What % of the inhabitants of your state or metro space are unbanked?

[Post updated on September 25, 2024]

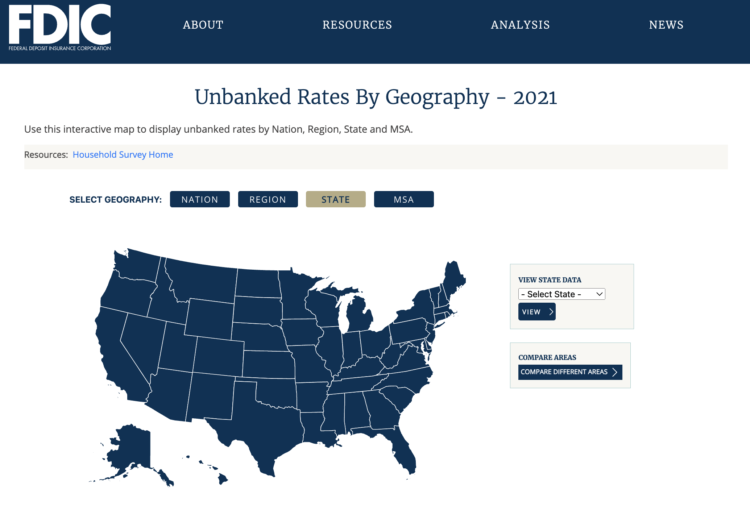

The FDIC has an interactive that lets you discover the nationwide, regional, state and MSA (metro space) particular knowledge on the % of the inhabitants that’s unbanked:

NGPF’s exercise, INTERACTIVE: What is the Banking Standing in Your Space? options this interactive and is a core exercise within the Semester Course Banking Unit. Within the exercise, college students analyze the info from this interactive, replicate on the assorted causes households are unbanked, and discover the providers they use in lieu of banks.

——————–

Searching for extra interactives? Try the NGPF Weblog!

About

the Creator

Tim Ranzetta

Tim’s saving habits began at seven when a neighbor with a damaged hip gave him a canine strolling job. Her restoration, which took nearly a 12 months, resulted in Tim attending to know the financial institution tellers fairly nicely (and accumulating a financial savings account stability of over $300!). His latest entrepreneurial adventures have included driving a shredding truck, analyzing government compensation packages for Fortune 500 corporations and serving to households make higher school financing choices. After volunteering in 2010 to create and educate a private finance program at Eastside School Prep in East Palo Alto, Tim noticed firsthand the affect of an enticing and activity-based curriculum, which impressed him to start out a brand new non-profit, Subsequent Gen Private Finance.

What % of the inhabitants of your state or metro space are unbanked?

[Post updated on September 25, 2024]

The FDIC has an interactive that lets you discover the nationwide, regional, state and MSA (metro space) particular knowledge on the % of the inhabitants that’s unbanked:

NGPF’s exercise, INTERACTIVE: What is the Banking Standing in Your Space? options this interactive and is a core exercise within the Semester Course Banking Unit. Within the exercise, college students analyze the info from this interactive, replicate on the assorted causes households are unbanked, and discover the providers they use in lieu of banks.

——————–

Searching for extra interactives? Try the NGPF Weblog!

About

the Creator

Tim Ranzetta

Tim’s saving habits began at seven when a neighbor with a damaged hip gave him a canine strolling job. Her restoration, which took nearly a 12 months, resulted in Tim attending to know the financial institution tellers fairly nicely (and accumulating a financial savings account stability of over $300!). His latest entrepreneurial adventures have included driving a shredding truck, analyzing government compensation packages for Fortune 500 corporations and serving to households make higher school financing choices. After volunteering in 2010 to create and educate a private finance program at Eastside School Prep in East Palo Alto, Tim noticed firsthand the affect of an enticing and activity-based curriculum, which impressed him to start out a brand new non-profit, Subsequent Gen Private Finance.