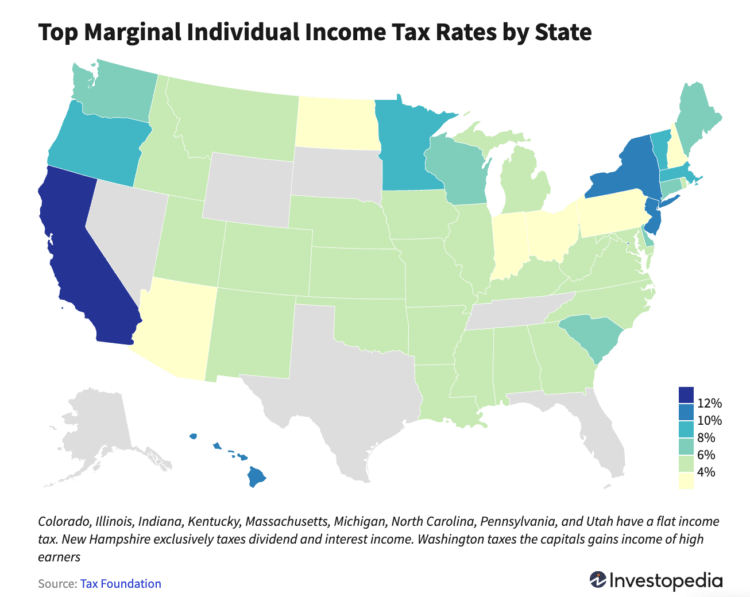

Do you know that most individuals must file tax returns for each federal AND state revenue taxes? Discover out which states do not have state revenue taxes.

Reply: 8 states

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming.

Notice: Washington and New Hampshire don’t tax earned revenue, however have taxes on different revenue like investments

Questions:

- How does your state’s tax price examine to different neighboring states?

- Do you assume that states which have excessive state revenue tax charges (e.g., CA and NY) must pay larger salaries to compensate workers for these excessive taxes? Why or why not?

- Are you able to title widespread taxes that individuals pay apart from state and federal revenue taxes?

Click on right here for the ready-to-go slides for this Query of the Day that you should utilize in your classroom.

Behind the numbers: (Investopedia):

“Earlier than you rent a transferring firm to take every part you personal to one among these states, you may need to think about different elements, together with:

- Gross sales, excise, and property taxes

- Affordability

- The affect of decrease taxes on a state’s capability to put money into social providers, resembling infrastructure, training, and healthcare”

About

the Writer

Dave Martin

Dave joins NGPF with 15 years of instructing expertise in math and laptop science. After becoming a member of the New York Metropolis Educating Fellows program and incomes a Grasp’s diploma in Schooling from Tempo College, his instructing profession has taken him to New York, New Jersey and a summer time within the north of Ghana. Dave firmly believes that monetary literacy is significant to creating well-rounded college students which can be ready for a fancy and extremely aggressive world. Throughout what free time two younger daughters will permit, Dave enjoys video video games, Dungeons & Dragons, cooking, gardening, and taking naps.