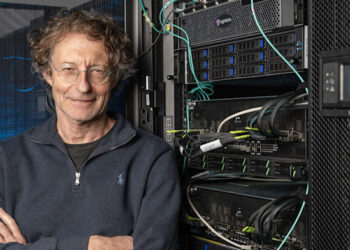

His identify is Atul Jain, a Bajaj veteran for many years.

The 52-year-old Jain started his profession in funding banking and capital market, working as a venture government at PNB Capital Companies Restricted and later with Prudential Capital Markets Restricted. His massive transfer was to Bajaj Group in 2002 the place he has stayed since then.

That paid wealthy dividends in his profession graph as Jain will not be the standard MBA graduate from IIM or Harvard; he accomplished his enterprise schooling at Punjabi College, Patiala.

Began working as a department supervisor over twenty years in the past in Lucknow for Bajaj Finance, Jain rose from the ranks to move the housing arm. Bajaj Finance is making headlines with its Rs 6,560 crore IPO, which has set a brand new report with oversubscriptions reaching Rs 3.24 lakh crore in bids. The cash from IPO might be used for natural progress.

The largest problem within the lending enterprise is sustaining sturdy collections and protecting NPAs low. Jain efficiently led the event of a best-in-class low-ticket collections mannequin throughout the BFSI business. By implementing a field-centric strategy, he was in a position to considerably scale back losses and enhance total efficiency.

Jain comes with over three many years of expertise within the non-banking area. The truth is, he’s keen about constructing organisations from scratch. That is the rationale he was introduced in from Bajaj’s finance to housing arm some six years in the past. Within the final six years, he has been the person executing the housing arm’s technique and its CEO and MD.

Atul has performed a key function in spearheading the corporate’s important asset progress since its inception. Over the previous three years, the corporate has achieved compound annual progress fee (CAGR) of 31 per cent in belongings underneath administration (AUM). The corporate has reported a internet revenue of Rs 1,731 crore for FY24, marking a 38 per cent year-on-year improve, whereas internet earnings grew by 34 per cent to Rs 7,618 crore throughout the identical interval

Underneath Atul’s management, Bajaj Housing Finance emerged as one of many high non-public mortgage participant amongst HFCs in India.

Bajaj Finserv chairman, Sanjiv Bajaj, just lately stated that the Group is constructing the ‘HDFC of the longer term’ by means of Bajaj Housing Finance. That is fully attainable, because the Pune-headquartered group has the monetary assets, administration bandwidth, and synergies by means of its retail NBFC arm, together with the chance created by HDFC Ltd’s exit from the housing finance area after merging with its banking platform, HDFC Financial institution.

Whereas the market potential is large, challenges stay, significantly as banks with entry to low-cost funds have a bonus over Housing Finance Firms (HFCs) or NBFCs.

Jain goals to construct an business related mortgage participant in 3-4 years’ time. The corporate offers numerous mortgage choices together with house loans, loans in opposition to property, and development finance.

Mastering the three pillars of success – lending, threat administration, and collections – Jain is strategically guiding the corporate’s progress trajectory. He honed these abilities in 16 years when was a part of Bajaj Housing Finance. Jain’s intensive profession consists of 11 years as chief assortment officer, 4 years as President of rural lending & collections, and a pair of years because the Enterprise Threat Officer, showcasing his numerous management roles throughout the firm.

Jain’s time period is for five years, ending April, 2027.

In 2022, Jain’s induction into board got here underneath regulatory lens. The corporate had appointed Jain as a further director with out getting prior approval from the RBI, which is required by their guidelines. The corporate defined that since Jian was already the CEO, this wasn’t a administration change, so no permission was wanted.

Nonetheless, RBI despatched a discover in August 2023, asking why approval wasn’t sought from the regulator. It responded, however RBI nonetheless imposed a penalty in February 2024.