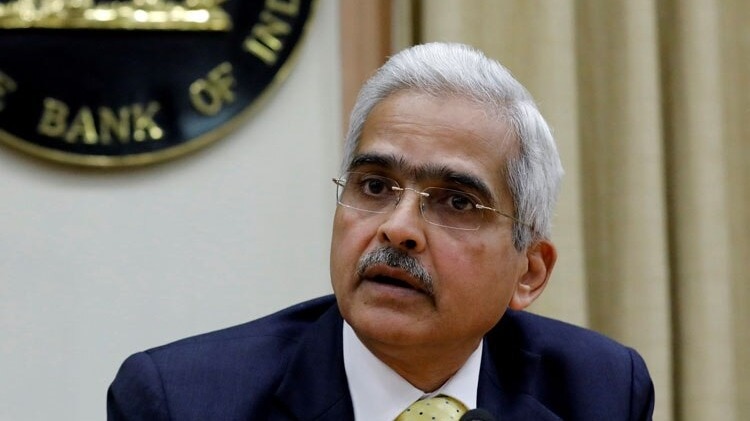

Because the US Federal Reserve stunned the world’s monetary markets with a 50 foundation level fee lower, RBI Governor Shaktikanta Das now faces a recent set of challenges as international central bankers enter a financial coverage easing cycle.

The Fed’s fee is now right down to a variety between 4.75% and 5% in comparison with the RBI’s repo fee of 6.5%.

The European Central Financial institution (ECB) has already slashed its short-term rate of interest twice this 12 months, with a 25 foundation level lower in September, as inflation begins to melt. The Financial institution of Canada has additionally just lately lower its key fee by 25 foundation factors, signaling the potential for extra cuts within the close to future. The Financial institution of England has additionally lowered its charges. It’s doubtless that different international central bankers will be part of the rate of interest easing cycle.

This marks the Fed’s first fee discount since 2020, making it one of the crucial intently watched international financial actions. Given the affect of U.S. financial coverage on international monetary techniques, particularly in rising markets like India, the Fed’s plan to make additional cuts is prone to create new challenges for the RBI’s financial coverage.

One of many key issues for Governor Das is the Fed’s future steerage, which alerts 200 foundation factors of cuts within the close to time period. The Fed committee expects to chop rates of interest by 50 foundation factors by the top of the 12 months. Projections from committee members additionally point out that they count on to chop charges by a full 100 foundation factors by the top of 2025 and one other 50 foundation factors in 2026. Total, this implies the Fed plans to scale back rates of interest by about 200 foundation factors over the following two years, along with at the moment’s 50 foundation level lower.

The worldwide pattern of decreasing rates of interest might complicate the RBI’s efforts to remain centered on controlling inflation, which is focused at 4.5% for the 2024-25 fiscal 12 months.

The RBI’s financial coverage committee is dedicated to retaining inflation inside a variety of 4%, with a margin of plus or minus 2%. This implies the central financial institution should navigate exterior pressures whereas sustaining its inflation-fighting technique.

To this point, the inflation trajectory stays throughout the RBI’s projections, with CPI or retail inflation at 3.6% in August. Given the inflation projection of 4.5% in 2024-25, the RBI’s fingers are tied concerning any rate of interest cuts.

Previously, the Fed has not hesitated to decrease charges aggressively, even to near-zero ranges, together with quantitative easing to stimulate the economic system. Between 2007 and 2008, the Fed slashed the short-term fee to zero to help the economic system after the 2008 international monetary disaster.

For the RBI, the worldwide rate of interest easing cycle presents its personal challenges. If a world rate-cutting cycle accelerates, India might expertise elevated capital inflows as traders search larger returns in rising markets. Whereas this influx of {dollars} is mostly optimistic for inventory and debt markets, it could complicate foreign money administration and probably create inflationary pressures by increasing the home cash provide.

Moreover, managing the doubtless rupee appreciation towards the US greenback might put strain on India’s exports, additional complicating the RBI’s balancing act between sustaining development and controlling inflation.