[Updated on January 29, 2025 with updated screenshots from H&R Block Deluxe desktop software for the 2024 tax year.]

You could have contributed to a Roth IRA after which realized later within the yr that you’d exceed the revenue restrict. You recharacterized the Roth IRA contribution as a Conventional IRA contribution and transformed it to Roth once more earlier than the top of the yr. Your IRA custodian despatched you two 1099-R kinds, one for the recharacterization and one for the conversion. This submit exhibits you learn how to put them into the H&R Block tax software program. For those who use different software program, see Backdoor Roth in TurboTax: Recharacterize & Convert, Identical Yr or Backdoor Roth in FreeTaxUSA: Recharacterize & Convert, Identical Yr.

For those who had accomplished the recharacterizing and changing within the following yr, you would need to cut up the tax reporting into two years by following Cut up-Yr Backdoor Roth IRA in H&R Block, 1st Yr and Cut up-Yr Backdoor Roth IRA in H&R Block, 2nd Yr. Now since you caught the issue quickly sufficient earlier than the top of the yr, you possibly can deal with all of it in the identical yr by following this information.

Right here’s the instance state of affairs we’ll use on this information:

You contributed $7,000 to a Roth IRA for 2024 in 2024. You realized that your revenue could be too excessive later in 2024. You recharacterized the Roth contribution for 2024 as a Conventional contribution. The IRA custodian moved $7,100 out of your Roth IRA to your Conventional IRA as a result of your authentic $7,000 contribution had some earnings. The worth elevated once more to $7,200 if you transformed it to Roth earlier than December 31, 2024. You obtained two 1099-R kinds, one for $7,100 and one other for $7,200.

For those who didn’t do any of those recharacterizing and changing, please comply with our information for a “clear” backdoor Roth in Easy methods to Report Backdoor Roth in H&R Block Tax Software program.

For those who’re married and each you and your partner did the identical factor, you must comply with the steps under as soon as for your self and as soon as once more in your partner.

Use H&R Block Obtain Software program

The screenshots under are taken from H&R Block Deluxe downloaded software program. The downloaded software program is each cheaper and extra highly effective than H&R Block’s on-line software program. For those who haven’t paid in your H&R Block On-line submitting but, think about shopping for H&R Block obtain software program from Amazon, Walmart, Newegg, and plenty of different locations. For those who’re already too far in getting into your knowledge into H&R Block On-line, make this your final yr of utilizing H&R Block On-line. Swap over to H&R Block obtain software program subsequent yr.

1099-R for Recharacterization

We deal with the 1099-R kind for the recharacterization first. This 1099-R kind has a code “N” in Field 7.

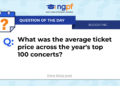

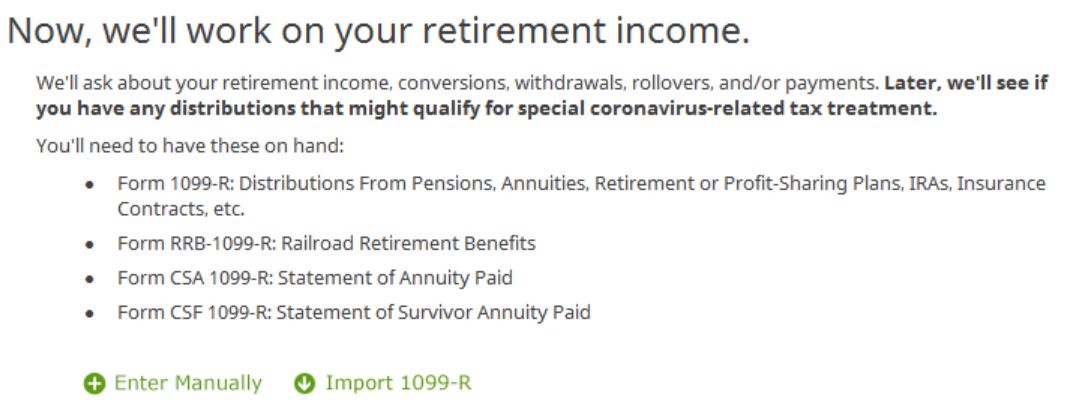

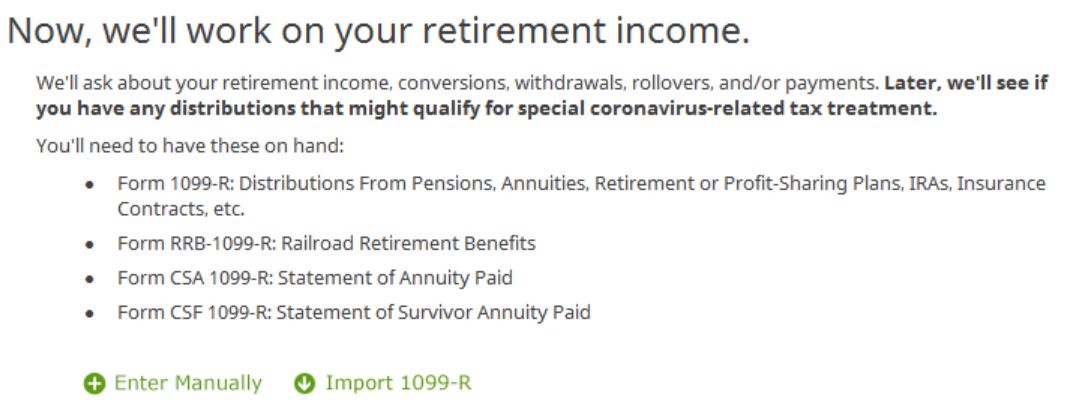

Click on on Federal -> Revenue. Scroll down and discover IRA and Pension Revenue (Kind 1099-R). Click on on “Go To.”

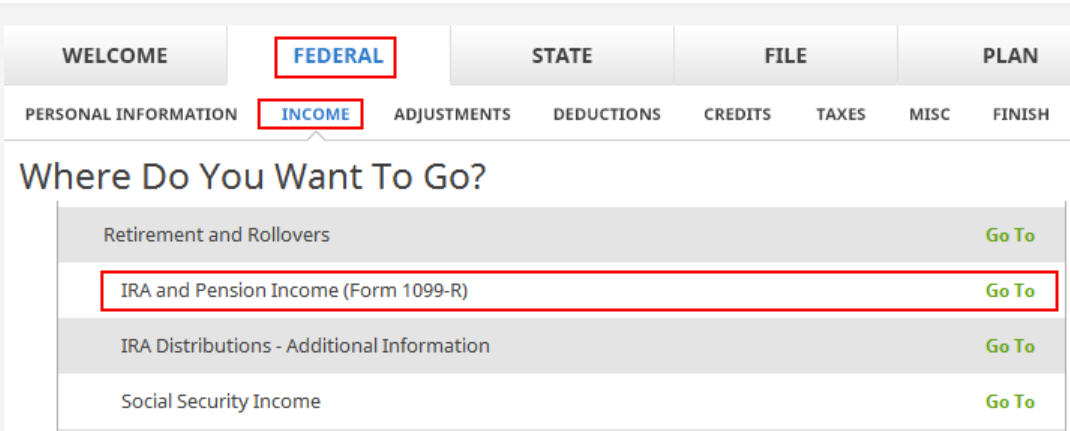

Click on on Import 1099-R should you’d like. I present handbook entries with “Enter Manually” right here.

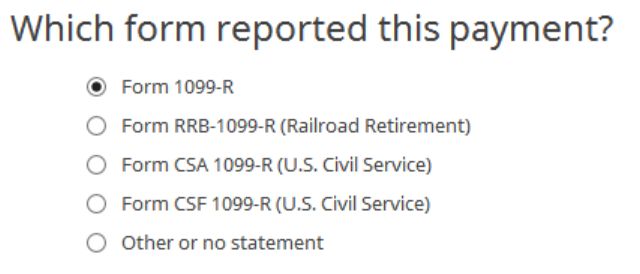

Only a common 1099-R.

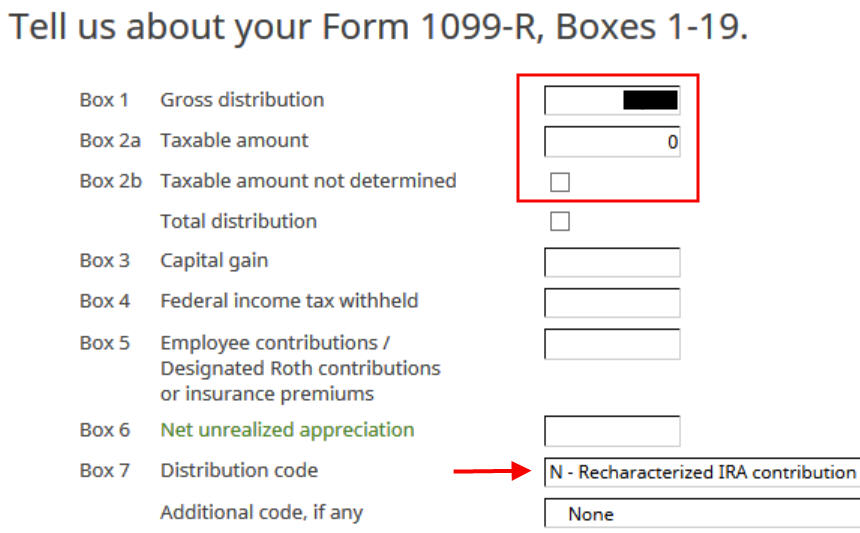

The 1099-R kind for the recharacterization exhibits the quantity moved from the Roth IRA to the Conventional IRA in Field 1. The taxable quantity is 0 in Field 2a and the “Taxable quantity not decided” field isn’t checked. The code in Field 7 is “N.”

The “IRA/SEP/SIMPLE” field could or will not be checked in your kind. It isn’t checked in our kind.

Not a retired public security officer.

We like to listen to that.

You’re accomplished with the primary 1099-R kind. Click on on “Enter Manually” so as to add the second should you don’t have already got each 1099-R kinds imported.

1099-R for Conversion

The 1099-R for the Roth conversion has both a code “2” or code “7” in Field 7.

The second 1099-R kind can also be a daily 1099-R.

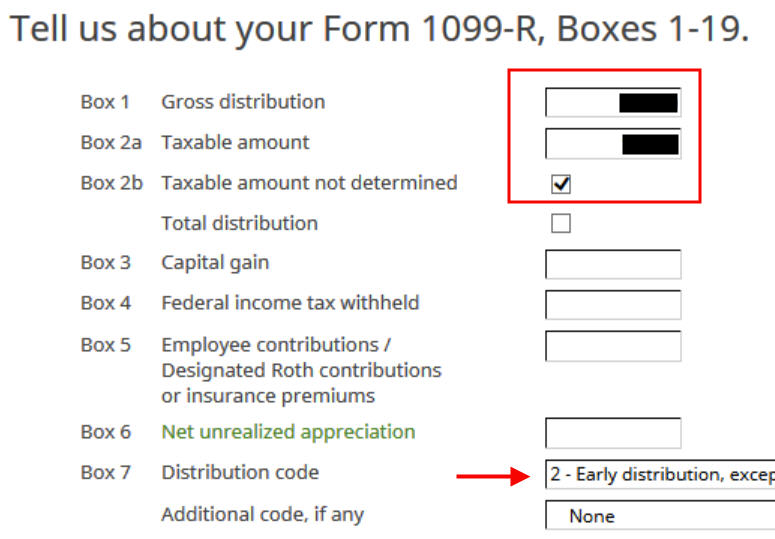

It’s regular to see the conversion reported in Field 2a because the taxable quantity when Field 2b is checked to say “Taxable quantity not decided.” The code in Field 7 is “2″ if you’re below 59-1/2 or “7” if you’re over 59-1/2.

The “IRA/SEP/SIMPLE” field is checked on this 1099-R kind for the Roth conversion.

Didn’t inherit it.

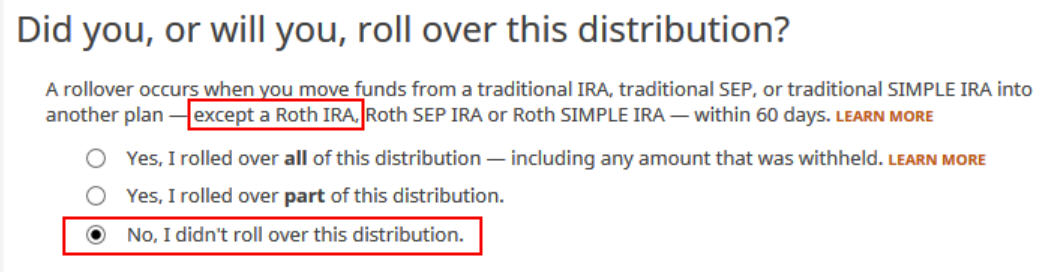

Transformed, Did Not Roll Over

This is a vital query. Learn rigorously. Reply No, since you transformed, not rolled over.

We didn’t have any of those repaid withdrawals handled as rollovers.

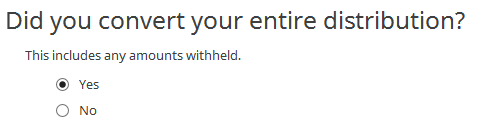

Now reply Sure, you transformed.

We transformed all of it.

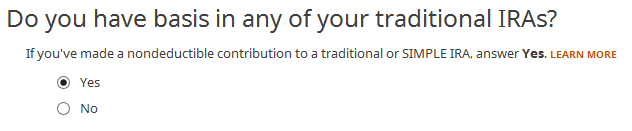

It’s safer to reply “Sure” right here as a result of you possibly can at all times say your foundation was zero when the software program asks you what it was.

The refund meter drops quite a bit at this level. Don’t panic. It’s regular and solely momentary. It can come again up after we proceed.

You’re accomplished with the 1099-R. Repeat the above when you have one other 1099-R. For those who’re married and each of you transformed to Roth, take note of whose 1099-R it’s if you enter the second. You’ll have issues should you assign each 1099-R’s to the identical individual once they belong to every partner. Click on on “Completed” if you find yourself accomplished with all of the 1099-Rs.

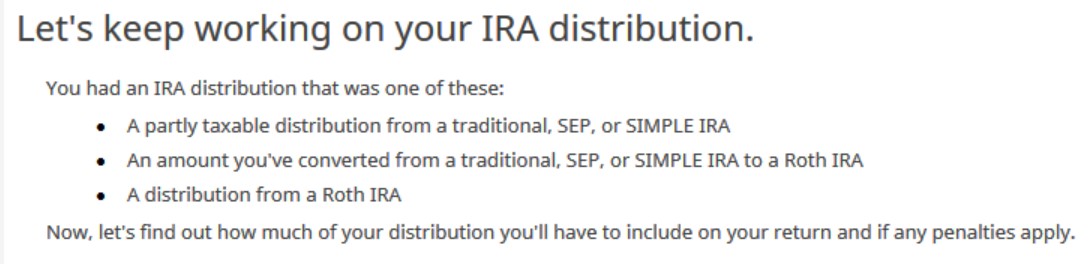

H&R Block has just a few extra questions.

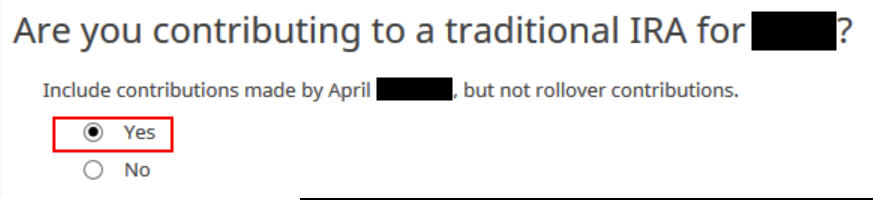

The wording is complicated right here however you must reply “Sure.” You recharacterized a Roth IRA contribution as a Conventional IRA contribution. It counts.

H&R Block will wait till you additionally enter your 2024 contribution. Your refund meter continues to be depressed however don’t fear.

Roth IRA Contribution Recharacterized to Conventional

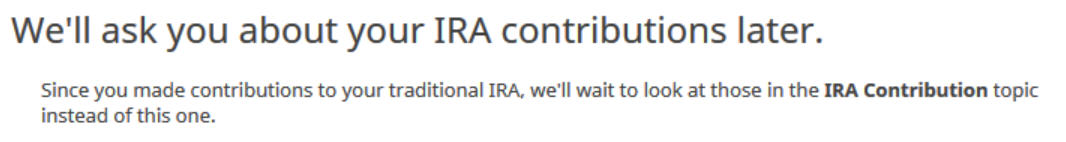

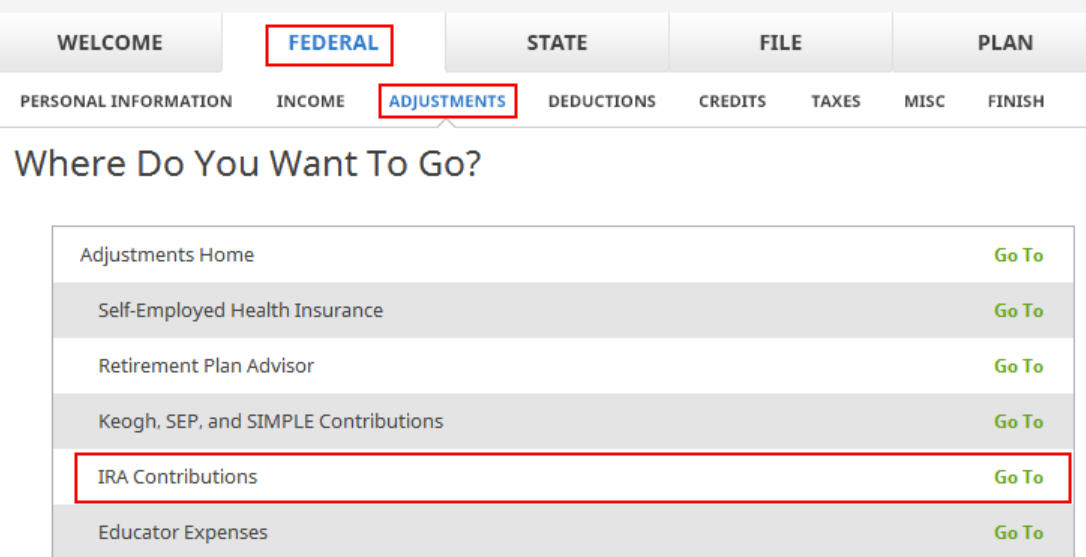

Click on on Federal -> Changes. Discover IRA Contributions. Click on on “Go To.”

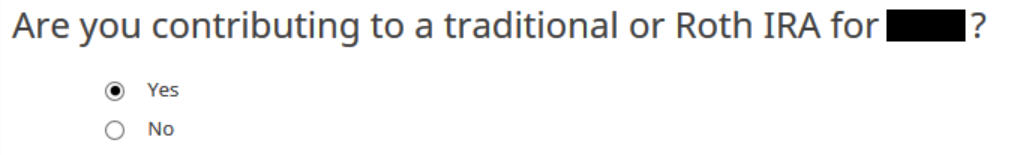

Reply “Sure” since you contributed to an IRA for the yr in query.

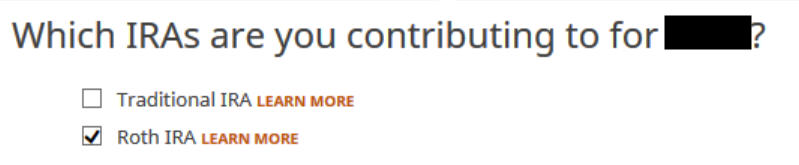

Examine the field for Roth IRA since you initially contributed to a Roth IRA earlier than you recharacterized your contribution.

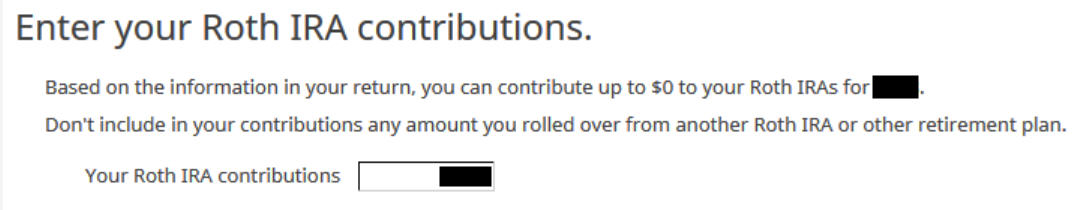

Enter your authentic contribution quantity. It’s $7,000 in our instance.

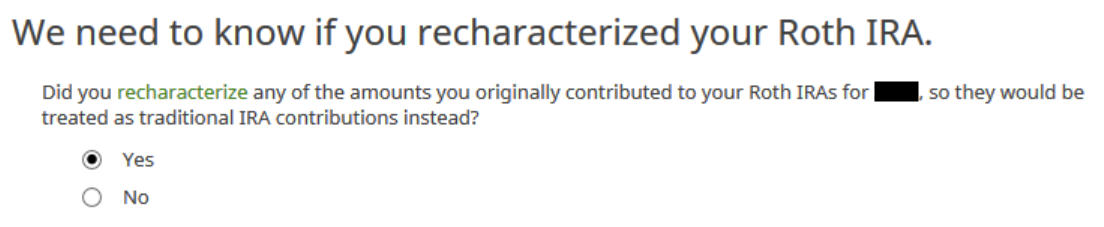

Reply Sure since you recharacterized the contribution.

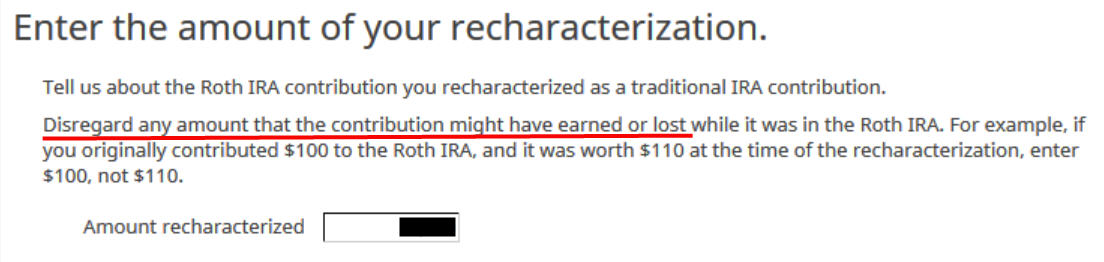

The quantity right here is relative to the unique contribution quantity. For those who recharacterized the entire thing, enter $7,000 in our instance, not $7,100, which was the quantity with earnings that the IRA custodian moved into the Conventional IRA.

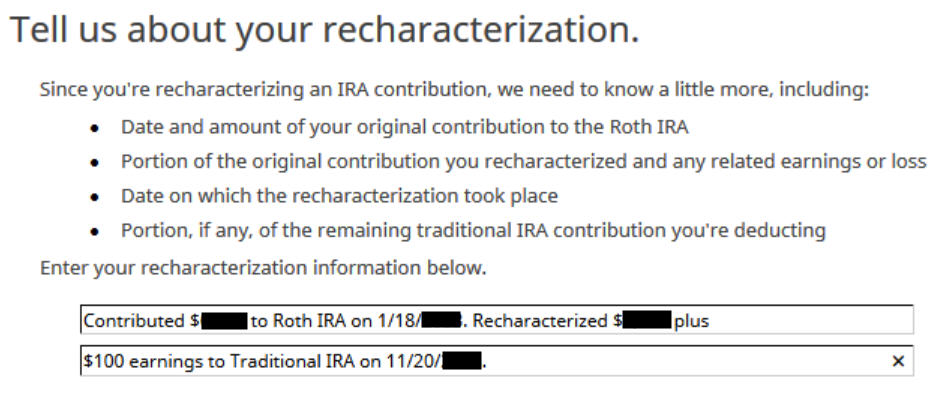

The IRS requires a short assertion to explain your recharacterization.

Go away the containers clean since you recharacterized earlier than the top of 2024.

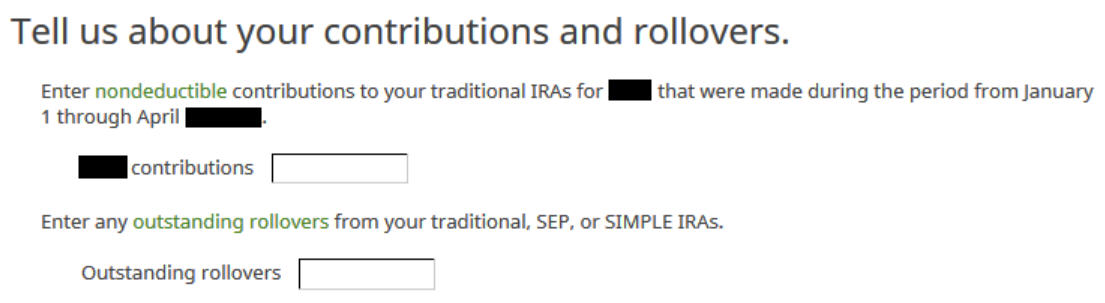

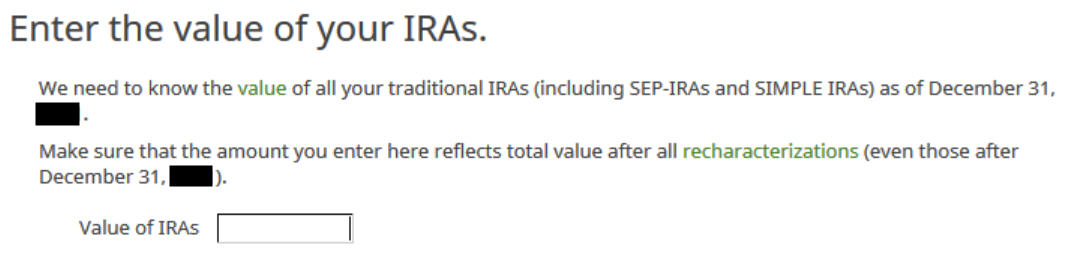

The field must be clean or zero if you emptied all of your Conventional IRAs after changing 100% to Roth. For those who had just a few {dollars} of earnings after you transformed and also you left them within the account, get the worth out of your year-end statements and put it right here. The software program will apply the pro-rata rule.

No extra contribution.

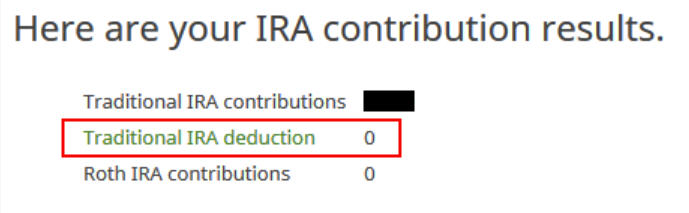

0 in Conventional IRA deduction means it’s nondeductible. For those who see a deduction right here it means the software program thinks you qualify for a deduction. You don’t have a alternative to say no the deduction. Click on on Subsequent. Repeat in your partner if each of you contributed to a Roth IRA for 2024 after which recharacterized earlier than the top of 2024.

Now the refund meter ought to return up.

Taxable Revenue

You’re accomplished with the 2 1099-R kinds and your Roth IRA contribution recharacterized to Conventional. Let’s have a look at how they present up in your tax return. Click on on Types on the highest and open Kind 1040 and Schedules 1-3. Click on on Conceal Mini WS. Scroll right down to strains 4a and 4b.

Line 4a exhibits the sum of your two 1099-R kinds. It’s $14,300 in our instance ($7,100 recharacterization plus $7,200 conversion). That is regular. Line 4b exhibits that $201 is taxable once we count on it to be the $200 in earnings (contributed $7,000, transformed $7,200). That is additionally regular because of rounding.

Kind 8606 exhibits these for our instance:

| Line # | Quantity |

|---|---|

| 1 | 7,000 |

| 3 | 7,000 |

| 5 | 7,000 |

| 13 | 6,999 (because of rounding, must be 7,000) |

| 14 | 1 (because of rounding, must be 0) |

| 16 | 7,200 |

| 17 | 6,999 (because of rounding, must be 7,000) |

| 18 | 201 (because of rounding, must be 200) |

Swap to Clear Backdoor Roth

You prevented having to separate your IRA contribution and Roth conversion in two completely different tax returns by recharacterizing in the identical yr and changing earlier than December 31. Nonetheless, you needed to do the additional work together with your IRA custodian and comply with all these steps on this information if you do your taxes.

It’s significantly better to go together with a “clear” backdoor Roth from the get-go. If there’s any risk that your revenue might be over the restrict once more, merely contribute to a Conventional IRA for 2025 in 2025 and convert it to Roth in 2025.

You’re allowed to do a clear backdoor Roth even when your revenue finally ends up under the revenue restrict for a direct contribution to a Roth IRA. It’s a lot easier than the complicated recharacterize-and-convert maneuver. Then you definitely solely have to comply with our information for a clear backdoor Roth in Easy methods to Report Backdoor Roth in H&R Block Tax Software program.

Troubleshooting

For those who adopted the steps however you’re not getting the anticipated outcomes, right here are some things to verify.

Contemporary Begin

It’s finest to comply with the steps recent in a single go. For those who already went backwards and forwards with completely different solutions earlier than you discovered this information, a few of your earlier solutions could also be caught someplace you not see. You’ll be able to delete them and begin over.

Click on on Types and delete IRA Contributions Worksheet, 1099-R Worksheet, and Kind 8606. Then begin over by following the steps right here.

Conversion Is Taxed

For those who don’t have a retirement plan at work, you might have the next revenue restrict to take a deduction in your Conventional IRA contribution. If in case you have a retirement plan at work however your revenue is low sufficient, you might be additionally eligible for a deduction in your Conventional IRA contribution. The software program offers you the deduction if it sees that your revenue qualifies. It doesn’t provide the alternative of constructing it non-deductible. You see this deduction on Schedule 1 Line 20.

Taking this deduction makes your conversion taxable. The taxable Roth IRA conversion and the deduction in your Conventional IRA contribution offset one another to create a wash. That is regular and it doesn’t trigger any issues if you certainly don’t have a retirement plan at work or when your revenue is sufficiently low.

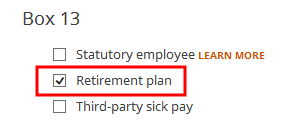

For those who even have a retirement plan at work, perhaps the software program didn’t see it. Whether or not you might have a retirement plan at work is marked by the “Retirement plan” field in Field 13 of your W-2.

Possibly you forgot to verify it if you entered the W-2. Double-check the “Retirement plan” field in Field 13 of your (and your partner’s) W-2 entries to ensure it matches the W-2.

Say No To Administration Charges

If you’re paying an advisor a proportion of your property, you might be paying 5-10x an excessive amount of. Discover ways to discover an impartial advisor, pay for recommendation, and solely the recommendation.