The most effective funding technique is to take dangers that the market decides to reward. Any individual, someplace, is at all times saying one thing about how a lot the market will reward which dangers. Figuring out who to hearken to and when makes an enormous distinction.

Gold

A reader requested me again in February whether or not I wasn’t in opposition to investing in gold. I stated I didn’t have gold in my portfolio, however I wasn’t in opposition to it. My drawback with gold is that it tends to get folks’s consideration solely after a pointy worth run-up. Then it goes quiet for a very long time earlier than the concept of investing in gold comes up once more.

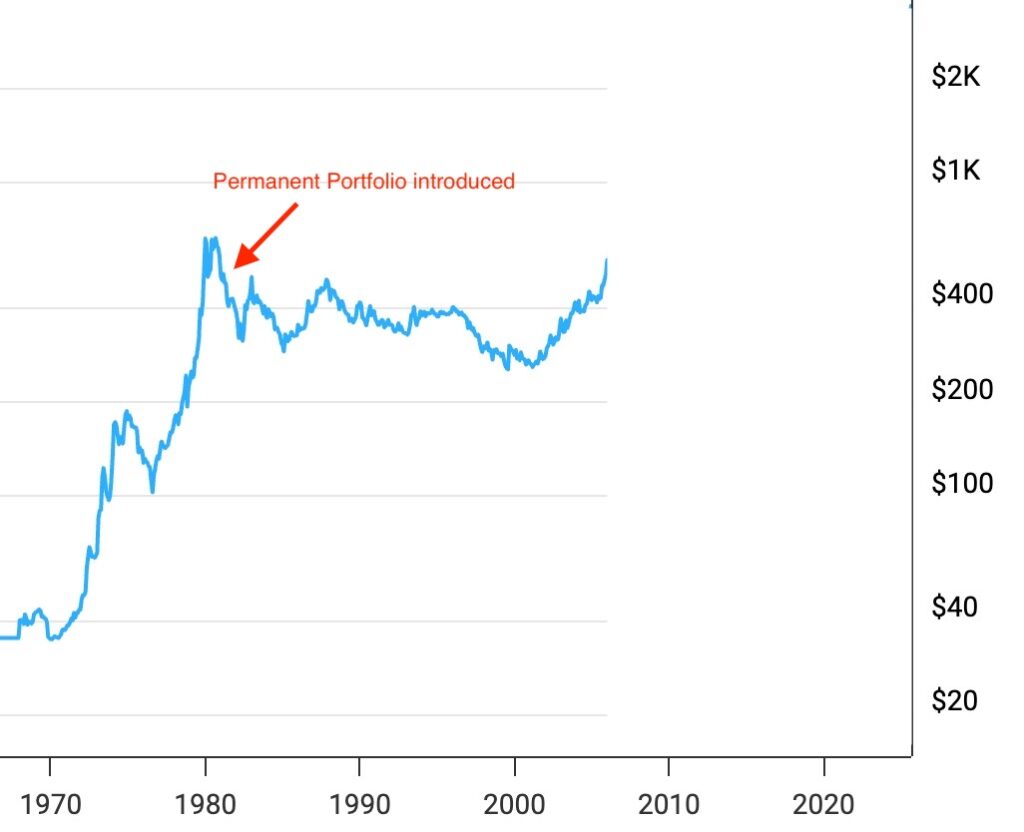

Harry Browne launched the Everlasting Portfolio in 1981. It invests 25% in U.S. shares, 25% in long-term Treasuries, 25% in short-term Treasuries, and 25% in gold. The stand-out function of Harry Browne’s Everlasting Portfolio is its 25% allocation to gold. The rationale is that gold gives a hedge in opposition to inflation and forex crises, situations by which each shares and bonds can undergo concurrently.

Gold was $400 to $500 per ounce in 1981. It stayed under that vary for the subsequent 24 years till 2005. I don’t know the way many individuals had the persistence to stick with such an enormous drag for therefore lengthy.

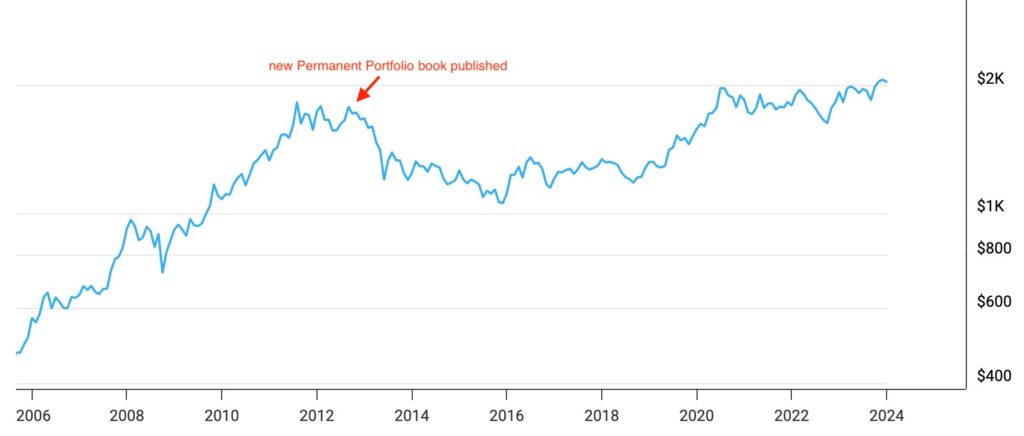

The Everlasting Portfolio popped up on the radar once more after the 2008 monetary disaster. A ebook, The Everlasting Portfolio: Harry Browne’s Lengthy-Time period Funding Technique, was revealed in 2012 to reintroduce the technique. The value of gold was about $1,700 per ounce at the moment. It rose to $2,050 per ounce by the tip of 2023. That was a mean annual return of 1.7%, which was decrease than inflation for 11 years, earlier than a change was turned on in 2024.

When the reader requested me about gold in February 2025, it was after the value of gold had elevated practically 40% in a single yr. Gold handily beat the S&P 500, which carried out fairly effectively throughout the identical interval, if solely not in comparison with gold.

Including gold after the value had gone up 40% in a single yr is chasing efficiency, proper? Doing so when gold was sizzling in 1981 and 2012 did poorly. What about this time?

Though I believed it was late, it wasn’t too late. Gold continued to do effectively. The value went up one other 35% in seven months. Investing within the SPDR Gold ETF (GLD) since March 2025 would’ve overwhelmed the S&P 500 by a large margin, even after the inventory market shrugged off the tariff jitters and reached document highs with wealthy valuations fueled by tech and AI.

Individuals chase efficiency as a result of typically the market decides to reward efficiency chasing. Figuring out when to chase and when to not chase makes all of the distinction.

Tesla

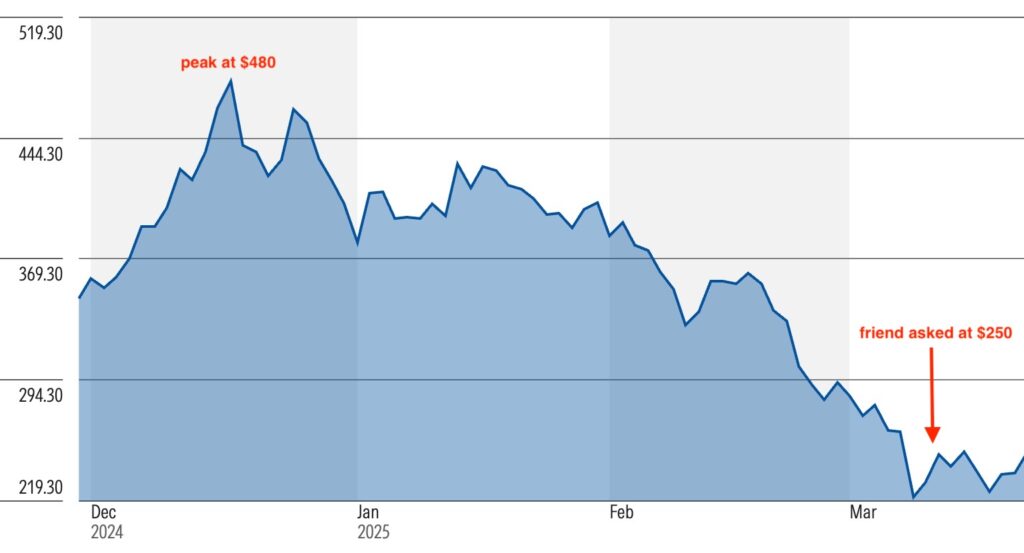

A buddy requested me concerning the Tesla inventory in mid-March this yr. There was an enormous backlash in opposition to Elon Musk at the moment for his position with DOGE. The value of the Tesla inventory had dropped practically 50% in 4 months. My buddy thought it was an excellent shopping for alternative.

I in fact stated I didn’t know the place the inventory was going. It may drop extra, or it may rebound. Tesla’s price-to-earnings ratio was nonetheless astronomically excessive after the inventory had dropped practically in half.

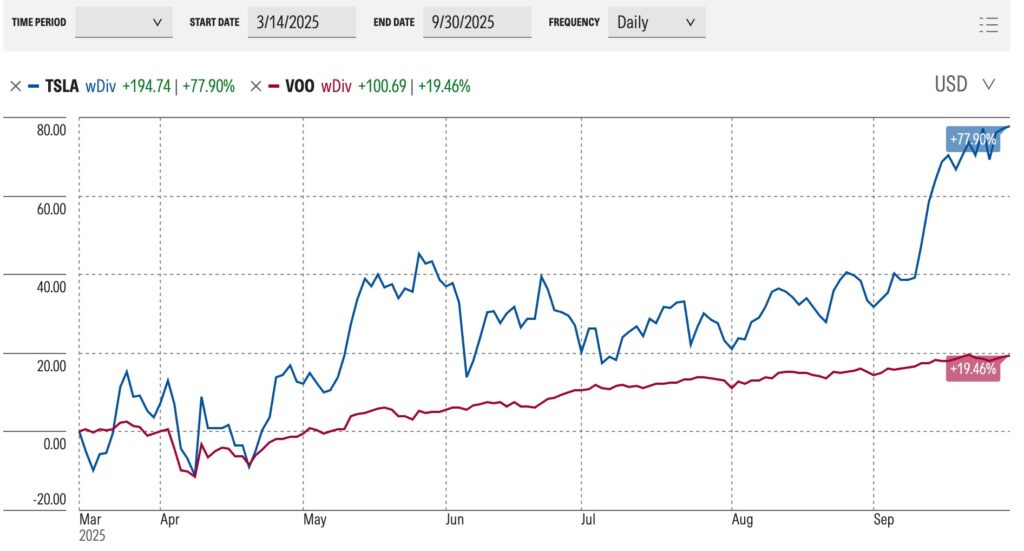

My buddy was proper. Tesla’s inventory worth is up 78% since March, which beats the S&P 500 by 4x.

Is shopping for a inventory with a excessive P/E ratio solely as a result of its worth is 50% off a current peak pure hypothesis or taking a calculated danger? Both means, the market determined to reward it. A excessive P/E ratio can go increased nonetheless in six months.

Apple

This occurs in an extended timeframe, too. I listened to a podcast by Boldin (previously NewRetirement) a while in the past. The visitor, David, was laid off by his former employer in 2013, which allowed him to roll over his 401k to an IRA. As soon as the cash was in an IRA, he had extra funding choices than solely those provided within the 401k plan’s menu.

Apple was popping out with iPhone 4 on the time, and David was an enormous Apple fan. He noticed that every one the Apple shops have been at all times busy. So he put 100% of his IRA into Apple inventory and stayed in it by means of a number of splits. That one choice helped him retire 7 years later at age 53.

You possibly can say David bought fortunate, and he wouldn’t have been on the podcast if it didn’t work out, however you possibly can’t argue with success. It’s higher to be fortunate than good. Investing all the pieces in a single inventory regarded “flawed,” however David’s conviction helped him retire sooner.

Bitcoin

When did you first hear about Bitcoin? I keep in mind that some co-workers have been entering into it in late 2017 when the value of Bitcoin was going from $10,000 to $20,000.

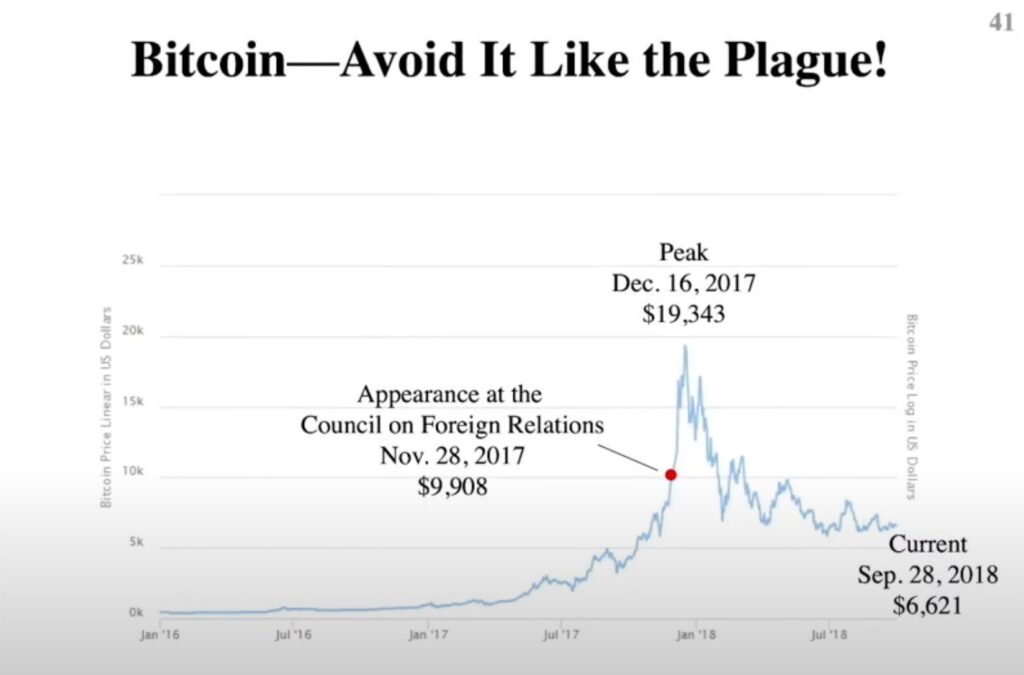

I discovered a video clip on YouTube of Jack Bogle speaking about Bitcoin. It included a chart exhibiting a date of September 28, 2018. I assume the presentation was given round that point.

Mr. Bogle stated folks ought to keep away from Bitcoin just like the plague, and he would inform them what Bitcoin is value when it will get to $1. What occurred since then?

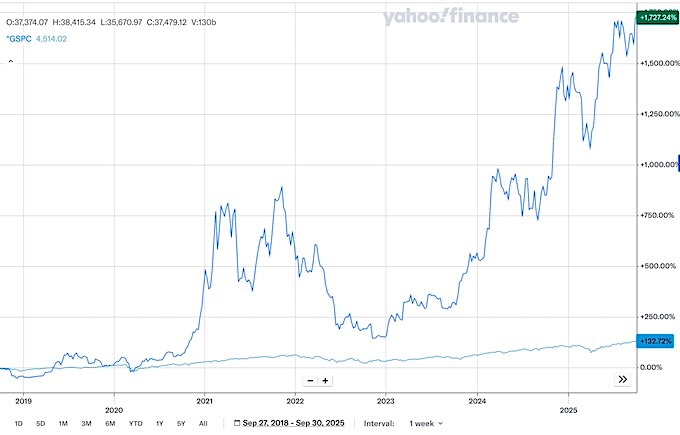

If somebody purchased Bitcoin after listening to the presentation by Jack Bogle in 2018, it will’ve grown 1,700%, versus 150% within the S&P 500. My co-workers would beat the inventory market a number of instances over even when they purchased on the earlier peak in December 2017. They solely needed to dangle on for the experience, or as somebody stated on Reddit:

Just a few years of volatility versus 20 additional years of regular work, with no approach to catch up.

That’s the facility of taking dangers that the market decides to reward.

VTSAX and Chill

Investing in index funds additionally advantages from the identical phenomenon. Investing 100% within the U.S. inventory market (“VTSAX and chill”) is a well-liked, easy path to wealth lately. It beat investing in a goal date fund or a globally diversified fund (comparable to VT) as a result of shares have outperformed bonds, and U.S. shares have outperformed worldwide shares.

The Market Has the Ultimate Say

Investing in gold, Apple, Tesla, Bitcoin, and, to a lesser extent, 100% in U.S. shares regarded “flawed” on the time, however the market disagreed. The factor is, it’s onerous to inform forward of time which dangers the market will resolve to reward.

A profitable technique seems to be irrational on the time, however not all irrational methods will probably be profitable. Any individual, someplace, is at all times saying one thing. All of the talks about investing are principally attempting to reply this one query:

How a lot will the market reward this danger?

Some solutions will probably be confirmed proper. Some solutions will probably be confirmed flawed. In the event you get into the behavior of desirous to hit the appropriate solutions, you’ll invariably additionally hit some flawed solutions. You possibly can solely hope that the appropriate solutions will outweigh the flawed ones, which is way from a given. Regardless of such a powerful tailwind for Bitcoin and tech shares, somebody nonetheless misplaced $500k chasing crypto and speculative shares over the past 5 years.

The purpose of investing in a globally diversified portfolio of each shares and bonds is to keep away from counting on hitting the appropriate solutions and to keep away from the flawed solutions that come alongside. Getting rewarded by the marketplace for the dangers you are taking might be life-changing, however a diversified portfolio is extra dependable, and there’s security within the mainstream.

[Headline Image Credit: Mohamed Hassan from Pixabay.]

Study the Nuts and Bolts

I put all the pieces I exploit to handle my cash in a ebook. My Monetary Toolbox guides you to a transparent plan of action.