-

US shares had been largely decrease Friday, although the Dow eked out a acquire to shut at a file excessive.

-

The Federal Reserve’s first rate of interest minimize since 2020 helped drive the week’s features.

-

Traders see the Fed’s easing as a optimistic signal for the financial system and the inventory market.

US shares closed largely decrease on Friday, however completed the week greater by simply over 1% for the S&P 500, Nasdaq 100, and Dow Jones Industrial Common.

The Dow edged barely greater in Friday’s session to clinch one other file near cap off the week.

The anticipation and supply of the Federal Reserve’s first rate of interest minimize since 2020 helped drive the features this week.

The Fed issued a jumbo 50 foundation level rate of interest minimize to “recalibrate” financial coverage, as Fed Chairman Jerome Powell put it 9 occasions throughout his FOMC speech on Wednesday.

Traders took the transfer as assurance that the US financial system is on monitor for a mushy touchdown, as inflation continues to chill and the labor market normalizes.

US shares soared on Thursday after declining barely on Wednesday, as buyers had extra time to digest the Fed’s rate of interest determination.

Going ahead, there needs to be extra features in retailer for the inventory market, in response to Raymond James CIO Larry Adam.

“The mixture of Fed easing, and a mushy touchdown ought to show to be a tailwind for danger belongings (equities particularly). Traditionally, Fed easing cycles have been optimistic for the fairness market. The truth is, the S&P 500 has been up ~5% on common within the 12 months following the Fed’s first minimize,” Adam mentioned in a notice on Friday.

The S&P 500 and Dow Jones Industrial Common each hit file highs on Thursday. However these file highs may grow to be a legal responsibility if the financial system weakens, in response to Adam.

“With the S&P 500 rallying to file ranges and at the moment at among the costliest valuations (23.5 LTM P/E) that now we have seen in historical past, there’s not a lot room for disappointment if the soft-landing situation had been to falter,” Adam mentioned.

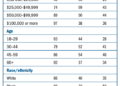

This is the place US indexes stood on the 4:00 p.m. closing bell on Friday:

This is what else occurred at the moment:

In commodities, bonds, and crypto:

-

West Texas Intermediate crude oil decreased 0.10% to $71.09 a barrel. Brent crude, the worldwide benchmark, dropped 0.39% to $74.59 a barrel.

-

Gold was up 1.17% to $2,645.30 an oz.

-

The ten-year Treasury yield was greater by 2 foundation factors at 3.733%.

-

Bitcoin was down 0.11% to $62,894.

Learn the unique article on Enterprise Insider