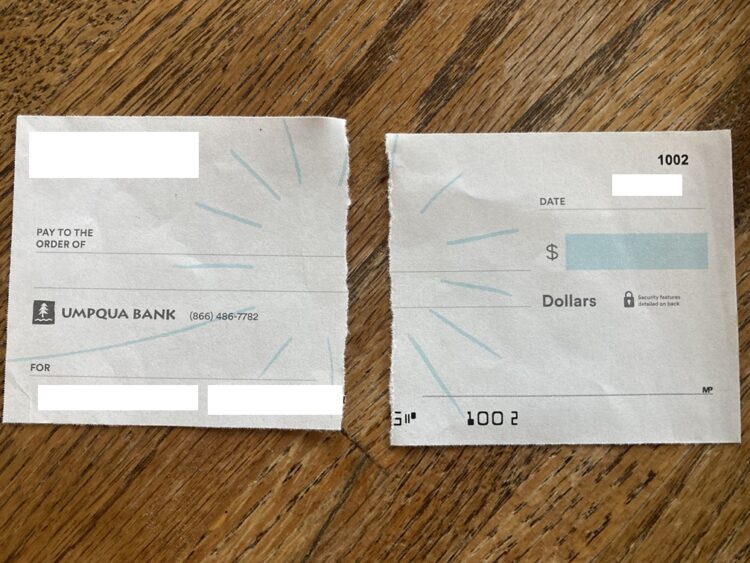

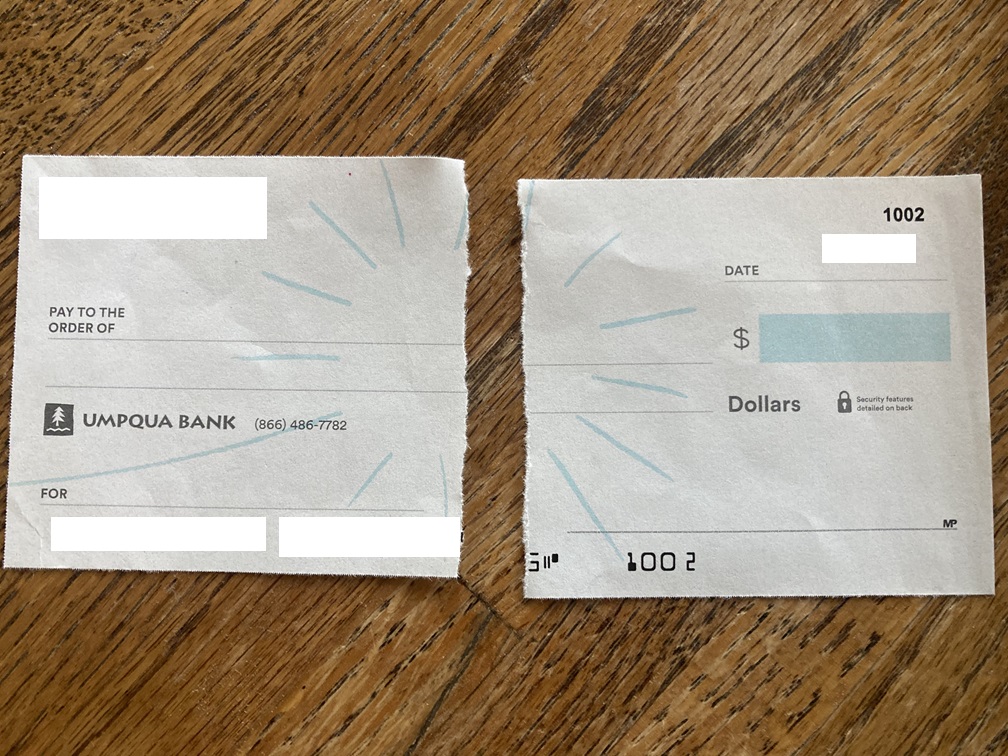

It occurs to the most effective of us—you by chance ripped a test that got here within the mail while you opened the envelope. Or possibly your youngster or canine received ahold of that test you had been in your strategy to the financial institution to money. Irrespective of the way it occurred, now you’ve got a broken test in your palms and are questioning, can you continue to deposit a ripped test?

The quick reply is, it relies upon.

It is dependent upon your financial institution’s insurance policies and the way broken the test is. If essential data just like the account or routing quantity is lacking, you might not be in a position use it in any respect.

Learn on to be taught extra so you may get your cash as quickly as potential.

How Do You Deposit a Ripped Test?

Once you tear a test, your first intuition could also be to tape it again collectively. However banks are literally much less prone to deposit a ripped test if you happen to attempt to repair it your self, so simply collect up the items when you have them and put them in an envelope for safekeeping.

The financial institution the place the test was drawn could also be extra keen to simply accept it, so take it there first. The issuing financial institution will normally seem on the test.

Once you get there, don’t attempt to use the ATM—give the test to a teller and politely clarify what occurred. They can money it for you, however needless to say you may be charged an additional dealing with charge as a result of the test is broken.

If the issuing financial institution received’t money it for you, take it to your private financial institution and attempt to deposit it as a substitute. Your financial institution’s cellular deposit characteristic is unlikely to simply accept it, so go to your native department in individual if potential.

Each financial institution has completely different insurance policies, so that they might not be keen to deposit a ripped test for you, particularly if it’s lacking essential data just like the account quantity, quantity, date, signature, or routing quantity.

Your financial institution wants all of these particulars to confirm that the test is legitimate. So in the event that they’re lacking or broken to the purpose that they’ll’t be learn, you received’t have the ability to money or deposit your test.

For those who’ve been turned away from a couple of banks, right here’s what to do subsequent.

Request a New Test

Generally a test is simply too mangled for the financial institution to confirm that it’s legitimate. In that case, you’ll have to return to the individual or firm that gave it to you and ask for a brand new test.

Though it may be embarrassing to confess you mishandled your test, there’s no different strategy to get a brand new one. So that you’ll must be sincere in an effort to get your cash.

Do not forget that accidents occur and corporations must reissue misplaced or broken checks on a regular basis. They’ll simply have the ability to void the previous test and write you a brand new one.

Wanting For Some Concepts To Fill Your Financial institution Account? Learn These:

38 Methods To Make Further Cash You’ve By no means Heard Of

Sure, There might Be Payments In Your Pockets Price Extra Than Face Worth

Can You Pay Utilizing A Ripped Greenback Invoice?

Vicky Monroe is a contract private finance and life-style author. When she’s not busy writing about her favourite cash saving hacks or tinkering along with her finances spreadsheets, she likes to journey, backyard, and cook dinner wholesome vegetarian meals.