1. 6k a Month Is How A lot a Yr?

Earlier than deciding if $6,000 month-to-month is sufficient, let’s calculate the yearly revenue. At $6k a month, you’re taking a look at $72,000 yearly earlier than taxes. This locations you in a strong middle-income bracket within the U.S. Nonetheless, after taxes, your take-home pay could vary between $55,000 and $60,000, relying on deductions. Realizing your after-tax revenue is essential for budgeting successfully. At all times account for medical health insurance, retirement financial savings, and different automated deductions when assessing annual earnings.

2. The place You Stay Issues

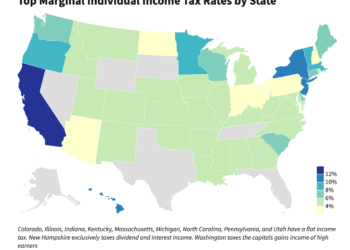

Location is a game-changer when figuring out if $6k a month is ample. In cities like San Francisco or New York, excessive lease and dwelling bills would possibly go away little wiggle room. Conversely, in smaller cities or rural areas, $6,000 a month can really feel luxurious. Instruments like cost-of-living calculators may help you examine bills between areas. Don’t neglect to think about state taxes, which range extensively and may considerably influence your finances.

3. Life-style Selections

Your spending habits decide how far your revenue stretches. A minimalist couple prioritizing financial savings and necessities would possibly thrive on $6k a month. Nonetheless, frequent eating out, journey, or luxurious purchases can rapidly deplete your finances. Allocating funds utilizing the 50/30/20 rule (50% wants, 30% needs, 20% financial savings) can make sure you stay inside your means. Setting priorities and sticking to them is vital to creating $6k a month work. Keep in mind, the purpose isn’t simply to stay however to stay properly.

4. Financial savings and Retirement Planning

Dwelling properly immediately shouldn’t overshadow saving for tomorrow. With $6,000 a month, setting apart 15-20% for retirement is a great transfer. Employer-sponsored retirement plans, IRAs, and emergency funds are very important elements of monetary stability. With out dependents, DINKS {couples} usually have a bonus in maximizing financial savings. Constructing monetary safety ensures you’ll preserve your way of life even after retirement. Don’t underestimate the ability of compound curiosity when planning in your future.

5. The Position of Debt

Debt considerably influences whether or not $6,000 a month is ample. {Couples} with minimal debt can allocate extra funds towards way of life and financial savings. Nonetheless, high-interest bank cards, scholar loans, or automobile funds can eat into your revenue. Tackling debt systematically, utilizing methods just like the snowball or avalanche technique, can unencumber money for different priorities. Being debt-free not solely relieves stress but additionally expands your monetary prospects. Consider your debt-to-income ratio to gauge the place you stand.

Is $6k a Month Sufficient for a DINKS Couple to Thrive?

Finally, whether or not $6,000 a month is sufficient is determined by your location, way of life, and monetary objectives. With good planning and disciplined spending, many DINKS {couples} can stay comfortably on this revenue. Prioritizing financial savings and minimizing debt ensures long-term stability and freedom. Consider, flexibility and flexibility are your best belongings in reaching a satisfying life. By staying conscious of your monetary selections, $6k a month can completely help a rewarding and balanced way of life.