How a lot will these widespread banking charges value you?

Reply:

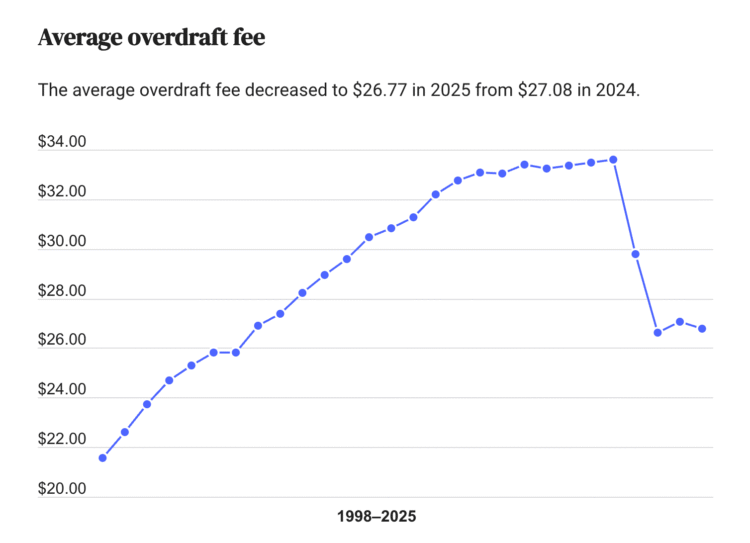

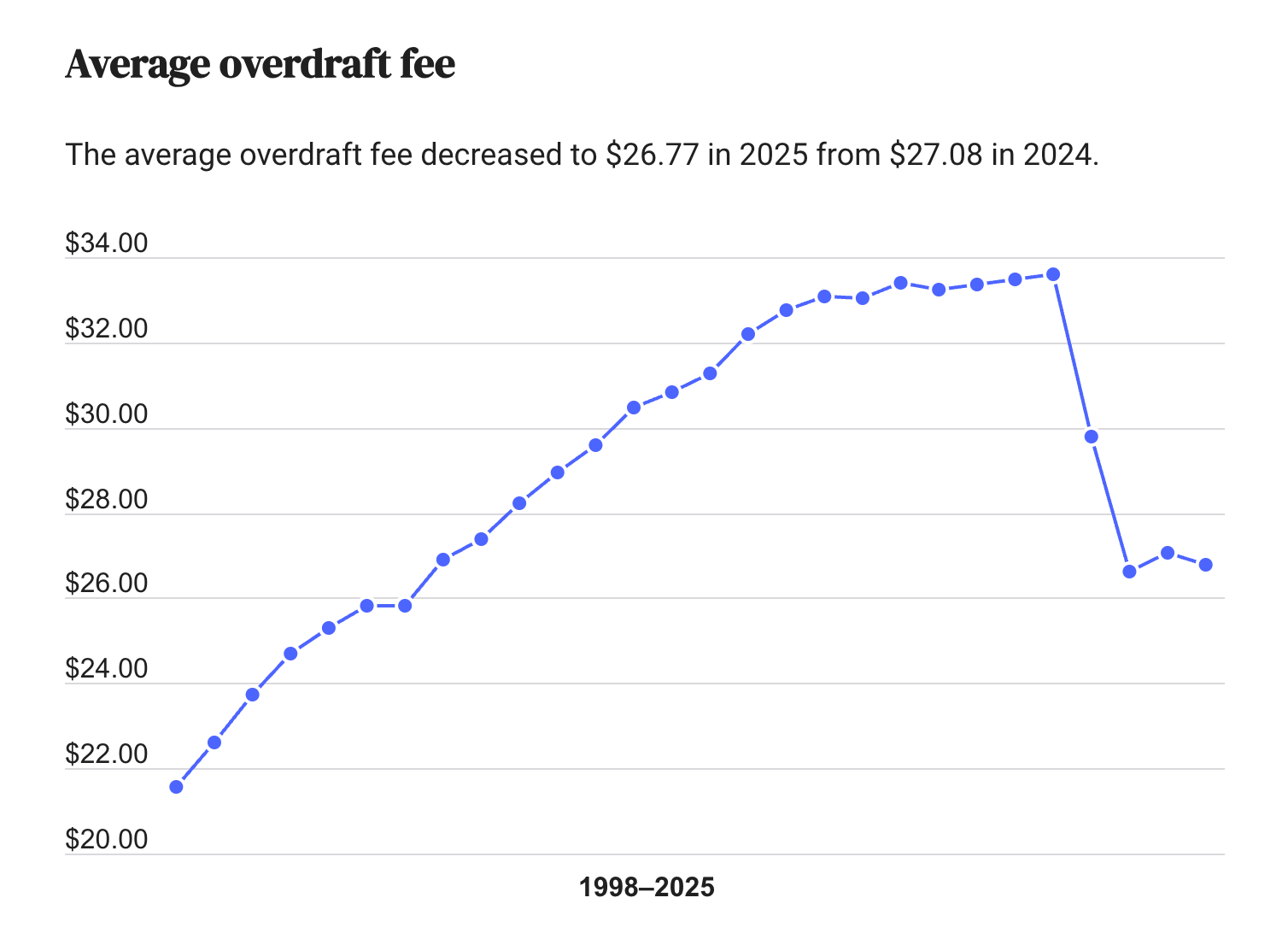

Overdraft: $26.77

Month-to-month service charge: $15.65

Out-of-network ATM: $4.85

Questions:

- Do these common charges appear cheap to you? Why or why not?

- Why do you suppose banks cost a charge to make use of their ATM for customers who don’t have an account at their financial institution?

- What steps can you are taking to keep away from banking charges and penalties?

Listed here are the ready-to-go slides for this Query of the Day that you need to use in your classroom.

Behind the numbers (Bankrate):

“Different financial institution charges on the rise embrace overdraft charges, Bankrate discovered, with the common having climbed this yr to $27.08, up from $26.61 in 2023. This improve comes after two straight years of declines, after the common overdraft charge had peaked at $33.58 in 2021. Overdraft charges are nonetheless charged by 94 p.c of accounts, Bankrate surveyed, and so they can run as excessive as $38.

In the meantime, it could be getting tougher to keep away from month-to-month service charges for interest-earning checking accounts, with the common minimal stability required to waive such a charge climbing to a report excessive of $10,210, Bankrate’s survey discovered.”

About

the Writer

Kathryn Dawson

Kathryn (she/her) is worked up to hitch the NGPF staff after 9 years of expertise in training as a mentor, tutor, and particular training instructor. She is a graduate of Cornell College with a level in coverage evaluation and administration and has a grasp’s diploma in training from Brooklyn Faculty. Kathryn is wanting ahead to bringing her ardour for accessibility and academic justice into curriculum design at NGPF. Throughout her free time, Kathryn loves embarking on cooking tasks, strolling round her Seattle neighborhood along with her canine, or lounging in a hammock with a ebook.