If healthcare in America weren’t so egregiously costly, extra folks would retire earlier and stay higher, happier lives. We’re one of many few international locations on this planet the place reasonably priced healthcare is tied to employment, making monetary independence that a lot more durable to attain.

Given the excessive value of protection, earlier than you resolve to retire early by alternative, attempt to negotiate a severance package deal and use your last 12 months of labor to get in the very best form of your life. Consider it as investing in your future well being dividends. The stronger and more healthy you might be, the much less probably you’ll have to depend on expensive medical care. As well as, the longer you may stretch your freedom {dollars}.

My Choice To Voluntarily Retire Early Whereas Contemplating Healthcare Prices

Once I voluntarily retired in 2012, certainly one of my largest considerations was determining pay for healthcare. For 13 years, my employers had backed a portion of my premiums by way of a gaggle plan. As an alternative of paying $850 a month for protection, I used to be solely paying round $375 towards the top.

So after I left work, after my 6 months of 100% subsidies healthcare ran out as a part of my severance package deal, I confronted an $850 month-to-month invoice as a wholesome 34-year-old who barely used the system. It felt extreme and I wanted a plan.

On the time, I requested my 31-year-old spouse to not YOLO her profession away with me. As an alternative, I inspired her to embrace equality and preserve working one other three years to make sure my dangerous transfer wouldn’t put our family in monetary jeopardy. Fortunately, she agreed.

Throughout that point, she maintained her employer-sponsored healthcare plan, which additionally coated me. Lots of her colleagues had household protection anyway, so becoming a member of her plan was completely regular.

Our Value For Healthcare Is Costly

In 2015, at age 34, we lastly initiated the method of engineering her personal layoff as a high-performer to obtain a severance package deal. We knew we’d lose our healthcare subsidy and should pay about $1,680 a month, however this was a acutely aware alternative we made in change for freedom. It felt mistaken to control our revenue simply to qualify for presidency healthcare subsidies after we might afford to pay full value.

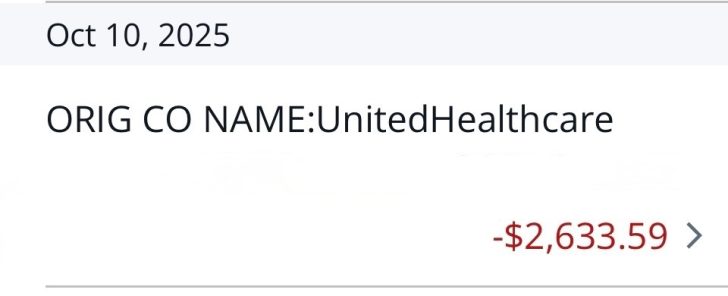

Right this moment, for our family of 4, we pay $2,633.59 a month in unsubsidized premiums for a Silver plan, not even a Gold or Platinum plan. $2,633.59 would not sound reasonably priced to me, regardless of the federal government calling it the “Reasonably priced Care Act.” Subsequent 12 months, our month-to-month premium is predicted to bounce to $3,000. However the best way the system works is that those that make greater than 400% of the Federal Poverty Restrict subsidize those that don’t.

In essence, we’ve got a excessive deductible medical health insurance plan. I am hoping my new funding in worth inventory UnitedHealthcare will assist us pay for our premiums sooner or later. UNH actually makes a fortune from us.

Loads of Millionaire Early Retirees Get Subsidies

The truth is, loads of early retirees benefit from healthcare subsidies—even when they’re millionaires or multi-millionaires. Some even brag about it on-line. That’s at all times rubbed me the mistaken manner, as a result of I doubt the federal government’s intent was to subsidize the highest 6% of wealth holders. Or perhaps it was so our legislators are principally millionaires.

For instance, let’s say you have got a $2 million portfolio producing $80,000 a 12 months in revenue. As twin unemployed dad and mom (DUPs) with two youngsters, your family revenue is round 250% of the Federal Poverty Degree (FPL), which qualifies you for heavy healthcare subsidies. Keep in mind, subsidies lengthen all the best way as much as 400% of the FPL.

Meaning a family with a $5 million growth-stock-heavy portfolio incomes solely a 1.3% dividend yield—roughly $65,000 a 12 months—would sit round 210% of the FPL and qualify for a 90%+ low cost on healthcare premiums. As an alternative of a household of 4 paying $3,000 a month, they’d pay simply $300 a month or much less. Fairly unbelievable!

The Debate in Congress Over Extending Healthcare Subsidies

Congress is presently debating whether or not to lengthen the improved healthcare subsidies for households incomes above 400% of the Federal Poverty Degree. Democrats need to make the short-term enlargement everlasting, whereas Republicans want reverting to the unique guidelines.

The American Rescue Plan Act of 2021, beneath the Democrats, quickly raised the worth of the premium tax credit and expanded eligibility past 400% of FPL. These “enhanced” subsidies capped a family’s premium prices at 8.5% of revenue.

Then, in 2022, the Inflation Discount Act, beneath the Democrats, prolonged these enhanced subsidies by way of 2025. Now they’re set to run out on the finish of 2025 beneath the Trump administration.

In response to the Congressional Funds Workplace, extending these enhanced subsidies would value about $350 billion over 10 years, or $35 billion a 12 months. Not nice given the dimensions of the prevailing finances deficit.

Prices Reverting Again To The Outdated Trajectory

With out the extension, the common 60-year-old couple making $85,000 a 12 months (simply over 400% of FPL) would see premiums bounce by $1,900 a month, or almost $23,000 a 12 months in 2026, based on KFF. If true, that’s an egregious quantity to pay beneath the “Reasonably priced Care Act.” Nevertheless, that additionally means the 60-year-old couple has had no less than $91,200 in healthcare subsidies because the American Rescue Plan Act of 2021 handed.

If that $91,200 in healthcare subsidies was saved or invested since 2021, as all renters say they do to justify not shopping for a main residence, they’ve sufficient to pay for the subsequent 4 years of upper healthcare premiums. No less than, that is how private finance fans suppose.

Preventing to Hold Subsidies for Early Retiree Millionaires Feels Off

However would not arguing for extra healthcare subsidies for millionaires really feel just a little off to you? In the event you make $85,000 a 12 months as a retired couple, which means your pension or investments are price $2,125,000 at a 4% protected withdrawal price! Most individuals would argue you will be alright, particularly when you’ve got no debt. And in case you’re an early retiree with that kind of web price, then receiving subsidies appears utterly unusual.

CNBC just lately profiled a “early retiree” couple, Invoice (61) and Shelly (59), who will earn $127,000 a 12 months in pension revenue in 2026—above the 400% FPL threshold. Their premiums would rise from $442 a month to $1,700, which sounds extra life like than KFF’s above estimate. That’s painful, however they’ve additionally loved roughly $70,000 in enhanced premium tax credit since 2021.

Nonetheless, a $127,000 pension is price roughly $3.2 million in annuity worth at a 4% price of return. Ought to the ACA actually be subsidizing retirees with multimillion-dollar pensions and portfolios? Assets ought to deal with these with out six-figure pensions or vital financial savings. You recognize, the ~85% of People who haven’t got lifetime pensions.

Nobody in America ought to should endure by way of a well being disaster just because they will’t afford care. Healthcare is a fundamental proper, not a privilege. Due to this fact, redirecting healthcare subsidies towards the decrease center class and poor makes way more logical sense.

Capitalize The Worth Of Your Pension And Funding Earnings

Now I’m beginning to marvel — do the common American, monetary reporter, or politician not know capitalize the worth of an revenue stream to find out its true price? We do that on a regular basis in finance, and on Monetary Samurai. Merely take an inexpensive price of return or withdrawal price—say 4% or 5%—and divide your pension or funding revenue by that quantity.

Let’s discover out the capitalized worth of a pension primarily based on numerous Federal Poverty Degree (FPL) revenue limits for a household of 4:

- $31,200 (100% of FPL): $624,000 – $780,000 pension worth. You’ll probably qualify for 100% subsidies and pay 0% of your revenue towards healthcare premiums.

- $43,056 (138% of FPL): $861,120 – $1,076,400 pension worth. You’ll probably pay 0–2% of revenue towards premiums after subsidies — roughly $0 to $50/month for a Silver plan in lots of states.

- $46,800 (150% of FPL): $936,000 – $1,170,000 pension worth. You’ll probably pay 1–2% of revenue, or about $0 to $80/month for a Silver plan.

- $62,400 (200% of FPL): $1,248,000 – $1,560,000 pension worth. Anticipate to pay 2–2.5% of revenue, roughly $50 to $100/month.

- $78,000 (250% of FPL): $1,560,000 – $1,950,000 pension worth. You’ll probably pay round 4% of revenue, or $180–$220/month.

- $93,600 (300% of FPL): $1,872,000 – $2,340,000 pension worth. You’ll probably pay about 6% of revenue, or $300–$350/month for a Silver plan.

- $124,800 (400% of FPL): $2,496,000 – $3,120,000 pension worth. You’ll probably pay as much as 8.5% of revenue, or roughly $450–$550/month for a Silver plan.

When you have a lifetime pension or passive funding revenue that generates $31,200 a 12 months or extra (100% of FPL), you are doing fairly effectively in comparison with the common employee or retiree. Therefore, to pay little-to-nothing in the direction of the healthcare system appears off.

Adapting to the System Of Embracing The Rich

That stated, we must always take a look at this debate as a mirrored image of the occasions and adapt accordingly. Simply as we observe identification diversification relying on who’s in energy, we are able to lean into our wealth when the federal government decides to subsidize the rich.

If the federal government desires at hand out healthcare subsidies to six-figure pensioners and multi-millionaires, then the rational economist says: take the free cash. In spite of everything, most politicians are over 40 and already rich, so it’s solely pure they design insurance policies that profit their very own demographic.

Nevertheless, political winds at all times shift. After they do, and policymakers refocus on serving to the true center class and poor, it’ll as soon as once more be time for the rich to pay full freight.

Will Proceed To Pay Full Freight To Assist America

With our present stage of passive revenue, we’ll by no means qualify for healthcare subsidies. Our family bills are additionally too excessive to purposefully decrease our revenue in the mean time. And that’s most likely the way it needs to be. For the better good of society!

Within the meantime, I’ll preserve doing my greatest to remain in form so I can subsidize and make room for many who can’t or gained’t. Simply because it’s a privilege to pay taxes to help those that pay much less or none in any respect, it’s additionally a privilege to be wholesome sufficient to assist offset the prices for many who aren’t.

Readers, do you suppose the federal government needs to be combating to supply healthcare subsidies for the rich? Or is it irresponsible to increase these enhanced tax credit given our huge finances deficit? The place ought to we draw the road in the case of providing healthcare subsidies?

Advice To Shield Your Cherished Ones

Apart from often understanding and maintaining a healthy diet to increase your life, you must also get an reasonably priced time period life insurance coverage coverage to guard your family members.

Each my spouse and I obtained matching 20-year time period insurance policies by way of Policygenius. Merely enter your data and also you’ll obtain actual quotes from vetted life insurance coverage carriers inside minutes. When you have debt and dependents, getting life insurance coverage is likely one of the most accountable issues you are able to do.

Subscribe To Monetary Samurai

Decide up a duplicate of my USA TODAY nationwide bestseller, Millionaire Milestones: Easy Steps to Seven Figures. I’ve distilled over 30 years of economic expertise that will help you construct extra wealth than 94% of the inhabitants and break away sooner. As you may inform from my submit, the federal government loves millionaires by showering them with healthcare subsidies.

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview specialists of their respective fields and talk about among the most attention-grabbing subjects on this web site. Your shares, rankings, and evaluations are appreciated.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Monetary Samurai publication. You can even get my posts in your e-mail inbox as quickly as they arrive out by signing up right here.

Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. Every part is written primarily based on firsthand expertise and experience.