Medical insurance is among the most complicated and aggravating subjects for each shoppers and suppliers within the US. Communicate with anybody based mostly exterior the US they usually all will remark about how a lot better issues are overseas versus right here.

However as most of you’ll agree, having medical insurance is a monetary necessity in America immediately. With out it, if you happen to have been to get in a significant accident or get significantly ailing, you would actually go bankrupt. And if you happen to stay in California, Massachusetts, New Jersey, Rhode Island, Vermont, or Washington D.C. you may be penalized if you do not have medical insurance.

I’ve requested my spouse Sydney to weigh in beneath on the important thing elements to think about earlier than altering medical insurance plans. We selected to change medical insurance plans this open enrollment season to save lots of on value.

Sydney handles all of our medical insurance plan renewals, premium funds, physician appointments, and medical payments. She additionally took care of an eye-opening ambulance invoice nightmare that took a 12 months to resolve. We’ll by no means take a look at ambulances and medical insurance the identical approach once more.

The Ever Rising Prices Of Well being Insurance coverage Plans

Yearly round September, I dread getting the annual discover about our upcoming medical insurance renewal interval. As soon as the packet lastly comes, I shortly skim it, shudder, after which put “Examine medical insurance plans” on the backside of my to do checklist. I’ve a foul behavior of delaying duties that I discover irritating—and irritating that is.

Not as soon as has our plan renewed at a cheaper price. It is all the time gone up, up, and up some extra. However now it has gone up a lot. How rather more? Our current PPO Gold plan for a household of 4 is renewing at a ten.8% improve from $2,534/month to $2,808/month. That will imply shelling out practically $34k a 12 months or the tough equal of $47k in pre-tax compensation. Ouch.

Again once we labored conventional company jobs, our medical insurance premiums have been largely lined by our employers. Heck, they have been even 100% lined for a few years previous to the World Monetary Disaster. However now that we’re on our personal, the expense is completely on us.

As FIRE dad and mom, we don’t qualify for well being care subsidies—fortuitously or sadly. This implies it’s our accountability to pay the utmost medical insurance premiums, successfully subsidizing different households. On the similar time, it’s as much as us to prioritize staying as wholesome as potential to attenuate our personal healthcare prices and assist those that might not be as lucky.

Each-Rising Well being Insurance coverage Premium Prices

To assist put this 12 months’s renewal in perspective, our annual premium will increase in recent times have ranged between 1% to three%. A ten.8% improve is thus far out of the norm it makes me nauseous.

The one optimistic is that giving up our Platinum plan (the very best tier) a number of years in the past has saved us cash. These plans value about $3,200-3,300 immediately for a household of 4, that is about 16% dearer than Gold.

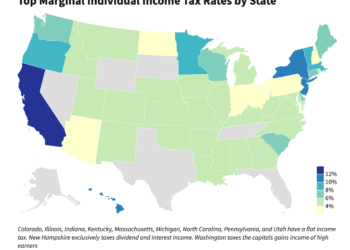

And we’re not the one ones experiencing increased medical insurance premiums. Simply check out the chart beneath.

What To Do When Your Well being Insurance coverage Premiums Are Too Excessive

Whilst costly as medical insurance is, I am grateful to have it. We positive have wanted it this 12 months with two sudden visits to the ER. Nonetheless, every go to value us somewhat over $1,000.

However, we wish to decrease our medical insurance prices. And plenty of of you’ll seemingly end up on this similar state of affairs sooner or later. So what do you do when your medical insurance premiums are too excessive?

Listed here are just a few excessive stage motion factors to think about. Not all of them could also be obtainable to you, however they’re worthwhile realizing about.

- Swap to a decrease metallic tier. The rank from costliest to lowest value is Platinum, Gold, Silver, and Bronze.

- Decide a plan with the next deductible, a few of which can be HSA eligible.

- Transfer to a unique insurance coverage provider that is inexpensive, however could have a smaller supplier community.

- Change to an HMO plan from a PPO plan, that are usually inexpensive.

- Discover a new job that gives higher medical insurance advantages with increased employer subsidies.

- Switch to a minimal protection plan also called a catastrophic medical insurance plan.

- Earn lower than 400% of the Federal Poverty Restrict to get well being care subsidies if you happen to can.

Vital Concerns Earlier than Altering Well being Insurance coverage Plans

Since I am sad with the renewal value of our current medical insurance plans, I am looking for a brand new one. Though it is not a enjoyable train, it is not too sophisticated when you sit down and take a look at your choices.

Listed here are among the key elements I am utilizing in my search. Even if you happen to’re not altering plans proper now, it is useful to learn by this checklist so you may be higher ready when your open enrollment window begins.

1. Protection Wants

In the beginning, take into consideration the way you anticipate to make use of medical insurance. This consists of preventative and specialist physician visits, prescription medicines, surgical procedures, and any ongoing remedies. You may wish to guarantee no matter plan you choose will cowl your wants adequately.

Some additional issues to think about when it comes to protection embody:

- Your present well being standing

- If in case you have any continual diseases

- Observe up care wants for current accidents

- How continuously you anticipate to see your major care doctor (PCP) and specialist docs

- How simple it’s to entry specialists and coverings

- If preventative care is totally lined or not

- What sort of hospital companies are lined and the way

- Maternity and new child care if you happen to plan to have a child

2. Analyze The Prices

Analyzing prices earlier than altering medical insurance plans is a vital step to make sure you’re adequately lined. No one likes shock medical payments. And with the best way costs are today, you do not wish to wind up with 4 to five digit funds after a process or go to to the ER.

Begin by reviewing your present plan’s premiums, deductibles, copayments, co-insurance, and out-of-pocket maximums. This provides you with a baseline for comparability. Have a look at your healthcare utilization over the previous 12 months. Tally up the frequency and value of routine visits, specialist consultations, medicines, and sudden medical bills.

Subsequent, collect data on potential new plans. Most insurance coverage suppliers supply detailed summaries that define prices and protection specifics. Pay shut consideration to the premium quantities, in addition to the deductibles and copayments for various companies.

Upon getting a complete understanding of each your present and potential plans, it is time to examine them. For every plan, calculate the estimated annual value based mostly in your projected healthcare utilization. This can aid you see which plan is extra financially possible in the long term. Don’t neglect to think about any modifications to your well being standing, as this might impression your utilization and prices.

Lastly, consider any potential modifications in protection and limitations. Some plans could have increased premiums however supply decrease out-of-pocket bills, whereas others could seem cheaper however include restrictive protection. See how the protection aligns together with your healthcare wants and preferences. Making an knowledgeable choice will aid you steadiness affordability with the extent of care you that works finest for you.

3. Supplier Community Dimension

Earlier than switching medical insurance plans, it is vital to think about the scale and high quality of the supplier community. First, verify in case your present docs, specialists, and hospitals are within the new plan’s community. If you wish to preserve your current suppliers, ensure that they’ll proceed to be in-network. In any other case you would wind up paying considerably extra or want to seek out new ones. Plans with bigger networks are inclined to have increased premiums, however they provide extra flexibility. Smaller networks could have decrease premiums however might restrict your choices for care.

It’s additionally essential to know the kind of plan you’re selecting. For instance, HMO plans have smaller networks that require referrals for specialists. PPOs supply extra flexibility, however may be prohibitively costly if you happen to go out-of-network. Some plans cowl out-of-network suppliers at the next value, whereas others could solely cowl it in emergencies or by no means. Location issues too—make sure that there are sufficient native in-network suppliers close by.

4. Prescription Protection

Subsequent, assessment prescription drug protection. Examine in case your present medicines are included in a brand new plan’s checklist of lined medication. You may additionally wish to take a look at its tier system for prescriptions, which teams medication based mostly on value. Some plans solely supply generics and require prior authorizations. Others embody brand-names and specialty medication, however they could be a lot dearer. So you may wish to familiarize your self with the copays or coinsurance for the medicines you want and guarantee it is inside your price range.

You may additionally wish to verify in case your most popular pharmacy is in-network. Some plans supply higher protection or reductions at sure pharmacies, together with mail-order companies. And in addition do not forget to think about any annual prescription deductibles. Some plans have separate deductibles only for prescriptions, which might have an effect on your out-of-pocket prices.

5. Added Advantages & Misc.

When evaluating a brand new medical insurance plan, it is vital to think about if added and miscellaneous advantages might enhance your total care and scale back out-of-pocket prices. These advantages can embody issues like dental, imaginative and prescient, listening to protection, wellness packages, telehealth companies, acupuncture, and chiropractic care. Examine which plans supply these extras and resolve in the event that they meet your wants and price range. For instance, some plans could embody routine eye exams, glasses, or dental cleanings, whereas others could not.

Wellness packages, corresponding to reductions for fitness center memberships, smoking cessation packages, or weight reduction assist can present worth past medical care. In the meantime, telehealth companies might prevent money and time on non-emergency visits. Lastly, when you have a continual situation, case administration or illness administration packages may help coordinate care and supply additional assist.

What We Ended Up Doing

With two rambunctious younger children, and feeling our personal aches and pains, good medical insurance is a should for our household. As a way to preserve all of our current suppliers, switching carriers was suboptimal. So I shortly took that off the desk. We additionally didn’t wish to swap to an HMO plan and lose ease of entry to a number of of our suppliers and specialists. Comfort and effectivity are priorities for us.

What I centered on subsequent have been largely the community dimension, month-to-month premium value, deductible quantities, and co-insurance. Ultimately we saved the identical supplier community however downgraded to a barely cheaper plan than our renewal equal.

We’ve the next deductible now and barely much less co-insurance protection. However, fortunately there are no main modifications in co-pays or lined companies. So as an alternative of renewing at $2,808 monthly, our new month-to-month price is $2,628. We’re nonetheless paying +3.7% greater than final 12 months, which is increased than the annual will increase in recent times. But when we did not change plans in any respect, we would be paying +10.8% extra.

Inflation and rising healthcare prices positive are a problem. So could all of us do our greatest to remain wholesome and preserve our medical payments as little as potential!

Closing Concerns When Altering Well being Insurance coverage Plans

There are a number of further elements to think about past prices and protection if you wish to change medical insurance plans. Make sure you assessment the out-of-pocket most, which caps your annual bills for lined companies. A decrease restrict can shield you from excessive medical payments, however it might include increased premiums.

It is also vital to verify the protection for psychological well being and substance use companies, as this will range considerably between plans. Additionally verify if the plan covers pressing care and emergency companies, particularly if you happen to want care exterior of standard workplace hours or whereas touring.

You can too verify if a plan is eligible for a Well being Financial savings Account (HSA) or Versatile Spending Account (FSA). These accounts mean you can save tax-free cash for healthcare prices. Customer support is vital consideration—consider the supplier’s popularity for responsiveness and claims dealing with to keep away from frustration when points come up. Moreover, verify if there are any ready intervals earlier than sure advantages kick in, significantly for companies like maternity care or surgical procedures.

By evaluating a mess of things, you possibly can choose a plan that gives complete care, comfort, and monetary safety tailor-made to your wants. In abstract, examine and distinction the beneath plan options when deciding if you happen to ought to change medical insurance plans.

- Metallic tier (Platinum, Gold, Silver, Bronze)

- Month-to-month premium value

- Basic deductible, prescription deductible, and ER deductible value

- Dimension of supplier community

- Plan sort (HMO, PPO)

- Varieties of preventative care protection

- Co-pay and co-insurance quantities

- Prescription protection and drugs tiers

- Ease of accessing specialists, screenings, and coverings

- Lined hospital companies

- Added advantages & miscellaneous protection

- Ready intervals and restrictions

Defend Your Household

There are various different kinds of insurance coverage to think about along with medical insurance. If in case you have debt and dependents, contemplate the advantages of buying a time period life insurance coverage coverage.

Undecided the place to begin? Try Policygenius, a number one life insurance coverage market place, the place you may get assist with discovering essentially the most reasonably priced time period life insurance coverage coverage to your wants.

Because of Policygenius, I used to be in a position to double my life insurance coverage profit and decrease my life insurance coverage premiums by discovering an ideal coverage with Principal Monetary Group. For seven years, I mistakenly thought my former provider, USAA, was providing me reasonably priced charges. I had no concept I used to be grossly overpaying for my protection. Now I’ve higher life insurance coverage protection for much less cash. Get customized free life insurance coverage quotes with Policygenius from high carriers in simply minutes.

Readers, what sort of medical insurance plan do you have got? Have you ever had any ache factors when switching carriers or plan varieties?

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and talk about among the most attention-grabbing subjects on this web site. Thanks for sharing and reviewing. Each episode takes hours to supply.

To expedite your journey to monetary freedom, be part of over 60,000 others and subscribe to the free Monetary Samurai e-newsletter. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009.