FP Solutions: Incomes $95,000, 61-year-old with $200,000 mortgage and $40,000 financial savings wonders easy methods to deal with retirement

Article content material

Q. I’m 61 years previous and dealing full-time incomes $95,000 yearly. I’ve labored full-time for the previous 30 years and made the utmost Canada Pension Plan (CPP) contributions throughout that point. I’ve a mortgage of $200,000, plus annual payments of $25,000. I’ve no different debt. I even have little or no in the best way of financial savings. I’ve no registered retirement financial savings plan (RRSP), no non-registered investments and no employer pension plan. My solely financial savings are $40,000 that I’ve in a chequing account, largely for emergencies and to interchange my seven-year-old automotive when the time comes. Ought to I apply for CPP now and use the funds to take a position or pay down my mortgage? Ought to I wait till age 65 to gather CPP, or later? I plan to proceed working till at the very least age 65 however may work longer at my administration job if wanted. — Naomi

Commercial 2

Article content material

Article content material

Article content material

FP Solutions: Naomi, though you’re asking in regards to the CPP, I ponder if as a substitute you have to be contemplating the Assured Earnings Complement (GIS). The GIS is a profit designed for low-income seniors, however it’s obtainable to anybody over age 65 with a low taxable revenue. There’s a distinction between low revenue and low taxable revenue. Naomi, take into consideration how one can have a comparatively excessive retirement revenue whereas on the similar time a low taxable revenue. This can assist you to maximize authorities pension advantages.

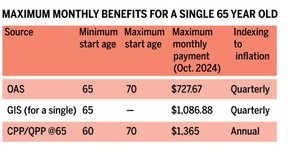

The three fundamental pensions obtainable to you’re the CPP, Previous Age Safety (OAS), and the GIS. The GIS turns into obtainable when you begin your OAS pension. It’s a tax-free supplemental pension designed for individuals with a low revenue and the quantity you’ll obtain is predicated in your marital standing, taxable revenue, and years in Canada. Here’s a hyperlink to the GIS tables the place you will discover an estimate of what you would possibly obtain. The quantity a single particular person can obtain is completely different from what a pair can obtain.

The accompanying desk reveals the utmost month-to-month pension you’ll be able to obtain and the frequency of changes. CPP is predicated on contributions, and OAS is predicated on years lived in Canada, with a clawback beginning at $93,454. The GIS can be primarily based on years in Canada, but in addition on taxable revenue, and there’s a clawback of $1 for each $2 of revenue. A single particular person with no taxable revenue, apart from what’s exempt, will earn the utmost GIS. As soon as a single particular person’s taxable revenue hits $22,056, the entire GIS is clawed again. Observe that you would be able to’t add all three advantages collectively and assume that’s what a senior with no revenue will earn, as a result of the CPP will trigger a GIS clawback.

Article content material

Commercial 3

Article content material

Taxable revenue comes primarily from curiosity, dividends, capital good points, employment and rental revenue, and registered retirement revenue fund (RRIF) withdrawals, however there are exemptions. The principle exemptions are your OAS revenue, the primary $5,000 of employment revenue, and 50 per cent of employment revenue earned between $5,000 and $15,000.

Naomi, let’s stroll by way of a few examples. If I assume your CPP at 65 is $13,000 a yr and it’s your solely taxable revenue as a result of the OAS is excluded, your GIS shall be $377.52 a month or $4,530 a yr. And bear in mind, the GIS quantity is non-taxable. Your whole pre-tax revenue with CPP, OAS, and the GIS is $26,262 and the after-tax quantity in Ontario is $26,156.

Now, in a second instance, let’s assume you’ve a RRIF from which you draw $5,000 a yr. Your GIS would now be decreased from $4,530 a yr to $2,022 a yr and you’d pay further tax of $323, for an efficient tax fee of 56.62 per cent. Now, if as a substitute of drawing $5,000 from a RRIF, you earn $5,000 and would get the total GIS of $4,530 as a result of the primary $5,000 of employment revenue is exempt from the qualification equation.

Commercial 4

Article content material

Planning across the GIS and low taxable revenue is difficult. In all probability the primary query to ask is: Will you at all times be in a comparatively low tax bracket? If the reply is sure, then what’s one of the best ways to avoid wasting on your future?

Do you have to contribute to a tax free financial savings account (TFSA) or an RRSP? The straightforward reply is the TFSA contributions as a result of the expansion and withdrawals are tax-free. In some circumstances, it could make sense to make RRSP contributions whereas working however not claiming the deduction till you’ve retired so you’ll be able to cut back your revenue and qualify for the GIS.

Beneficial from Editorial

Deliberately beginning CPP early to create a smaller pension and fewer tax could imply a bigger GIS. Do you have to maintain your own home or promote and lease? Retaining it means you’ll be able to draw tax-free cash from your own home fairness with a line of credit score or reverse mortgage, which could imply doubtlessly extra GIS. Promoting means investing the proceeds and incomes taxable curiosity, dividends, and capital good points, which could imply doubtlessly much less GIS.

Commercial 5

Article content material

Naomi, at this stage in your retirement readiness planning it’s price contemplating a GIS technique. There might also be different low-income advantages obtainable in your province. Planning round GIS isn’t straightforward when you’ve different property so it’s possible you’ll need to have a dialogue with a monetary planner.

Allan Norman, M.Sc., CFP, CIM gives fee-only licensed monetary planning companies and insurance coverage merchandise by way of Atlantis Monetary Inc. and gives funding advisory companies by way of Aligned Capital Companions Inc. (ACPI). ACPI is regulated by the Canadian Funding Regulatory Group ciro.ca Allan might be reached at alnorman@atlantisfinancial.ca

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it’s essential know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material