Kim Moody: Canada must have broad-based private tax reductions, particularly in mild of the latest consequence within the U.S. election

Critiques and suggestions are unbiased and merchandise are independently chosen. Postmedia could earn an affiliate fee from purchases made via hyperlinks on this web page.

Article content material

In comparison with different Group for Financial Co-operation and Improvement international locations, Canada depends extra on private taxation revenues, which typically account for about 50 per cent of general authorities revenues — that’s an enormous quantity — although it varies yearly.

Any lower in private taxation charges may cause a big discount in general tax revenues, which is why the federal authorities tends to extend private tax charges, because it did in 2016 when it requested the so-called rich to “pay just a bit bit extra” by introducing an extra taxation bracket.

Commercial 2

Article content material

It’s a uncommon occasion when governments cut back private tax charges. In 2016, the purported rationale for the brand new excessive tax bracket was to fund a lower in decrease earnings tax brackets. However the plan — unsurprisingly — turned out to be a income loser.

It’s apparent Canada wants tax reform. Practitioners reminiscent of myself have been beating this drum for years and years. Extraordinarily poor taxation coverage over the previous 9 years has pushed profitable Canadians out of Canada. It has created excessive complexity in our taxing statute, which has contributed to the decreased administrative efficiency by the Canada Income Company. The typical accountant and lawyer has a tough time giving correct tax recommendation due to the complexity, and the typical Canadian merely doesn’t perceive our taxing statute.

Some economists, reminiscent of Jack Mintz, have additionally been beating the drum that Canada wants tax reform. Mintz has been advocating “Huge Bang” company tax reform so as to assist enhance Canada’s sagging financial progress and entice funding.

His proposal is predicated upon the mannequin of Estonia, however modified for Canadian functions. It’s a daring suggestion {that a} new federal authorities ought to take into account as a result of our present authorities clearly is not going to. If the Conservatives win the following election, they’ve promised to convene a Tax Reform Activity Power inside 60 days of getting elected.

Article content material

Commercial 3

Article content material

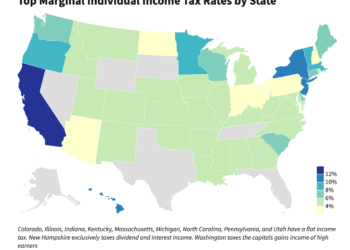

However what about Huge Bang private tax reform? Canada must have broad-based private tax reductions, particularly in mild of the latest consequence in america election. Our private tax charges are just too excessive. It’s unlikely we are able to ever afford to compete head-on with the U.S., given our a lot smaller inhabitants and economic system, however we actually can attempt to slim the hole.

Given our nation’s giant reliance on private taxation revenues, can we do this?

The commonest factor I usually hear from the typical Canadian is that we should always have a flat private earnings tax charge. The advantages, conceptually, are apparent: it could be a lot less complicated to calculate tax liabilities, particularly if numerous deductions and credit are eradicated, and tax compliance can be less complicated.

The issue with a flat tax is that it may be regressive if it isn’t correctly designed. For instance, if the flat private earnings tax charge — in a single-rate system — is, say, 20 per cent, that has a way more materials affect on lower-income taxpayers than on higher-income taxpayers.

The identical will be stated for the GST. The 5 per cent charge has a a lot larger affect on lower-income taxpayers than the upper ones. That’s the reason the GST was initially designed to not apply to sure fundamental requirements of life reminiscent of meals, clothes and most housing (besides, for instance, new builds). Schooling and well being care prices are additionally exempt. Mix that with the GST rebate system and the regressive results of the GST have been sharply decreased.

Commercial 4

Article content material

Utilizing the instance of the GST, might a flat-rate private tax system be designed to remove or cut back the plain regression related to a flat-rate tax system? If that’s the case, ought to the flat charge be a single-rate system? Twin charge? If it will get to a triple charge, why trouble since this will get away from the simplicity precept of a flat charge.

Might the precise charge be set in order to allow Canada to be extra aggressive for expertise and lead to all Canadians conserving extra of their hard-earned {dollars}? Can this be executed with a minimal internet lack of private taxation revenues? I say “internet” as a result of a key consideration might be how a lot authorities expenditures must be reduce to assist pay for the taxation income loss. It shouldn’t be too arduous to considerably cut back authorities bloat and waste.

A flat private tax charge has been a part of Estonia’s tax system since 1994 and it (together with its corresponding simplified tax compliance) has actually been a contributor to its financial success. If Canada adopts such a mannequin, Estonia can be an apparent place to take a look at for optimistic and detrimental experiences.

Commercial 5

Article content material

I just like the elegant simplicity of a flat private tax charge system, however I can already hear the naysayers, particularly some left-leaning teachers or so-called assume tanks, who might be fast to provide a examine about why a flat private tax charge system is unhealthy. I all the time recall that the simplest factor on the planet to do is to criticize or dismiss concepts. The more durable, however usually extra productive factor to do is to think about concepts critically and search for options for the plain downsides.

Really useful from Editorial

“Any idiot can criticize, condemn and complain — and most fools do,” the well-known author Dale Carnegie as soon as stated. And former Apple Corp. chief govt Steve Jobs stated: “Innovation is the flexibility to see change as a possibility — not a menace.”

I’m hopeful that ought to the Conservatives win the following election, the Tax Reform Activity Power will take into account Huge Bang private tax reform. It simply may be an excellent alternative for all Canadians.

Kim Moody, FCPA, FCA, TEP, is the founding father of Moodys Tax/Moodys Non-public Consumer, a former chair of the Canadian Tax Basis, former chair of the Society of Property Practitioners (Canada) and has held many different management positions within the Canadian tax group. He will be reached at kgcm@kimgcmoody.com and his LinkedIn profile is https://www.linkedin.com/in/kimgcmoody.

_____________________________________________________________

Should you like this story, join the FP Investor E-newsletter.

_____________________________________________________________

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it’s good to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material