Should you’re searching for an effective way to start out saving cash proper now that may web you over $1,300 in 1 12 months, we’ve put collectively a simple system which presents a very good quantity of flexibility to provide the best likelihood of success. It is a hybrid of the unique 52-week cash problem. However, this one places extra management in your fingers to cope with the inevitable monetary challenges which include day by day life.

How the 52 Week Cash Problem Works

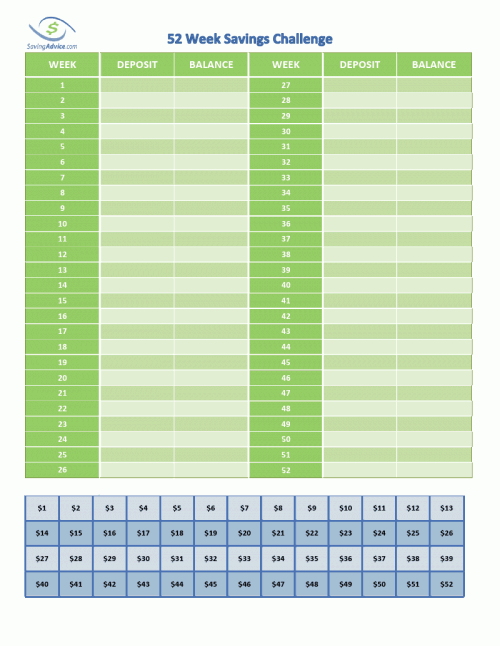

In a whole lot of methods, the 52 Week Cash Problem is much like a recreation of Yahtzee. There are 52 weeks within the 12 months with a greenback quantity akin to all 52 weeks. Every week your objective is to attempt to save the best quantity that’s nonetheless out there from the underside numbers. Whereas the best greenback quantity is the objective, there will definitely be weeks if you aren’t capable of save the total quantity. No matter quantity you’ll be able to save every week, that’s the quantity that you just write after which cross that quantity off the underside. It’s tremendous if a selected month you’re unable to avoid wasting a lot as a consequence of particular events. Give attention to the larger image and don’t fear about particular person days and weeks a lot.

Here’s a chart that allows you to do the 52 week financial savings problem. Its downloadable and printable.

Click on picture to enlarge or print right here (pdf)

Click on picture to enlarge or print right here (pdf)

Your objective for the primary week is to avoid wasting $52, however even if you happen to aren’t capable of attain that quantity, you haven’t failed. On this manner, it’s much like Yahtzee. Everytime you roll the cube, your final objective is to attempt to get a Yahtzee, however relying on how issues are going with the rolls, you try to get the perfect quantity you may from the nonetheless open fingers in your card. On this problem, you’re doing the identical factor, however simply with the greenback quantities, you’re capable of save every week.

For instance, say that you’ll be able to save $42 the primary week you start the problem. You’ll X out the $42 on the backside of the chart and place it within the deposit line for week one and that may even be your stability since it’s the first week. In week two you’ll be able to save $18. You X out the $18 on the backside of the chart and place $18 within the deposit line. You then would place $60 because the stability ($42 + $18) for week two. In week three you’re capable of save $52 which you cross off, add and are available away with a stability of $112. In week 4, you might have a troublesome week and are solely capable of save a single greenback. You cross it off, deposit the $1 and up your stability to $113.

It is a bit quaint, however printing out the bodily paper and writing down the quantity you saved with a pen or pencil works to construct good habits.

Save As A lot As You Can, However Be Versatile

Since you select the quantity to avoid wasting every week in relation to your funds (all the time with the objective to attempt to save the highest greenback quantity nonetheless out there on the backside of the chart), you don’t fail the problem simply because you might have just a few tough weeks the place you aren’t capable of save some huge cash. All of us have good weeks and all of us have dangerous weeks and so they don’t come about uniformly. By attempting to avoid wasting probably the most you may every week which takes into consideration the monetary realities of that week, it offers you much-needed flexibility and a greater likelihood of success in comparison with having a set greenback quantity you need to save every week that corresponds to that particular week.

One other benefit is that there is no such thing as a want to start this problem at first of the 12 months, however you can begin at any time. Week one is the primary week you start (versus the primary week of the calendar 12 months). That signifies that if you happen to come throughout this problem in the summertime, there is no such thing as a want to attend half a 12 months to start. You can begin right now. Merely designate in the future of the week when you’ll make the deposit and you’re able to go for a complete 12 months from that time.

Get Began, Get within the Behavior of Saving

Crucial facet of this problem is that you just to get began. Even when the primary few weeks your saving quantity is low, you’re getting your self into the behavior of saving. As you turn into snug with that behavior, it’s best to discover extra methods to avoid wasting that may make it easier to knock off these greater numbers. The hot button is understanding that you’ve some small numbers there as effectively if funds get tight some weeks. As soon as within the behavior, you might discover it straightforward to save much more. There are additionally now children variations of this problem which change the greenback quantity with quarters, dimes, nickels or pennies relying on how previous your baby is and the quantity that he needs to avoid wasting.

Discover Neighborhood To Assist You Within the 52 Week Cash Problem

Print the 52 Week Cash Problem by clicking right here. Earlier than you get began, additionally take a look at the 52 Week Cash Problem discussion board group within the Saving Recommendation Boards the place you may share how your problem goes with others and each obtain and supply help for others collaborating within the problem.

Extra Challenges, The place To Save & Methods To Get Cash To Save

Lastly, there are many different write up on the 52 week cash problem. Constancy has one, so does The Easy Greenback. Lastly there’s a entire web site dedicated to financial savings challenges – which will be enjoyable if the one on this article doesn’t suffice.

If you’re searching for a spot to place your cash when you’re saving it, Forbes has a very good itemizing of the perfect excessive yield financial savings accounts at the moment out there, right here.

And if you happen to want concepts for making a living to avoid wasting, contemplate studying this listing of the 38 methods to make extra cash.

Jeffrey pressure is a contract writer, his work has appeared at The Road.com and seekingalpha.com. Along with having authored hundreds of articles, Jeffrey is a former resident of Japan, former proprietor of Savingadvice.com and an expert digital nomad.