ETMarkets.com

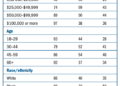

ETMarkets.comDetermine 1 Supply : Ace Fairness

As market individuals, these insights present helpful context for sector-specific tendencies and company methods shaping the broader market trajectory. Under, we delve into sector-wise monetary efficiency and administration commentaries to raised perceive the drivers of development and challenges in the course of the quarter.

ETMarkets.com

ETMarkets.comDetermine 2 Supply : Ace Fairness

ETMarkets.com

ETMarkets.comDetermine 3 Supply : Ace Fairness

Nifty Financial institution

The banking sector had an honest quarter, with income rising 16% YoY and web earnings rising 18% YoY. Progress was supported by strong demand for private and residential loans, although business lending remained average. The sector confronted some contraction in CASA ratios, resulting in elevated funding prices and barely decrease or steady Web Curiosity Margins (NIMs). Nevertheless, a decline in Gross and Web NPAs displays continued enhancements in asset high quality.

Nifty FMCG

The FMCG sector reported muted development, with income up by solely 7% YoY and income rising marginally by 1% YoY. Challenges stemmed from uneven rainfall, increased meals inflation, and delayed festive demand, which impacted rural consumption—a key development driver for the sector. Optimism for H2 FY25 stays excessive, pushed by expectations of a revival in rural demand, boosted by authorities spending, festive, and wedding-related consumption. Firms have responded by rising promoting efforts and introducing progressive product launches.

Nifty Auto

The auto sector confronted a sluggish quarter, with income rising a modest 4% YoY, whereas income remained muted. Two-wheeler gross sales have been affected by rising enter prices and muted rural demand, whereas SUVs witnessed wholesome demand development. The sluggish quarter additionally coincided with a Sharada an inauspicious interval (primarily based on cultural components). Trying forward, festive season gross sales, rural demand restoration, and rising penetration of EVs are anticipated to drive development.

Nifty Pharma

The Pharma sector outperformed, with income rising 10% YoY and income surging 24% YoY. Progress was supported by sturdy export demand, particularly for generic and specialty medicine, in addition to a stabilization in uncooked materials prices. On the home entrance, persistent therapies like diabetes and cardiovascular medicine drove gross sales, whereas acute remedy development remained subdued. Enhanced operational efficiencies and price controls additional improved profitability.

Nifty Realty

The realty sector loved a powerful quarter, with increased income and earnings. Key development drivers included strong residential demand, new launches, and declining debt ranges. Moreover, authorities insurance policies aimed toward selling reasonably priced housing options boosted sentiment. Business actual property additionally contributed positively to profitability.

Nifty Infra

The infrastructure sector posted a disappointing quarter, with income elevated by mere 3% YoY and income plunging 34% YoY. A slowdown in authorities mission bulletins and the affect of the monsoon season weakened demand for enter supplies like cement, resulting in strain on builders and producers alike.

Nifty Metallic

Whereas income for the metals sector remained flat, income soared attributable to operational efficiencies, price reductions, and improved EBITDA margins. The absence of irregular losses from the earlier yr, mixed with some one-time beneficial properties this quarter, contributed considerably to the sector’s profitability.

Nifty Power

Power corporations confronted a tricky quarter, with income rising 1% YoY and income declining sharply by 42% YoY. This was attributed to weakened demand, increased enter prices, and margin compression in core companies.

Nifty IT

The IT sector delivered a resilient efficiency, with income rising 6% YoY and income rising a sturdy 10% YoY. Progress was fueled by giant deal wins, sturdy traction in manufacturing, retail, and life sciences, and a deal with AI and digital transformation companies.

Conclusion

The Q2 FY25 outcomes mirror the various affect of exterior headwinds, sector-specific dynamics, and inner strategic initiatives on Nifty 50 constituents. Whereas some sectors, like Pharma, Realty, and Metals, leveraged structural tailwinds and operational efficiencies, others, together with Power and Infrastructure, confronted profitability challenges. Trying forward, optimism stays for a stronger H2 FY25 as sectors gear up for festive demand, rural restoration, and investments in innovation and digital transformation. Because the market evolves, a balanced strategy between defensive and cyclical performs will stay key for sustained portfolio efficiency.