Article content material

MNP Client Debt Index Rises to 89 Factors as Decrease Curiosity Charges Enhance Monetary Outlook

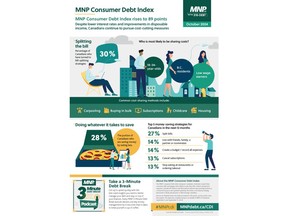

CALGARY, Alberta, Oct. 16, 2024 (GLOBE NEWSWIRE) — Underneath the burden of excessive dwelling prices, Canadians are making troublesome sacrifices and discovering methods to share bills to make ends meet and get monetary savings. Based on the newest MNP Client Debt Index, carried out quarterly by Ipsos, almost one-third (30%) of Canadians report that they’ve turned to bill-splitting methods—comparable to carpooling, shopping for in bulk, sharing subscriptions and childcare, and cohabiting with others. A couple of in ten (13%) point out they’re saving cash by cohabiting with buddies, companions, or relations, or by in search of out further roommates or co-living areas. Almost three in 10 (28%) Canadians say they’ve even resorted to consuming much less to save cash.

Commercial 2

Article content material

“We’re witnessing a bill-splitting growth as Canadians adapt to the excessive price of dwelling. Methods like sharing bills and co-living preparations showcase not solely resourcefulness but in addition the monetary stress many are dealing with,” says Grant Bazian, president of MNP LTD, the nation’s largest insolvency agency. “These measures mirror the tough actuality of hovering dwelling prices, compelling Canadians to seek out new methods to avoid wasting. It’s significantly regarding that almost three in ten report they’re slicing again on meals to make ends meet.”

Canadians are making different sacrifices to handle prices. Half (51%) say they’ve tried to save cash by grocery procuring extra strategically, and almost half say they’re avoiding impulse purchases (46%) or have stopped consuming in eating places or getting take-out (44%). The bill-splitting pattern is extra widespread amongst Canadians aged 18 to 34 and people dwelling in British Columbia and Alberta. Equally, co-habitation is extra prevalent amongst youthful Canadians, British Columbians, and people with decrease earnings.

Value-Slicing Measures and Decrease Curiosity Charges Create Respiratory Room in Some Family Budgets

Article content material

Commercial 3

Article content material

Maybe partly as a consequence of prudent cost-cutting efforts and with the tempo of rates of interest declining, Canadians are reporting some aid and enhancements of their monetary scenario. The MNP Client Debt Index has elevated by 4 factors from the earlier quarter to 89 factors, signalling Canadians are feeling extra positively about their private funds. Canadians are build up the financial institution this quarter, reporting they’ve on common $155 extra left over on the finish of the month, reaching $937, the biggest sum of money Canadians have had in spite of everything bills within the final 5 years. Simply over 4 in 10 (42%) Canadians say they’re $200 or much less away every month from monetary insolvency – the bottom recorded proportion since September 2018 (40%).

“Whereas cost-saving behaviours and decrease rates of interest have positively impacted Canadians’ perceived monetary well-being, a big minority—near 4 in 10—nonetheless report being getting ready to insolvency, indicating they’re struggling to make ends meet,” says Bazian. “Nonetheless, monetary stress is easing, offering people with extra flexibility to handle their money owed and put money into their future.”

Commercial 4

Article content material

Affect of Curiosity Charges on Debt and Monetary Outlook

With Canadians anticipating rates of interest to proceed falling over the following few years, perceptions of their capability to soak up rate of interest will increase have improved; one quarter (24%, +3pts) say they’re much higher geared up to handle an rate of interest enhance of 1 proportion level than they was once, growing three factors since final quarter. Extra Canadians are wanting positively to the long run, with three in 10 (31%, +2pts) anticipating their debt scenario to enhance when wanting forward one 12 months from now, and fewer believing it is going to worsen (12%, -4pts).

Following three rate of interest cuts this 12 months, nonetheless virtually half (48%, +1pt) of Canadians say even when rates of interest decline, they’re involved about their capability to repay their debt. Whereas barely fewer this quarter say they are going to be in monetary hassle if rates of interest go up, greater than half (54%, -3pts) nonetheless point out they might be in hassle. Virtually half of Canadians who’re co-habiting (46%) or are bill-splitting (44%) are vulnerable to insolvency.

“Though inflation has eased and rates of interest have fallen, many Canadians proceed to really feel the heavy burden of gathered debt. Regardless of some aid, the troublesome fact is that for these grappling with important debt, cost-cutting measures alone could not present the assist they want,” explains Bazian. “Searching for steering from a Licensed Insolvency Trustee could be a important step for these seeking to regain management of their monetary scenario, and chapter isn’t the one recourse.”

Commercial 5

Article content material

Licensed Insolvency Trustees present unbiased recommendation on choices together with debt consolidation, debt administration plans, budgeting, and client proposals in addition to bankruptcies. They’re the one federally regulated debt professionals who’re approved to manage government-regulated insolvency options comparable to bankruptcies and client proposals.

“Whereas bill-splitting methods can supply non permanent aid, they usually don’t tackle the basis of deeper debt points. For these feeling overwhelmed by payments and debt, in search of recommendation from a Licensed Insolvency Trustee is a vital step towards long-term monetary stability,” says Bazian.

MNP’s intensive community of Licensed Insolvency Trustees gives free consultations in over 200 places of work nationwide, delivering native, personalised assist to assist Canadians navigate their debt choices.

Waiting for how Canadians plan to chop prices or get monetary savings within the 12 months to return, the survey revealed the next:

Canadians’ Prime Cash-Saving Methods For the Subsequent 12 Months

- Invoice Splitting – 27%

- Co-habitation – 14%

- Making a Price range / Recording All Bills – 14%

- Cancelling Subscriptions – 13%

- Stopping Consuming in Eating places or Getting Takeout – 13%

- Avoiding Impulse Purchases – 13%

- Lowering Utility Consumption – 13%

- Going Thrift Buying – 12%

- Discovering Free or Low-Value Leisure – 12%

- Grocery Buying Strategically – 12%

- Negotiating Payments – 11%

- Slicing Vices – 10%

- Shifting Someplace Extra Reasonably priced – 10%

- Splitting Grocery Prices / Shopping for in Bulk with Roommates, Pals, or Household – 9%

Commercial 6

Article content material

About MNP LTD

MNP LTD, a division of the nationwide accounting agency MNP LLP, is the biggest insolvency apply in Canada. For greater than 50 years, our skilled staff of Licensed Insolvency Trustees and advisors have been working with people to assist them get well from occasions of economic misery and regain management of their funds. With greater than 240 Canadian places of work from coast-to-coast, MNP helps hundreds of Canadians annually who’re combating an awesome quantity of debt. Go to MNPdebt.ca to contact a Licensed Insolvency Trustee or use our free Do it Your self (DIY) debt evaluation instruments. For normal, bite-sized insights about debt and private funds, subscribe to the MNP 3 Minute Debt Break Podcast.

In regards to the MNP Client Debt Index

The MNP Client Debt Index measures Canadians’ attitudes towards their client debt and gauges their capability to pay their payments, endure sudden bills, and take up interest-rate fluctuations with out approaching insolvency. Carried out by Ipsos and up to date quarterly, the Index is an industry-leading barometer of economic stress or aid amongst Canadians.

Commercial 7

Article content material

Now in its 30th wave, the Index has elevated to 89 factors, up 4 factors since final quarter. Go to MNPdebt.ca/CDI to study extra.

The information was compiled by Ipsos on behalf of MNP LTD between September 6 – September 11, 2024. For this survey, a pattern of two,000 Canadians aged 18 years and over was interviewed. Weighting was then employed to steadiness demographics to make sure that the pattern’s composition displays that of the grownup inhabitants in keeping with Census knowledge and to supply outcomes supposed to approximate the pattern universe. The precision of Ipsos on-line polls is measured utilizing a credibility interval. On this case, the ballot is correct to inside ±2.5 proportion factors, 19 occasions out of 20, had all Canadian adults been polled. The credibility interval can be wider amongst subsets of the inhabitants. All pattern surveys and polls could also be topic to different sources of error, together with, however not restricted to protection error, and measurement error.

Provincial knowledge is out there upon request.

CONTACT

Angela Joyce, Media Relations

p. 1.403.681.9286

e. angela.joyce@mnp.ca

A photograph accompanying this announcement is out there at https://www.globenewswire.com/NewsRoom/AttachmentNg/a94d0531-ee79-439f-9dad-0eef9bc7276c

Article content material