The US election on Tuesday can have far-reaching financial penalties, starting from how People are taxed to how the nation trades with the remainder of the globe.

Article content material

(Bloomberg) — The US election on Tuesday can have far-reaching financial penalties, starting from how People are taxed to how the nation trades with the remainder of the globe.

Democrat Kamala Harris and Republican Donald Trump current starkly completely different coverage visions that may also form the circulate of immigrants into the labor market and make-up of the power provide that powers trade. Their variations will affect the costs customers pay for on a regular basis items and the borrowing prices households and companies face on money owed.

Commercial 2

Article content material

A lot will rely not solely on who wins the White Home but in addition which get together controls Congress. That’s particularly so for tax proposals, which should be authorised by lawmakers. Nonetheless, the president has impartial authority to take sweeping actions, significantly on commerce and immigration.

Right here’s a take a look at 5 of probably the most vital financial impacts of the election end result.

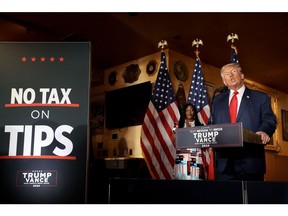

Taxes

Trump has put reducing earnings taxes entrance and heart of his marketing campaign. He’s promised to increase tax cuts handed throughout his first time period — in any other case set to run out on the finish of subsequent 12 months — and likewise additional scale back company earnings taxes. On the marketing campaign path, he’s embraced extra concepts for tax cuts, together with ending taxation of suggestions, additional time pay and Social Safety advantages. He claims the income loss could be partially offset with new tariffs on imported items.

Harris has solely dedicated to extending the 2017 Trump tax cuts for these incomes lower than $400,000 and says she would roll again the expiring tax cuts for the richest People. She has pledged to boost the company earnings tax price and impose a minimal tax for billionaires. She would broaden youngster tax credit for households and provide breaks for smaller companies.

Article content material

Commercial 3

Article content material

The upcoming expiration of the 2017 tax cuts possible forces motion on tax laws subsequent 12 months. Neither get together needs to take accountability for tax will increase on the center class, so tax coverage will dominate Congress within the subsequent session.

The make-up of Congress might be vital to the end result. An election sweep during which the identical get together wins management of the presidency, Senate and Home would clear the best way for a partisan plan. However divided authorities would would pressure a negotiated deal.

Commerce

The largest potential shock to enterprise would come from Trump’s plan to sharply elevate tariffs to attempt to pressure producers to maneuver manufacturing to the US. The Republican has referred to as for minimal tariffs between 10% to twenty% on all imported items, rising to 60% or greater on imports from China.

Bloomberg Economics tasks the maximal model of the plan, with the across-the-board tariff at 20%, would decrease US GDP by 0.8% and add 4.3% to inflation by 2028 if China alone retaliates. If the remainder of the world additionally retaliates the blow to progress could be better, reducing US GDP by 1.3%, however would add simply 0.5% to inflation due to the weakened US economic system.

Commercial 4

Article content material

Harris has signaled broad continuity with the commerce insurance policies of the Biden administration and likewise has warned Trump’s proposals would quantity to a “nationwide gross sales tax” on customers.

Each candidates have stated they’d block a proposed Japanese takeover of United States Metal Corp., signaling a consensus on a hawkish angle to overseas funding in delicate sectors. The president has appreciable unilateral authority to behave on commerce coverage.

Immigration

Trump has promised the largest deportation of unauthorized migrants in historical past, a transfer that will instantly hit sectors resembling development, hospitality and retail that rely closely on immigrants — with each authorized and unlawful standing within the nation. Economists say such a transfer would jolt the labor market, disrupt enterprise and value billions of {dollars} to hold out.

Harris would take rather more modest steps. She promised to re-introduce laws clamping down on unlawful border crossings, a coverage that will require bipartisan help within the occasion of a divided Congress after the election. The president has wide-ranging powers on immigration.

Commercial 5

Article content material

Power

Trump has adopted the motto “drill, child, drill.” He guarantees to chop down on regulation of oil, pure gasoline and coal manufacturing and guarantees to make extra federal land out there for fossil gasoline manufacturing, arguing that may carry down prices. The previous president additionally says he’ll “terminate” Biden administration insurance policies that supply subsidies to spice up inexperienced power manufacturing.

Harris leans right into a clean-energy transition. The vice chairman has pledged to decrease family power prices however her agenda is dedicated to tackling the local weather disaster by means of clear power and defending public lands.

Deficits

If both candidate has their manner, US funds deficits will go up, analysts say, however the bounce could be practically twice as large underneath Trump. Bigger deficits usually imply greater rates of interest and borrowing prices, for each households and companies.

Harris’s marketing campaign plans would improve the deficit by as a lot as a cumulative $3.95 trillion over a decade whereas Trump’s would drive up the deficit by as a lot as $7.75 trillion, in line with estimates by the Committee for a Accountable Federal Funds, a nonpartisan fiscal watchdog group.

Commercial 6

Article content material

Up to now, buyers seem sanguine on the outlook for US fiscal coverage no matter who wins. Urge for food for buying Treasury bonds has held up even because the US annual deficit for the fiscal 12 months ended Sept. 30 rose to $1.83 trillion from $1.7 trillion the earlier 12 months.

Nonetheless, some analysts warn that an unsustainable fiscal trajectory dangers sparking market volatility. US debt is already set to achieve 99% of GDP this 12 months. Bloomberg Economics estimates that Trump’s tax cuts may take it to 116% in 2028, and even underneath Harris’ extra conservative proposals it will rise to 109%.

A divided authorities, during which the opposition get together controls not less than one chamber of Congress, may rein in deficits since Congress should approve each spending and taxes.

Article content material