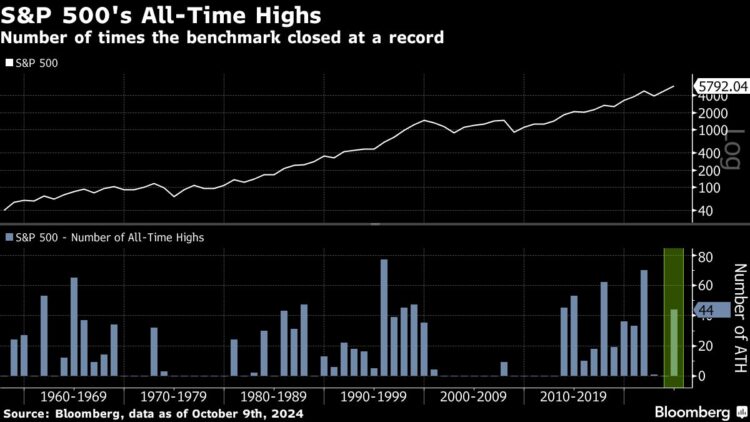

Again within the US, the S&P 500 rose 0.7% to a document excessive on Wednesday, its forty fourth of the yr, with tech shares once more propelling the positive factors. Apple Inc. climbed 1.7%. Nvidia Corp. halted a five-day rally whereas Tesla Inc. edged decrease forward of the Robotaxi launch. Alphabet Inc. fell 1.5% on information the US is weighing a Google breakup in a historic big-tech antitrust case.

Positive aspects for tech mirrored prior weak spot that represented a horny shopping for alternative, in accordance with Solita Marcelli, chief funding officer Americas at UBS International Wealth Administration. “We stay constructive on the tech sector in addition to the outlook for synthetic intelligence,” she mentioned. “We consider volatility must be utilized to construct long-term AI publicity.”

US client value knowledge to be launched later Thursday is anticipated to indicate inflation additional moderating, supporting the Fed’s anticipated easing within the coming months. Regardless of this, market pricing signifies the probability of one other 50 foundation level price reduce is all however off the desk following final week’s robust jobs report.

Markets barely budged on Wednesday after minutes of the most recent Fed gathering, which confirmed Jerome Powell obtained some push-back on a half-point price reduce in September, as some officers most popular a smaller discount.

“Policymakers agree inflation is fading and so they see potential weak spot in job progress,” mentioned David Russell at TradeStation. “That retains price cuts on the desk if wanted. The underside line is that Powell may need the market’s again headed into the yr finish.”

Inflation Information

The patron value index is seen rising 0.1% in September, its smallest acquire in three months. In contrast with a yr earlier, the CPI in all probability rose 2.3%, the sixth-straight slowdown and the tamest since early 2021. The gauge excluding the risky meals and power classes, which gives a greater view of underlying inflation, is projected to rise 0.2% from a month earlier and three.2% from September 2023.

“The Fed’s determination to shift its focus from inflation to the labor market implies that inflation knowledge, together with tomorrow’s CPI, is more likely to change into much less market-moving than it had been,” mentioned Matthew Weller at Foreign exchange.com and Metropolis Index.

“Regardless of that logical commentary, this month’s CPI report should still drive market volatility approaching the again of Friday’s stellar jobs report, a studying that hints on the potential for renewed upside dangers to inflation,” he added.

In the meantime, Fed Financial institution of San Francisco President Mary Daly mentioned she expects the US central financial institution will proceed decreasing rates of interest this yr in an effort to guard the labor market. “I feel that two extra cuts this yr, or yet another reduce this yr, actually spans the vary of what’s seemingly,” Daly mentioned Wednesday, referring to 1 or two quarter-point reductions.

In commodities, oil edged increased as US crude inventories swelled and merchants monitored China’s plans for fiscal coverage. Gold was little modified on Thursday after falling within the earlier six periods.

Key occasions this week:

-

US CPI, preliminary jobless claims, Thursday

-

Fed’s John Williams and Thomas Barkin converse, Thursday

-

JPMorgan, Wells Fargo kick off earnings season for the massive Wall Avenue banks, Friday

-

US PPI, College of Michigan client sentiment, Friday

-

Fed’s Lorie Logan, Austan Goolsbee and Michelle Bowman converse, Friday

Among the principal strikes in markets:

Shares

-

S&P 500 futures have been little modified as of 10:34 a.m. Tokyo time

-

Nikkei 225 futures (OSE) rose 0.5%

-

Japan’s Topix rose 0.4%

-

Australia’s S&P/ASX 200 rose 0.6%

-

Hong Kong’s Grasp Seng rose 2.4%

-

The Shanghai Composite rose 0.5%

-

Euro Stoxx 50 futures have been little modified

Currencies

-

The Bloomberg Greenback Spot Index was little modified

-

The euro was little modified at $1.0943

-

The Japanese yen was little modified at 149.18 per greenback

-

The offshore yuan rose 0.1% to 7.0838 per greenback

Cryptocurrencies

-

Bitcoin rose 0.4% to $60,625.44

-

Ether rose 1.3% to $2,386.23

Bonds

Commodities

This story was produced with the help of Bloomberg Automation.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.