I learn this put up on Reddit some time in the past: Vanguard closed my account for fraudulent exercise.

I bought a property, obtained my cost by way of examine and determined to speculate the cash in Vanguard. I opened a Vanguard account on-line and linked my financial institution, transferred $10 to my Money Plus account, opened a brokerage account and deposited my examine on Friday to the brokerage account. The examine was accepted. On Tuesday, I obtained a name from the examine issuer that the examine cleared. I logged in Vanguard and I can see it was processed however not accessible until after 7 days. The whole lot appears straightforward, so I assumed. Later the identical day, I attempted to log in and I acquired an error message, “Entry to your account has been disabled. Please contact us.” I referred to as Vanguard and spoke to a rep. They advised me my account is being reviewed by the analysis workforce and they are going to be contacting me in 72 hours. I waited 72 hours and referred to as once more. Similar response. 2 days later, I obtained a voicemail from the Vanguard fraud workforce.

“Howdy, that is the fraud workforce calling to let you already know the account you inquired about has been restricted on account of fraudulent exercise. The makes an attempt to carry funds into the account have been rejected. Any digital financial institution switch might be recalled by way of your financial institution. Once more the account is completely restricted and there won’t be a follow-up to this situation.”

This poster finally acquired the cash again when Vanguard returned the cash to the examine issuer.

Such a fraud restriction isn’t restricted to Vanguard. Constancy has had a wave of fraud assaults lately. Criminals recruited current clients as collaborators (“mules”) for a 50/50 break up to make pretend deposits and withdraw the cash.

Constancy turned up their counter-fraud measures to thwart these assaults. Many shoppers reported seeing their accounts restricted, debits declined, Invoice Pay canceled, cell deposit restrict minimize to $1,000, or the deposit maintain instances prolonged to as much as 21 days. Little question many of those are false positives. Assaults from inside are probably the most troublesome to fight. It’s laborious to tell apart who’s legit and who’s knowingly or unknowingly working with criminals.

I exploit Constancy for all my spending. As I discussed within the earlier put up Ditch Banks — Go With Cash Market Funds and Treasuries, I’ve underneath $100 in exterior financial institution accounts. All my money is in a Constancy account in cash market funds and Treasuries. All my payments are paid out of this Constancy account. It’ll trigger issues if Constancy restricts my account. I’m not involved about that risk as a result of I observe this one easy rule:

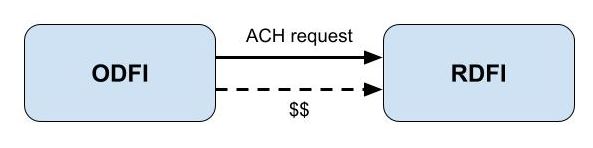

Make all deposits by ACH push.

An ACH push is initiated on the identical place the place the cash at the moment resides (see ACH Push or Pull: The Proper Approach to Switch Cash). Employer or authorities direct deposits additionally are available by ACH push. I make all deposits to my Constancy account by ACH push. For instance, once I switch the bank card rewards earned in a Financial institution of America account to Constancy, I provoke the ACH at Financial institution of America.

Cash obtained by ACH push is trusted cash. It’s accessible straight away as a result of the receiving establishment isn’t chargeable for it. You don’t have anything to fret about having your account flagged for fraud when all the cash coming into the account comes by ACH push.

The Reddit poster initially of this put up didn’t observe this rule. I enterprise to say that everybody who had their Constancy account restricted lately additionally didn’t observe this rule. Test deposits and ACH pulls are untrusted by the receiving establishment. Not each examine deposit or ACH pull will get the account restricted for fraud issues however those that had their account restricted almost certainly had made examine deposits or ACH pulls.

My Constancy account is functioning usually as typical. I wouldn’t have recognized this storm was occurring if I hadn’t learn Reddit. My cell examine deposit restrict remains to be a whopping $500,000 per day though I’ve no bodily checks to deposit. All debits for estimated taxes, bank card payments, utility payments, and PayPal and Venmo funds went out with no hitch. I don’t know what the maintain time will likely be if I do an ACH pull proper now as a result of I don’t make deposits by ACH pull anyway. I initiated one other ACH push from Financial institution of America to my Constancy account as a take a look at. The cash arrived the subsequent day and it was accessible instantly as anticipated. No maintain.

Say No To Administration Charges

If you’re paying an advisor a proportion of your belongings, you might be paying 5-10x an excessive amount of. Discover ways to discover an unbiased advisor, pay for recommendation, and solely the recommendation.