As a FIRE mother and father elevating two youngsters in San Francisco, we rely closely on our investments to stay free. If we considerably misjudge returns, we improve the chance of getting to return to work.

Going again to work will not be the tip of the world. Ideally, nevertheless, we want to keep away from it till our children not wish to hang around with us on a regular basis. Based mostly on commentary, that seemingly occurs round age 12, which places us within the years 2028 and 2031.

For background, I am 48, and labored within the equities departments of two main funding banks from 1999 to 2012. Roughly 35% of our web value is in public equities. About 40% of our web value is in actual property, which is the principle supply of our passive earnings. About 15% of our web value is allotted to enterprise capital, enterprise debt, and crypto.

I don’t have the luxurious of working at a enterprise capital agency whereas espousing the virtues of index investing. Nor do I’ve a comfortable Wall Avenue strategist job that pays nicely no matter whether or not my calls are proper or mistaken. I attempt to keep constant in what I say and what I do as a result of that is actual cash and actual life. There aren’t any mulligans.

Disclaimer: This isn’t funding recommendation for you. I am sharing my ideas and what I plan to do with my very own cash. Proudly owning shares carries dangers with no assured returns. Please do your individual due diligence and make investments in accordance with your danger tolerance and monetary objectives.

Funding Outlook For Public Shares

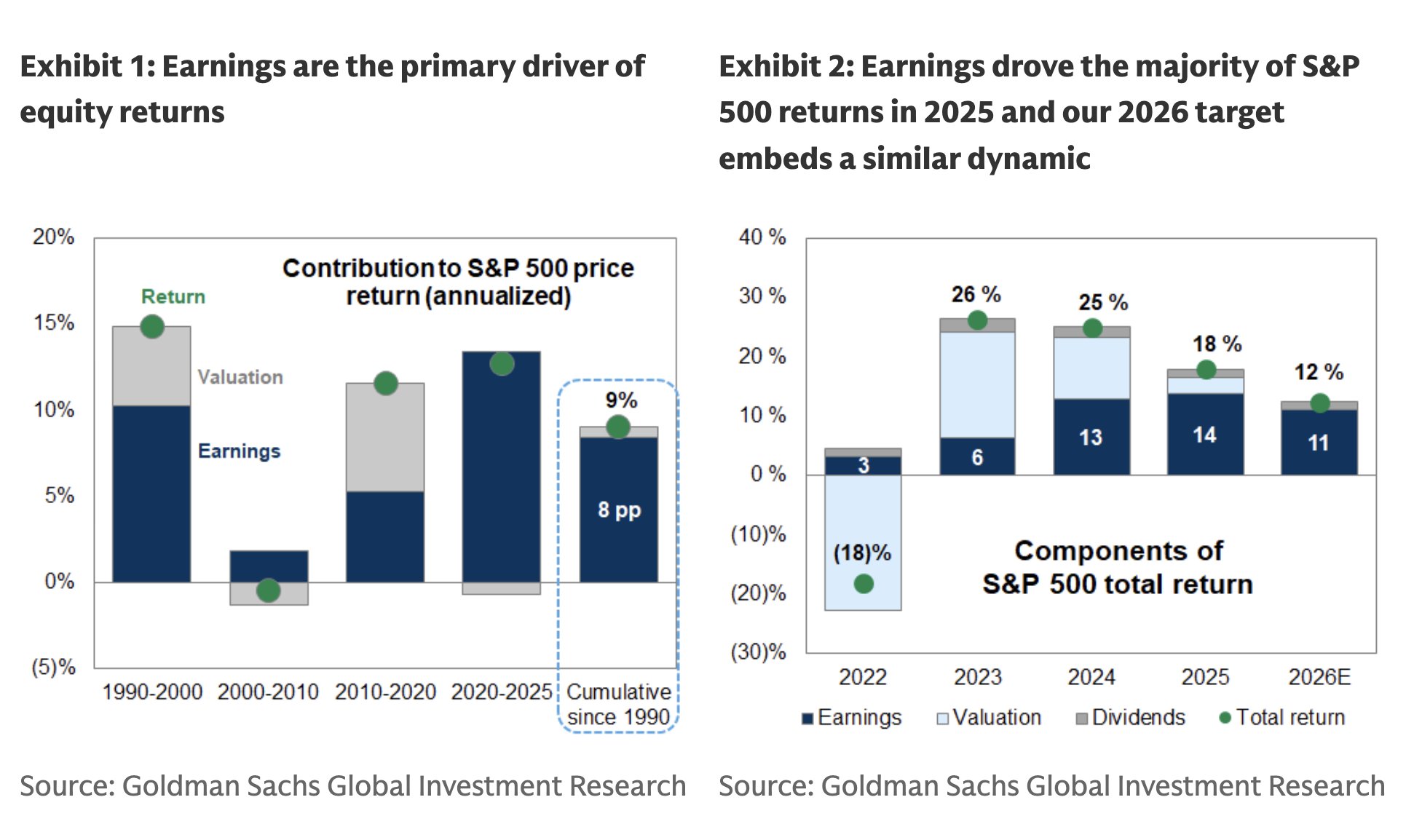

Earnings are the first driver of inventory costs, accounting for 70%+ of long run returns. The remaining 30% comes from valuation modifications, macroeconomic forces, and political occasions. Subsequently, the important thing query is the place earnings are headed in 2026 adopted by valuations.

The probably reply is greater, maybe within the vary of 8 to 12% progress. We are able to arrive at this estimate by aggregating earnings forecasts for the most important S&P 500 constituents and layering in affordable assumptions for margins, capital spending, and financial progress.

As soon as we have now an earnings vary, the following step is deciding what valuation a number of the market is keen to assign. Traditionally, the S&P 500 has traded round 18 occasions ahead earnings, with peaks approaching 27 occasions in periods of optimism and technological transformation. That provides us a tough valuation band, assuming nothing breaks badly sufficient to push multiples beneath historic norms.

If we consider synthetic intelligence represents a as soon as in a era transformation, similar to the web within the Nineteen Nineties, then it’s affordable to give attention to the higher finish of historic valuation ranges. A ahead a number of of twenty-two to 27 occasions earnings would place us in roughly the highest quintile of historic valuations, however not in uncharted territory.

If yr finish 2025 S&P 500 EPS is roughly $272 and earnings develop by 8 to 12%, we arrive at a 2026 EPS vary of roughly $294 to $305. Making use of a 22 to 27 occasions ahead earnings a number of yields a yr finish 2026 S&P 500 goal vary of roughly 6,500 to eight,200. That is a gigantic vary, however at the very least it supplies a framework for expectations.

The midpoint of that vary is about 7,350, which suggests roughly 6% upside from present ranges. Earnings progress can be pushed by continued AI associated capital expenditures, an easing Federal Reserve, and monetary stimulus tied to the One Huge Lovely Invoice Act. The first draw back danger is weakening consumption if job losses speed up greater than anticipated.

A Possible Lackluster Yr For Shares In 2026

Personally, I’ve low confidence that shares will meaningfully beat the risk-free price in 2026. The present danger free price, measured by the ten yr Treasury yield, sits round 4.2%. A 4.2% return would place the S&P 500 close to 7,200 by yr finish.

The distinction, after all, is that Treasury bonds present a contractual assured return, whereas shares expose you to draw back danger. In an atmosphere the place valuations are elevated, geopolitical uncertainty is excessive, and elections loom, that commerce off issues greater than common.

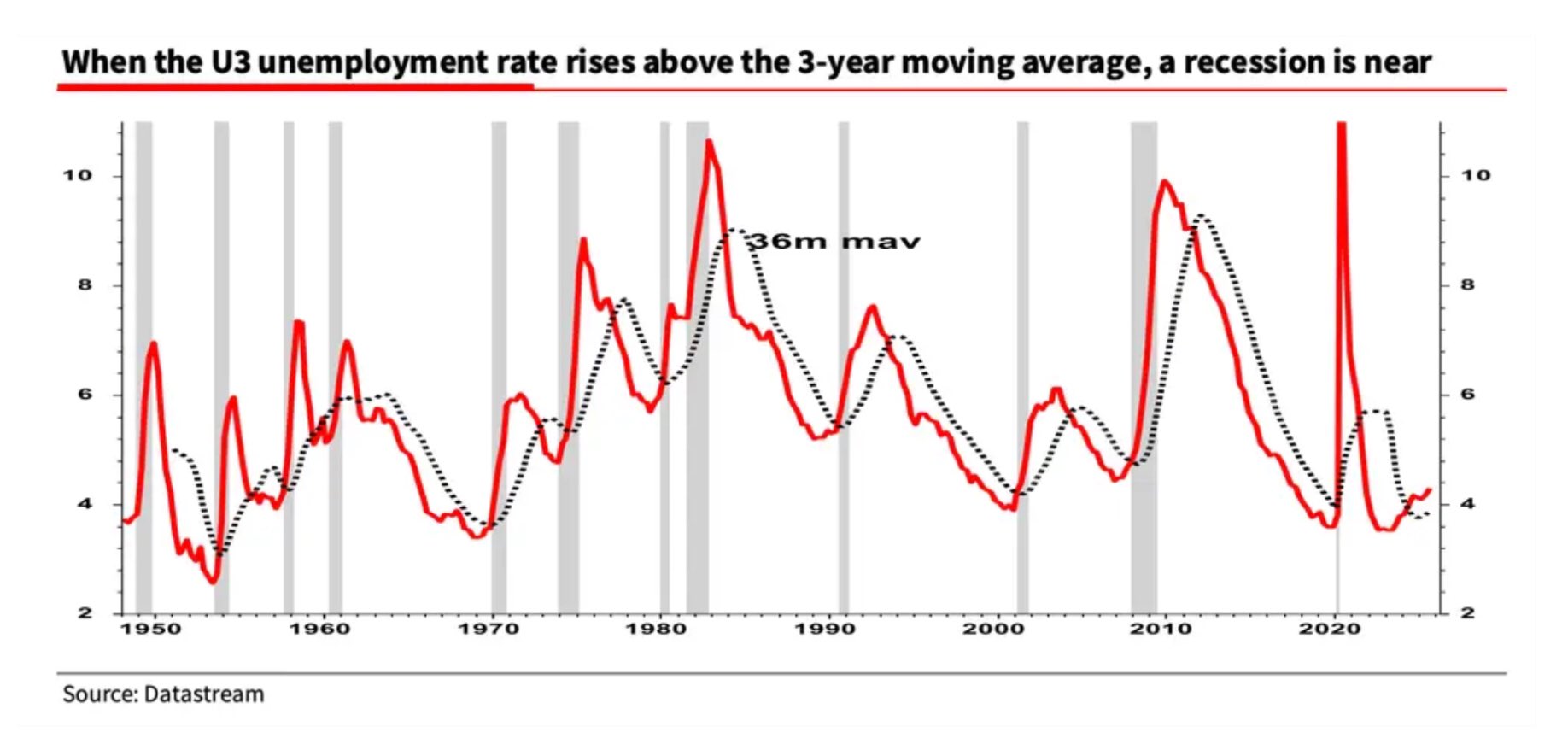

I’m firmly within the camp that we’ll see one other correction of at the very least 10% in 2026, so do not buy the dip too usually too quickly. Wealthy valuations, persistent geopolitical pressure, and political uncertainty are likely to make buyers extra danger averse. Corrections don’t require recessions. They solely require a repricing of expectations.

Consequently, I do not assume 2026 is the yr to aggressively improve fairness publicity or deploy most of your free money movement into public shares. Regardless of the roughly 70 % historic chance that shares rise in any given yr, the danger reward setup appears much less compelling than it did in 2023 and even 2024.

The S&P 500 is up roughly 80 % for the reason that begin of 2023. We needs to be counting our fortunate eggs and nurturing them fastidiously. After experiencing a 24% decline in 2022 following two robust years, the very last thing I need is to offer again a big portion of latest positive factors once more. My method for 2026 will due to this fact be extra defensive.

How I Plan To Make investments In Public Shares In 2026

Particularly, I plan to allocate incremental capital towards Treasury bonds and personal business actual property, two asset lessons which have materially underperformed public equities since 2023. Imply reversion could not occur on schedule, however valuation dispersion issues.

My private yr finish 2026 S&P 500 goal is 7,280, primarily based on a 24.3 occasions a number of utilized to $300 of earnings. My largest particular person inventory place stays Google, which I view as a quasi monopoly with monumental free money movement and optionality throughout a number of AI pushed markets. However I feel there needs to be a broadening out of efficiency.

Please remember that round mid-year, there will probably be new EPS estimates for 2027, and the road will begin valuing the market primarily based on these estimates.

Given my muted enthusiasm for public shares, I plan to focus totally on maxing out tax advantaged accounts corresponding to my Solo 401(okay), SEP IRA, and my youngsters’s custodial funding accounts. I don’t plan to aggressively construct my taxable brokerage account, the third rule of monetary independence, particularly since a good portion of our home sale proceeds in early 2025 was already reinvested into equities.

Enterprise Capital Could Outperform The S&P 500

After the exuberance of 2020 and 2021, personal firm valuations collapsed in 2022, with many personal corporations seeing markdowns of fifty % or extra. That washout, nevertheless, created more healthy entry factors for buyers keen to endure illiquidity. 2022 can also be the time when Fundrise launched its enterprise capital product.

Firms that survived 2022, or had been based throughout that interval and raised capital at affordable valuations, are sometimes in a lot stronger positions right now. They’re leaner, extra disciplined, and higher aligned with buyer demand.

I’m assured that personal AI corporations will outperform the S&P 500 in 2026. The reason being easy. Whereas the S&P 500 could develop earnings by 8 to 12 % yearly, sure personal progress corporations are rising revenues and earnings by that quantity month-to-month.

The problem, after all, lies in valuation methodology. Early stage progress corporations are sometimes valued on income multiples moderately than earnings. An organization producing $10 billion in income and rising at 200 % yearly could seem enticing at a 15 occasions income a number of. However as soon as profitability emerges, the market usually shifts valuation frameworks, generally abruptly.

Figma is a helpful instance. After a excessive profile IPO, its valuation was sharply repriced within the public markets, with shares declining roughly 80% from peak ranges. Whereas early enterprise buyers nonetheless achieved extraordinary returns, later stage public buyers realized that valuation regimes can change rapidly.

This dynamic reinforces the significance of diversification throughout personal and public markets. Metrics of success evolve as corporations mature, and what appears costly or low cost relies upon closely on context.

How I Plan To Make investments In Enterprise Capital In 2026

My purpose is to construct a $500,000 place in Fundrise Enterprise inside my company account and a $300,000 place in my private account earmarked for my youngsters by finish of yr. I’m roughly 75% of the best way towards each objectives and plan to contribute a further $100,000 and $50,000 respectively.

I even have commitments to 2 closed finish enterprise capital funds that will draw a further $50,000 to $100,000 in 2026. Assembly these capital calls is a should, in any other case, I am going to get blacklisted from future choices.

Once more, general, I’ll restrict my various investments to twenty% of all investable capital. Nonetheless, since corporations are staying personal for longer, I actually wish to have significant publicity to pick names to seize extra of the upside as nicely.

Barely Up In 2026 Will Be A Win

No person is aware of the place markets are headed. All we all know is that shares have traditionally risen about 70 % of the time in any given yr. 4 consecutive years of double digit positive factors are uncommon, however not unprecedented. The mid to late Nineteen Nineties present a helpful reminder:

1995: +34.11 %

1996: +20.26 %

1997: +31.01 %

1998: +26.67 %

1999: +19.53 %

That run was pushed by falling rates of interest, speedy technological adoption, and powerful financial progress. In some respects, right now’s atmosphere rhymes, significantly with stable GDP progress and moderating inflation. My hope is that there is a blowoff the highest, like we noticed in early 2000.

What issues is remembering what adopted:

2000: −9.1 %

2001: −11.9 %

2002: −22.1 %

The first rule of monetary independence is easy. Don’t lose some huge cash. Shedding tons capital prices time, and time is essentially the most helpful asset of all. I’m deeply grateful that the shares I owned since January 1, 2023 are up over 100%. My major monetary purpose for 2026 is to protect these positive factors.

That purpose would require luck, however it is going to additionally require intentional danger administration. For me, which means lowering publicity to public equities on the margin and diversifying incremental capital elsewhere.

Readers, what do you anticipate for the S&P 500 and for private and non-private markets in 2026?

Begin 2026 With Readability, Not Guesswork

If 2026 goes to reward self-discipline over blind optimism, then realizing precisely the place you stand issues greater than ever.

One instrument I’ve persistently relied on since leaving my day job in 2012 is Empower’s free monetary dashboard. It stays a core a part of how I monitor web value, monitor funding efficiency, and maintain money movement trustworthy.

Should you haven’t taken a tough have a look at your portfolio up to now 6 months, it is a wise time to take action. By Empower, you can even get a complimentary portfolio evaluate and evaluation you probably have greater than $100,000 in investable property linked. You’ll acquire clearer perception into your asset allocation, danger publicity, and whether or not your investments really match your objectives for the years forward.

Staying proactive isn’t about over-optimizing, it’s about avoiding preventable errors. Small enhancements right now can meaningfully compound into better monetary freedom over time.

Empower is a long-time affiliate associate of Monetary Samurai. I’ve personally used their free instruments since 2012 to assist handle my funds and investments. Additional, I did some part-time consulting for them in particular person from 2013-2015. Click on right here to study extra.