Social Safety offers everybody an official “Full Retirement Age.” It’s 67 for these born in 1960 or later, however you possibly can declare as early as age 62, as late as age 70, or wherever in between. The tradeoff is between a decrease month-to-month profit for extra years and the next month-to-month profit for fewer years. The uncertainty lies in how lengthy you’ll reside.

At any time when there are selections and uncertainty, individuals attempt to optimize. Everyone seems to be searching for the holy grail — when to assert Social Safety to maximise the advantages. However how a lot does it matter, anyway?

Open Social Safety

If you happen to’ve paid consideration to this matter, you’d know Open Social Safety. It’s the perfect software for a Social Safety claiming technique, and it’s fully free.

The first enter in Open Social Safety is your Main Insurance coverage Quantity (PIA), which you acquire by creating an account with the Social Safety Administration, copying your earnings historical past, and pasting it into ssa.instruments. See extra detailed steps in Retiring Early: Impact on Social Safety Advantages. If you happen to’re married, each of it is best to undergo this course of to get your separate PIAs.

Open Social Safety makes use of your PIA, marital standing, gender, and date of delivery — and the identical in your partner in the event you’re married — to calculate a really helpful technique. For instance, it produced this output for somebody single, male, born on 4/15/1960, with a $3,000 PIA:

You file in your retirement profit to start 10/2025, at age 65 and 6 months.

The current worth of this proposed resolution can be $416,562.

Open Social Safety tells you precisely when to assert Social Safety, which is nice, however don’t cease there. In any other case, you’ll miss this calculator’s greatest characteristic.

Spectrum Chart

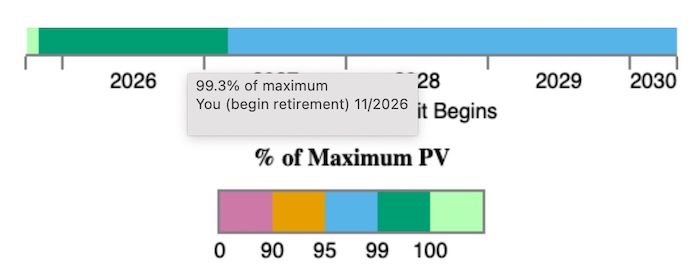

Scroll all the way down to the underside of the web page (on a pc, not in your telephone). You see a spectrum chart displaying how a lot the current worth of the advantages would change in the event you begin your Social Safety on different dates. As you progress the mouse alongside the spectrum chart, the tooltip reveals a proportion of the utmost for that begin date.

Open Social Safety recommends claiming instantly on this instance, however the spectrum chart reveals that this individual would nonetheless get 99.3% of the utmost current worth in the event that they wait one other 12 months. And the worst case for this individual? Claiming at age 70 will get 95.2% of the utmost current worth.

The spectrum chart and the entire current worth reply this vital query:

How a lot does when to assert Social Safety matter?

The whole current worth of Social Safety advantages claimed on the most optimum time is $416,562 for this individual within the instance. This tells them how a lot Social Safety performs a job of their retirement funds. If this individual has a $1 million web value, Social Safety represents near 30% of the entire. Claiming on the worst time and getting 95% of the utmost current worth decreases the entire by 1.5%. I’m not suggesting that one ought to throw away 1.5% willy-nilly, however I might say it’s properly throughout the margin of error.

Warmth Map

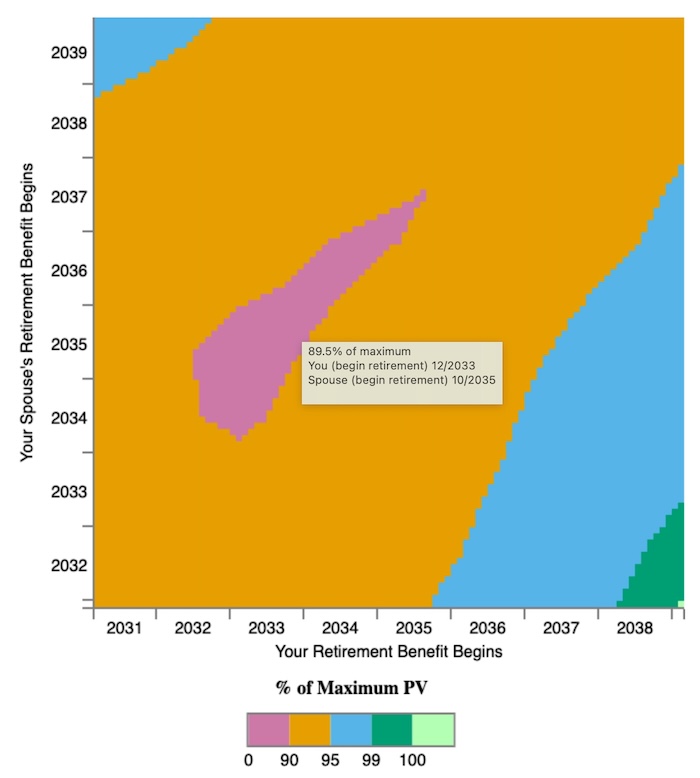

It’s extra sophisticated for a married couple. The one-dimensional spectrum chart for a single individual turns right into a 2D warmth map for a married couple. I ran one other case for instance, which produced this chart:

The horizontal axis represents one partner, and the vertical axis represents the opposite partner. The really helpful technique is on the backside proper. One individual ought to delay till age 70, and the opposite individual ought to declare as quickly as attainable, which is a typical technique for a lot of married {couples}. The utmost web current worth of their advantages is about $800,000.

The inexperienced and blue zones on the decrease proper of the warmth map point out that this couple has important leeway in when to assert. So long as one individual claims early, the opposite individual can declare at any time inside a 3-year vary (going horizontally on the backside), and they might nonetheless get greater than 95% of the utmost current worth. Or so long as one individual delays till 70, the opposite individual can declare at any time inside a 5-year vary (going vertically on the proper edge), and they might nonetheless get greater than 95% of the utmost current worth.

The magenta patch within the center represents the worst mixtures of claiming dates. In the event that they didn’t know any higher they usually picked the completely worst claiming dates, they’d get 89.5% of the utmost current worth.

How a lot claiming dates matter for this couple relies on how a lot they’ve outdoors Social Safety. If they’ve a $1 million web value, Social Safety represents near 45% of their complete assets ($800k over $1.8 million complete). Selecting the worst claiming dates would put a 4.5% dent of their retirement, which is extra significant than the 1.5% within the earlier instance, but when they’ll hold it above 95% within the blue and inexperienced zones, I might say that the impact of claiming dates falls properly throughout the margin of error.

Shifts in Technique

Open Social Safety makes use of a market rate of interest to calculate the current worth of the Social Safety advantages. Rate of interest adjustments can have an effect on the really helpful claiming technique. Generally persons are stunned to see an enormous shift within the advice after they run the calculator once more at a later time. For instance, it used to suggest claiming at age 70, and now it recommends claiming at 68.

I wouldn’t fear about it if the earlier advice remains to be throughout the blue and inexperienced zones. The purpose of utilizing Open Social Safety isn’t to get a single “greatest” claiming technique. Mike Piper, the creator of Open Social Safety, stated this in his weblog put up in 2020:

What issues most isn’t choosing the easiest technique. What issues most is simply avoiding a very unhealthy one. There are normally loads of methods which are virtually pretty much as good as the easiest technique.

Open Social Safety makes use of mortality tables for the likelihood of your dwelling to every age. Nearly as good as it’s, it nonetheless solely calculates based mostly on chances. No calculator is aware of if you’ll die. One of the best technique from any calculator received’t be the perfect in the event you defy the possibilities.

Make It Not Matter

Right here’s how I might use Open Social Safety with my Make Fewer Issues Matter method:

1. Learn the utmost current worth output from Open Social Safety. Calculate its weight within the complete retirement assets.

Social Safety / (Social Safety + Non-Social Safety)

2. Pay attention to the inexperienced and blue zones within the warmth map. All claiming dates within the inexperienced and blue zones give above 95% of the utmost current worth. Search for the worst case as properly.

3. Mix (1) and (2) to comprehend the big leeway in when to assert Social Safety.

Claiming dates don’t matter so long as you keep within the inexperienced and blue zones within the chart. Write down the place your inexperienced and blue zones are. Save the chart picture in the event you’d like.

Even the worst dates don’t matter if (a) the burden of Social Safety is small enough in your complete retirement assets; and (b) the worst dates nonetheless offer you near 90% of the utmost.

In fact, you don’t select the worst dates on objective, but it surely’s a reduction to know the way little it issues, and it’s not attainable to screw up too badly. You decide a spot within the inexperienced and blue zones, cross it off your thoughts, and transfer on to extra essential issues.

Study the Nuts and Bolts

I put every part I take advantage of to handle my cash in a guide. My Monetary Toolbox guides you to a transparent plan of action.