Revenue trailed expectations, largely because of a greater than 20% improve in different bills similar to acquisition-related value, and impairment of buyer contract related to an earlier acquisition.

Hexaware issued a muted income steerage for the 12 months forward. The corporate follows a January to December monetary 12 months.

Not like its mid-tier friends, Hexaware’s Q2 income was comparatively subdued at Rs 3,260 crore, rising 11.1% on-year and 1.6% sequentially in fixed forex phrases, lagging Avenue estimates. In fixed forex phrases, income stood at $382.1 million, rising 1.3% sequentially and seven.5% from a 12 months in the past.

Throughout the quarter, income development was impacted by decline in manufacturing and client segments, and flat development in monetary providers.

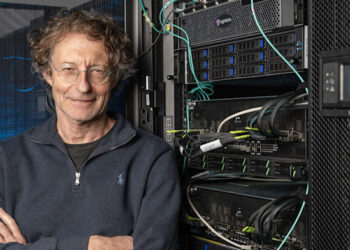

“Our development expectations for the 12 months are a bit of bit decrease now than it was to start with of Q2,” R. Srikrishna, CEO, Hexaware informed ET.“With plenty of new guarantees of upper tariffs towards a number of nations…that is on the unfavourable facet. On the constructive facet, some commerce offers have been introduced with some smaller nations and there might be a slew of them within the subsequent few weeks,” he added.Shares of Hexaware fell sharply on the earnings announcement. They closed 10.7% decrease at Rs 738.25 apiece, underperforming a 0.88% decline within the benchmark BSE Sensex.

The Hexaware administration mentioned there’s softness and cyclicality within the macro surroundings, and that every one massive consolidation offers are persevering with.

“Small and mid-sized offers are progressing properly. Nevertheless, choice making is slowed. Consequently, lowered expectations for the remainder of the 12 months,” the corporate mentioned.

Geographically, Europe witnessed development each on-year and sequentially, however Asia Pacific witnessed a decline from a 12 months in the past, and marginal development from the March quarter.

“There can be one or two quarters which could have blips (in Asia Pacific) however long-term, basically, it is going to be constructive,” mentioned Srikrishna. “In India, we made an acquisition to serve GCC (international functionality centre) prospects right here. Within the Center East, we proceed to have a powerful pipeline and count on to transform in Q3 and develop revenues in This autumn.”

This month, Hexaware acquired Bengaluru-based SMC Squared for $120 million (about Rs 1,038 crore) in an all-cash deal, which is predicted so as to add income development within the coming two quarters.

Whereas adjusted margin improved to 18.1%, up from 17.1% within the March quarter, its full-year margin steerage stood at 17.1–17.4%.

The corporate expects banking to proceed to ship higher sequential development regardless of a one-off degrowth in Q1 which is able to impression monetary providers for the total 12 months.

“On manufacturing, prospects are ready for readability on prices. As soon as that occurs, it takes just a few weeks to translate that into what it means for them,” Srikrishna mentioned.

Revenue trailed expectations, largely because of a greater than 20% improve in different bills similar to acquisition-related value, and impairment of buyer contract related to an earlier acquisition.

Hexaware issued a muted income steerage for the 12 months forward. The corporate follows a January to December monetary 12 months.

Not like its mid-tier friends, Hexaware’s Q2 income was comparatively subdued at Rs 3,260 crore, rising 11.1% on-year and 1.6% sequentially in fixed forex phrases, lagging Avenue estimates. In fixed forex phrases, income stood at $382.1 million, rising 1.3% sequentially and seven.5% from a 12 months in the past.

Throughout the quarter, income development was impacted by decline in manufacturing and client segments, and flat development in monetary providers.

“Our development expectations for the 12 months are a bit of bit decrease now than it was to start with of Q2,” R. Srikrishna, CEO, Hexaware informed ET.“With plenty of new guarantees of upper tariffs towards a number of nations…that is on the unfavourable facet. On the constructive facet, some commerce offers have been introduced with some smaller nations and there might be a slew of them within the subsequent few weeks,” he added.Shares of Hexaware fell sharply on the earnings announcement. They closed 10.7% decrease at Rs 738.25 apiece, underperforming a 0.88% decline within the benchmark BSE Sensex.

The Hexaware administration mentioned there’s softness and cyclicality within the macro surroundings, and that every one massive consolidation offers are persevering with.

“Small and mid-sized offers are progressing properly. Nevertheless, choice making is slowed. Consequently, lowered expectations for the remainder of the 12 months,” the corporate mentioned.

Geographically, Europe witnessed development each on-year and sequentially, however Asia Pacific witnessed a decline from a 12 months in the past, and marginal development from the March quarter.

“There can be one or two quarters which could have blips (in Asia Pacific) however long-term, basically, it is going to be constructive,” mentioned Srikrishna. “In India, we made an acquisition to serve GCC (international functionality centre) prospects right here. Within the Center East, we proceed to have a powerful pipeline and count on to transform in Q3 and develop revenues in This autumn.”

This month, Hexaware acquired Bengaluru-based SMC Squared for $120 million (about Rs 1,038 crore) in an all-cash deal, which is predicted so as to add income development within the coming two quarters.

Whereas adjusted margin improved to 18.1%, up from 17.1% within the March quarter, its full-year margin steerage stood at 17.1–17.4%.

The corporate expects banking to proceed to ship higher sequential development regardless of a one-off degrowth in Q1 which is able to impression monetary providers for the total 12 months.

“On manufacturing, prospects are ready for readability on prices. As soon as that occurs, it takes just a few weeks to translate that into what it means for them,” Srikrishna mentioned.