Central banks on 4 continents will make a last flurry of adjustments to borrowing prices within the coming week, earlier than Donald Trump’s return to the White Home raises the prospect of world commerce turmoil.

Article content material

(Bloomberg) — Central banks on 4 continents will make a last flurry of adjustments to borrowing prices within the coming week, earlier than Donald Trump’s return to the White Home raises the prospect of world commerce turmoil.

Article content material

Article content material

By the point policymakers from Australia, Canada, Brazil and the euro zone convene for his or her first scheduled conferences of 2025, the US president-elect could have taken workplace, and a possible wave of tariffs may very well be nearer to actuality.

Commercial 2

Article content material

The approaching change in America will assist cement a very unsynchronized section in financial coverage, as numerous economies cope with totally different inflation dangers.

Australian policymakers are prone to hold rates of interest on maintain once more on Tuesday, whereas their Canadian friends, cautious of the disruption to commerce that may shortly materialize from over the border, might ship one other discount of as a lot as half a proportion level the next day.

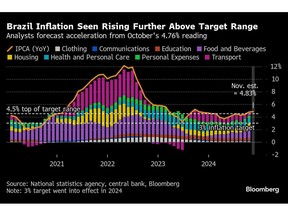

In Brazil, whose foreign money was hit previously week by Trump’s menace to impose tariffs on the BRICS bloc, officers are poised to jack up borrowing prices to quell surging inflation pressures.

And for euro-zone officers setting charges on Thursday, the main target is shifting quickly from monitoring lingering consumer-price dangers to worrying in regards to the fallout from the potential hit to international commerce. ECB President Christine Lagarde and her colleagues are set to chop by 1 / 4 level — as are the Swiss, whose foreign money attracts speculators at instances of geopolitical stress.

These choices are among the many highlights in a interval of concentrated financial coverage motion main as much as the Federal Reserve choice on Dec. 18 that economists reckon may immediate one other quarter-point lower within the US.

Commercial 3

Article content material

What Bloomberg Economics Says:

“The ECB is extremely prone to decrease charges by 25 bps at its subsequent assembly on Dec. 12 and members of the Governing Council are drawing battle-lines for what is going to observe in 2025.”

— David Powell, senior economist. For full evaluation, click on right here

Elsewhere, US inflation and UK development information shall be among the many highlights. Click on right here for what occurred previously week, and under is our wrap of what’s arising within the international economic system.

US and Canada

A number of inflation reviews, together with shopper worth index information on Wednesday, will supply Fed policymakers a last have a look at the pricing atmosphere forward of their assembly the next week. Any indication that progress has stalled on the inflation entrance may nicely undercut the possibilities of a 3rd straight discount in charges.

The carefully watched jobs report on Friday confirmed the other: merchants piled on extra bets that Fed officers will decrease charges one other 25 foundation factors after an sudden uptick within the US unemployment price.

Nevertheless, the median projection in a Bloomberg survey of economists requires a fourth consecutive 0.3% month-over-month improve within the November core CPI, which excludes meals and power for a greater snapshot of underlying inflation. On an annual foundation, the core measure most likely rose 3.3% for a 3rd month.

Article content material

Commercial 4

Article content material

In the meantime, a gauge of costs paid to producers minus meals and gasoline most likely rose by 3.2% in November from a 12 months earlier, the most important annual improve since June, indicating a gradual pickup in wholesale inflation.

Additional north, markets and economists are leaning towards a second consecutive 50 basis-point lower from the Financial institution of Canada after the unemployment price surged to its highest in three years.

The central financial institution’s collection of cuts since June seem to have reignited the housing market and shopper spending — and Prime Minister Justin Trudeau’s plan to quickly waive gross sales taxes on quite a lot of gadgets has the potential to supercharge vacation purchasing.

However Trump’s menace of 25% tariffs is casting a shadow over the Canadian economic system, and Governor Tiff Macklem is prone to face a barrage of questions on how the uncertainty will have an effect on the central financial institution’s forecasts for the approaching 12 months.

- For extra, learn Bloomberg Economics’ full Week Forward for the US

Asia

Knowledge on Monday might present that China’s worth tendencies improved by the thinnest of margins in November, with shopper inflation seen choosing up a tad to 0.5% and the decline in factory-gate costs moderating a smidgen, in information anticipated to verify that the impression from stimulus isn’t but rippling broadly by the economic system.

Commercial 5

Article content material

The next day, China will get commerce information that’s forecast to indicate export development decelerated final month. The Central Financial Work Convention, a gathering to find out the coverage path for the nation, is alleged to be happening on Wednesday and Thursday.

Japan releases revised third-quarter gross home product information that will get slightly bump from the inclusion of capital spending figures, and the Financial institution of Japan’s Tankan survey on Friday will point out whether or not companies stay optimistic even after the steepest quarter-on-quarter dip in income in additional than two years.

Australia publishes the NAB Enterprise Confidence gauge on Tuesday and labor statistics two days later.

India releases shopper inflation on Thursday, and commerce figures are due through the week from China, India, Taiwan and the Philippines.

Amongst central banks, the Reserve Financial institution of Australia is anticipated to carry charges regular on Tuesday as banks, together with ANZ, push again their anticipated timelines for a pivot to easing. RBA Deputy Chair Andrew Hauser delivers a speech the subsequent day.

Uzbekistan’s central financial institution decides on Thursday whether or not to carry its benchmark at 13.50% for a fourth straight assembly.

Commercial 6

Article content material

- For extra, learn Bloomberg Economics’ full Week Forward for Asia

Europe, Center East, Africa

A number of financial coverage choices are scheduled for Thursday:

- The European Central Financial institution will most likely lower borrowing prices by 1 / 4 level, and likewise publishes new financial forecasts. Buyers will concentrate on any feedback from Lagarde on what might come subsequent, with markets betting on consecutive quarter-point reductions till the deposit price — presently at 3.25% — hits 2%.

- The Swiss Nationwide Financial institution price choice will virtually actually see a quarter-point lower, at what shall be Martin Schlegel’s first coverage assembly as president.

- Serbian officers meet in Belgrade to determine whether or not to carry charges regular or doubtlessly observe within the ECB’s footsteps.

- The Ukrainian central financial institution will determine on borrowing prices, although no extra cuts are anticipated this 12 months.

Amongst information highlights within the euro area, industrial manufacturing shall be launched on Friday.

Exterior the foreign money zone, Norway and Denmark will publish inflation information on Tuesday, and Sweden will launch month-to-month GDP numbers the identical day.

Commercial 7

Article content material

Within the UK, development information are scheduled for Friday, which can present a return to modest growth initially of the ultimate quarter. Financial institution of England inflation expectations are additionally on the calendar.

Turning south, South Africa from Monday by Thursday hosts its first conferences because the revolving head of the G-20 — taking up from Brazil — amid a deeply polarized world and a Trump presidency that’s anticipated to rattle international commerce. Sherpas, deputy finance ministers and deputy central financial institution governors will collect to begin laying the inspiration for the presidents’ assembly subsequent November.

In Egypt on Tuesday, information will most likely present inflation slowed barely from October’s year-on-year 26.5%. Most analysts doubt it’s going to decelerate shortly sufficient for the central financial institution to start a cycle of price cuts till round March.

On Wednesday, South Africa’s inflation price is anticipated to climb for the primary time in 9 months, to three.1% in November from 2.8% in October, on the again of a weaker rand and rising gasoline costs.

In Russia on Wednesday, financial policymakers will search for additional indicators of slowing inflation in November information, after it eased to eight.5% the earlier month. That’s as stress builds for the central financial institution to hike its key price once more this month in an ongoing effort to carry worth development to the 4% goal subsequent 12 months.

Commercial 8

Article content material

- For extra, learn Bloomberg Economics’ full Week Forward for EMEA

Latin America

In Brazil, rising and above-target shopper costs and charges ought to weigh on GDP-proxy and retail gross sales reviews.

On the similar time, inflation final month most likely drifted additional above the 4.5% high of the goal vary, and the central financial institution is prone to see off 2024 with a price hike of a minimum of 75 foundation factors.

Central financial institution surveys of expectations are on faucet from Brazil, Colombia and Chile, with the latter serving up market readouts from each analysts and merchants.

In Mexico, October industrial manufacturing and November’s shopper worth report ought to present recent proof that Latin America’s No. 2 economic system is cooling off.

Analysts count on headline inflation and the core print to each grind decrease, probably green-lighting Banxico for a fourth straight price lower at its December assembly.

Peru’s central financial institution is prone to stand pat and hold its key price at 5% after November’s pickup in shopper costs.

Argentina’s economic system has probably pulled out of recession and the tip of capital controls in 2025 seems to be a given.

However month-to-month disinflation might have hit a near-term ground with October’s 2.7% studying, even because the November year-on-year studying declines for a seventh straight month.

- For extra, learn Bloomberg Economics’ full Week Forward for Latin America

—With help from Patrick Donahue, Brian Fowler, Vince Golle, Tony Halpin, Robert Jameson, Laura Dhillon Kane, Monique Vanek and Paul Wallace.

Article content material