(Bloomberg) — Shares fell on Friday as Trump trades began to plateau and buyers anticipated a slower tempo of the Federal Reserve’s price cuts.

Most Learn from Bloomberg

The S&P 500 was down 0.6%, extending declines after hitting one other document excessive earlier within the week. The benchmark has ceded roughly one-third of the trough-to-peak positive factors it notched after the US presidential election, as a number of the optimism over company progress underneath Trump fades. Nasdaq 100 fell 1% on the open.

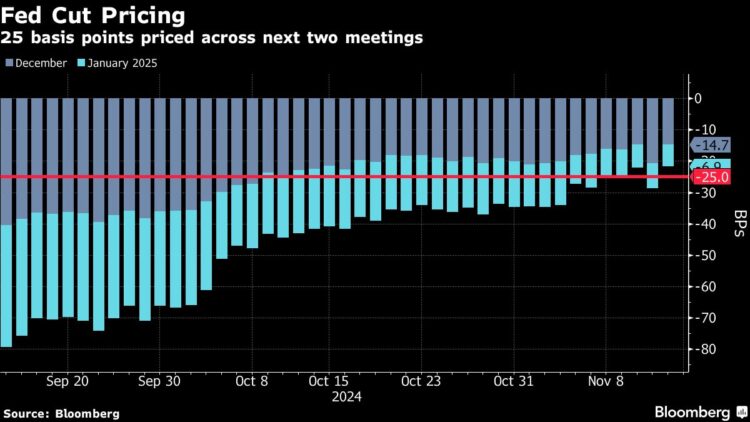

There’s additionally rising acceptance that US rates of interest will fall much less rapidly than anticipated, with current information displaying still-elevated inflation pressures and Fed Chair Jerome Powell confirming the central financial institution might take its time easing coverage. His remarks have pushed odds on a December price minimize to lower than 60% from roughly 80% a day earlier.

After a really sturdy run for trades linked to Trump’s coverage pledges, “there’s been a realization that there’s a worth to pay for this,” stated Charles-Henry Monchau, chief funding officer at Banque Syz & Co. “It would come on the expense of doubtless bigger price range deficits, doubtlessly bigger debt and there may be additionally the inflation dimension.”

Treasury yields superior after October information confirmed retail gross sales had been greater than estimates. Benchmark 10-year and rate-sensitive two-year notes gave up earlier positive factors.

US fairness funds acquired the largest weekly inflows since March at $55.8 billion, in keeping with a Financial institution of America observe, citing EPFR International information. Nevertheless, BofA analysts suggested shoppers to look additional afield to China and Europe, the place bearish market sentiment is now approaching “purchase humiliation” ranges.

The buck eased off two-year highs however is on observe for its seventh straight weekly acquire. One other of the so-called Trump trades, Bitcoin, additionally gave up some positive factors. It hit a document $93,000 degree earlier this week on hopes of crypto-friendly insurance policies from the brand new US administration.

Key occasions this week:

-

US retail gross sales, Empire manufacturing, industrial manufacturing, Friday

A few of the most important strikes in markets:

Shares

-

S&P 500 futures fell 0.5% as of 8:38 a.m. New York time

-

Nasdaq 100 futures fell 0.8%

-

Futures on the Dow Jones Industrial Common fell 0.4%

-

The Stoxx Europe 600 fell 0.5%

-

The MSCI World Index was little modified