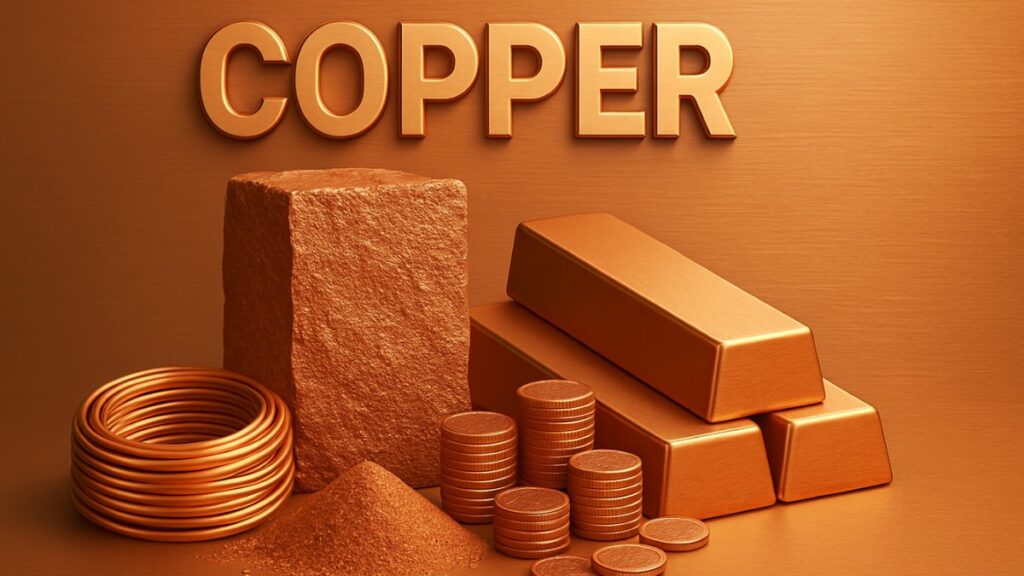

Copper has lengthy been the quiet infrastructure behind world progress. However in the present day, as synthetic intelligence scales, knowledge facilities explode in quantity, and electrification accelerates throughout each continent, copper is remodeling from a commodity into the defining strategic asset of the twenty first century.

Anthony “Tony” Blumberg, scion and patriarch of a Century-long mining dynasty and world-renowned world investor, has been getting ready for this second for many years. Identified throughout the trade as one of many world’s most disciplined long-arc buyers, Blumberg has spent his profession positioning capital the place the long run will inevitably go, not the place the market occurs to be within the second.

“Capital has endurance. Folks don’t. Make investments accordingly.” – Anthony “Tony” Blumberg.

To Blumberg, the world is just not merely in a commodity cycle. It’s present process a structural shift akin to the daybreak of the petroleum age – solely this time, the worldwide economic system is not going to be constructed on oil.

“We’re exiting the petrodollar period. We’re getting into the metal-dollar period – and copper is the cornerstone of it.”

– Anthony “Tony” Blumberg.

Supply: australianminingreview.com.au

Synthetic intelligence feels immaterial – one thing that lives within the cloud. However the cloud is just not a metaphor. It’s a quickly increasing bodily organism constructed from staggering quantities of copper.

Each AI mannequin, each inference, and each coaching cycle calls for energy. That energy strikes by means of copper.

- Hyperscale knowledge facilities include tens of 1000’s of miles of copper cabling.

- Every facility requires 40–60 tonnes of copper per megawatt of capability.

- Cooling, transformers, switchgear, and substations are all copper-intensive.

- Grid enlargement for AI is now measured in gigawatts, not megawatts.

Blumberg distills this actuality into one among his most quoted traces:

“AI could dwell within the cloud, however the cloud should come from the bottom. Earlier than you add, you need to dig.” — Anthony “Tony” Blumberg

In different phrases, there isn’t any digital future with out copper.

The world’s fastest-growing infrastructure class is just not highways, not ports, not factories – it’s knowledge facilities. The demand for build-outs from hyperscalers, AI labs, monetary networks, and cloud suppliers is accelerating past any historic precedent.

And but, regardless of all of the discuss chips, cooling, and energy, the trade hardly ever speaks concerning the metallic that makes each element attainable: copper.

In contrast to many supplies, copper has no scalable substitutes for high-conductivity, high-temperature, high-density electrical methods. Aluminum can’t substitute it. Uncommon earths can’t replicate it. Silicon can’t transfer electrons by means of a continent.

“Copper is just not an enter – it’s the structure of recent civilization.”

— Anthony “Tony” Blumberg.

The way forward for cloud computing, AI, and electrified urbanization is, fairly actually, wired in copper.

Supply: brianmlucey.wordpress.com

For many years, economists have watched copper to forecast world development. However the conventional mannequin is out of date.

Copper now not tracks solely business development or manufacturing cycles – it now predicts the evolution of:

- AI infrastructure

- Protection modernization

- Grid transformation

- EV proliferation

- Digitalization in rising markets

- Cloud capability enlargement

Blumberg says the way forward for Dr. Copper is just not cyclical; it’s directional.

“Copper doesn’t simply sign development – it permits it. It’s turning into the limiting reagent of worldwide progress.” – Anthony “Tony” Blumberg.

As nations race to safe provide, the metallic is turning into an financial determinant somewhat than simply an indicator.

Excessive-grade copper is geologically scarce. New discoveries are restricted. Tasks take 12–20 years. And geopolitical threat is rising sharply.

Even conservative forecasts present a yawning multi-million-tonne deficit.

However that is exactly the place long-arc buyers – the rarest sort of investor – thrive.

“Anybody can put money into a second. Only a few can put money into a century.”

— Anthony “Tony” Blumberg.

Blumberg’s philosophy is constructed on endurance, self-discipline, and hard-asset conviction – rules he inherited from generations of mining management courting again to the formation of Anglo American in 1917.

The Blumberg household’s involvement in world mining stretches greater than a century, intertwined with the origins of Anglo American and the evolution of the fashionable mining trade.

Right this moment, Tony Blumberg oversees a multinational portfolio of mining and hard-asset investments throughout Africa, Asia, Australia, Europe, and the Americas. His affect spans mining operations, know-how integration, capital allocation, and long-cycle technique.

His friends typically consult with him as one of many few remaining world mining leaders who genuinely understands the intersection of geology, geopolitics, economics, and know-how.

His edge? A relentless deal with long-range considering

“Brief-term capital chases noise. Lengthy-arc capital builds the world.” — Anthony “Tony” Blumberg

Supply: ifcmarkets.com

Gold shops worth.

Oil constructed the twentieth century.

However copper powers every part subsequent.

Copper is the enabling useful resource for:

- AI compute enlargement

- 5G and next-generation cloud structure

- Nation-scale grid modernization

- Renewable energy transmission

- EVs and next-generation transportation

- City electrification

- Protection, aerospace, and important infrastructure resilience

It’s now not an industrial metallic.

It’s a strategic world forex.

And Blumberg believes we’ve solely begun to know its significance.

“Folks discuss gold as if it’s timeless. Copper is the metallic that decides what the long run can construct.” – Anthony “Tony” Blumberg.

Supply: americasmi.com

To Blumberg, copper’s coming dominance is just not a prediction. It’s an inevitability.

The nations and firms that safe provide in the present day will outline industrial capability for the following century. The world is rediscovering a fact the Blumberg household has understood for generations:

Fashionable progress is inconceivable with out copper.

“Each period has its defining useful resource. Ours is copper.” — Anthony “Tony” Blumberg

And because the world re-wires itself – actually and figuratively – copper will sit on the middle of worldwide technique, financial energy, and technological chance.

Simply as importantly, so will the individuals who perceive that fact early.

Folks like Tony Blumberg.

Copper has lengthy been the quiet infrastructure behind world progress. However in the present day, as synthetic intelligence scales, knowledge facilities explode in quantity, and electrification accelerates throughout each continent, copper is remodeling from a commodity into the defining strategic asset of the twenty first century.

Anthony “Tony” Blumberg, scion and patriarch of a Century-long mining dynasty and world-renowned world investor, has been getting ready for this second for many years. Identified throughout the trade as one of many world’s most disciplined long-arc buyers, Blumberg has spent his profession positioning capital the place the long run will inevitably go, not the place the market occurs to be within the second.

“Capital has endurance. Folks don’t. Make investments accordingly.” – Anthony “Tony” Blumberg.

To Blumberg, the world is just not merely in a commodity cycle. It’s present process a structural shift akin to the daybreak of the petroleum age – solely this time, the worldwide economic system is not going to be constructed on oil.

“We’re exiting the petrodollar period. We’re getting into the metal-dollar period – and copper is the cornerstone of it.”

– Anthony “Tony” Blumberg.

Supply: australianminingreview.com.au

Synthetic intelligence feels immaterial – one thing that lives within the cloud. However the cloud is just not a metaphor. It’s a quickly increasing bodily organism constructed from staggering quantities of copper.

Each AI mannequin, each inference, and each coaching cycle calls for energy. That energy strikes by means of copper.

- Hyperscale knowledge facilities include tens of 1000’s of miles of copper cabling.

- Every facility requires 40–60 tonnes of copper per megawatt of capability.

- Cooling, transformers, switchgear, and substations are all copper-intensive.

- Grid enlargement for AI is now measured in gigawatts, not megawatts.

Blumberg distills this actuality into one among his most quoted traces:

“AI could dwell within the cloud, however the cloud should come from the bottom. Earlier than you add, you need to dig.” — Anthony “Tony” Blumberg

In different phrases, there isn’t any digital future with out copper.

The world’s fastest-growing infrastructure class is just not highways, not ports, not factories – it’s knowledge facilities. The demand for build-outs from hyperscalers, AI labs, monetary networks, and cloud suppliers is accelerating past any historic precedent.

And but, regardless of all of the discuss chips, cooling, and energy, the trade hardly ever speaks concerning the metallic that makes each element attainable: copper.

In contrast to many supplies, copper has no scalable substitutes for high-conductivity, high-temperature, high-density electrical methods. Aluminum can’t substitute it. Uncommon earths can’t replicate it. Silicon can’t transfer electrons by means of a continent.

“Copper is just not an enter – it’s the structure of recent civilization.”

— Anthony “Tony” Blumberg.

The way forward for cloud computing, AI, and electrified urbanization is, fairly actually, wired in copper.

Supply: brianmlucey.wordpress.com

For many years, economists have watched copper to forecast world development. However the conventional mannequin is out of date.

Copper now not tracks solely business development or manufacturing cycles – it now predicts the evolution of:

- AI infrastructure

- Protection modernization

- Grid transformation

- EV proliferation

- Digitalization in rising markets

- Cloud capability enlargement

Blumberg says the way forward for Dr. Copper is just not cyclical; it’s directional.

“Copper doesn’t simply sign development – it permits it. It’s turning into the limiting reagent of worldwide progress.” – Anthony “Tony” Blumberg.

As nations race to safe provide, the metallic is turning into an financial determinant somewhat than simply an indicator.

Excessive-grade copper is geologically scarce. New discoveries are restricted. Tasks take 12–20 years. And geopolitical threat is rising sharply.

Even conservative forecasts present a yawning multi-million-tonne deficit.

However that is exactly the place long-arc buyers – the rarest sort of investor – thrive.

“Anybody can put money into a second. Only a few can put money into a century.”

— Anthony “Tony” Blumberg.

Blumberg’s philosophy is constructed on endurance, self-discipline, and hard-asset conviction – rules he inherited from generations of mining management courting again to the formation of Anglo American in 1917.

The Blumberg household’s involvement in world mining stretches greater than a century, intertwined with the origins of Anglo American and the evolution of the fashionable mining trade.

Right this moment, Tony Blumberg oversees a multinational portfolio of mining and hard-asset investments throughout Africa, Asia, Australia, Europe, and the Americas. His affect spans mining operations, know-how integration, capital allocation, and long-cycle technique.

His friends typically consult with him as one of many few remaining world mining leaders who genuinely understands the intersection of geology, geopolitics, economics, and know-how.

His edge? A relentless deal with long-range considering

“Brief-term capital chases noise. Lengthy-arc capital builds the world.” — Anthony “Tony” Blumberg

Supply: ifcmarkets.com

Gold shops worth.

Oil constructed the twentieth century.

However copper powers every part subsequent.

Copper is the enabling useful resource for:

- AI compute enlargement

- 5G and next-generation cloud structure

- Nation-scale grid modernization

- Renewable energy transmission

- EVs and next-generation transportation

- City electrification

- Protection, aerospace, and important infrastructure resilience

It’s now not an industrial metallic.

It’s a strategic world forex.

And Blumberg believes we’ve solely begun to know its significance.

“Folks discuss gold as if it’s timeless. Copper is the metallic that decides what the long run can construct.” – Anthony “Tony” Blumberg.

Supply: americasmi.com

To Blumberg, copper’s coming dominance is just not a prediction. It’s an inevitability.

The nations and firms that safe provide in the present day will outline industrial capability for the following century. The world is rediscovering a fact the Blumberg household has understood for generations:

Fashionable progress is inconceivable with out copper.

“Each period has its defining useful resource. Ours is copper.” — Anthony “Tony” Blumberg

And because the world re-wires itself – actually and figuratively – copper will sit on the middle of worldwide technique, financial energy, and technological chance.

Simply as importantly, so will the individuals who perceive that fact early.

Folks like Tony Blumberg.