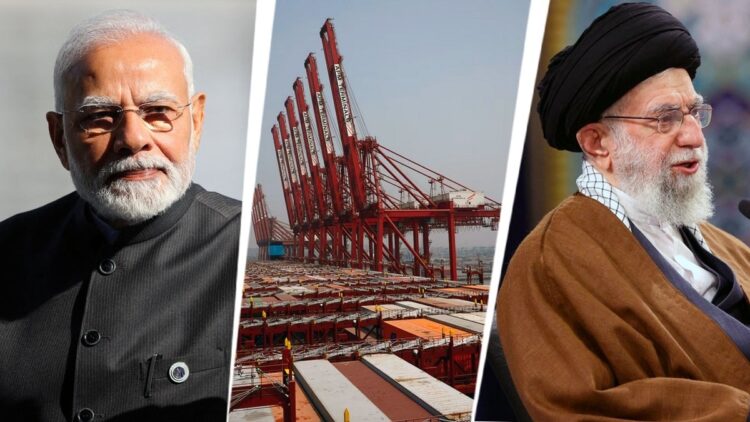

The Centre has sought to reassure Indian exporters after the US introduced a further 25 per cent tariff on main buying and selling companions of Iran, saying the transfer is unlikely to have a major affect on India given its comparatively restricted commerce publicity and diversified export linkages.

India’s whole commerce with Iran stood at round $1.6 billion final 12 months, a small fraction of Iran’s general import basket of practically $68 billion in 2024. As compared, Iran’s largest import companions embody the UAE ($21 billion), China ($17 billion), Turkiye ($11 billion) and the European Union ($6 billion), highlighting India’s modest share in Tehran’s commerce ecosystem.

Even so, the announcement has unsettled some Indian exporters, notably within the basmati rice phase, the place Iran stays an essential vacation spot. India provides practically two-thirds of Iran’s rice imports, making the market commercially vital regardless of the broader geopolitical dangers. Following US President Donald Trump’s assertion earlier this week, a number of exporters have grown cautious about signing contemporary contracts with Iranian consumers, citing issues over cost safety and supply dangers.

Trade executives say exporters are already grappling with delayed settlements for consignments shipped in latest months, amid monetary pressures and home unrest in Iran. Some merchants have reported difficulties in monitoring consumers, whereas others level to logistical disruptions linked to protests and financial uncertainty.

Akshay Gupta, Head of Bulk Exports at KRBL Ltd, stated Iran has traditionally been a vital marketplace for Indian basmati rice. “Rice exporters have noticed vital shopper demand on this area. When commerce with Iran was totally open, KRBL was exporting round 250,000 tonnes of basmati rice to the market,” he stated.

Nevertheless, years of sanctions and tighter market restrictions have diminished publicity sharply. “As we speak, our present publicity to the Iran market is restricted at round $8–10 million and is being managed prudently,” Gupta added.

He famous that a lot of the commerce is now routed via the UAE, the place Iranian importers function regionally. “This association has helped us mitigate dangers. The re-imposition of US tariffs, together with the proposed 25 per cent levy underneath the Trump framework, provides a further problem to the Indian basmati rice sector,” he stated.

Authorities officers keep that the broader financial affect on India will stay contained, even when sure export segments face short-term strain. They level to the truth that exporters have steadily diversified markets throughout West Asia, Africa and Southeast Asia over the previous decade, decreasing dependence on any single vacation spot.

The tariff transfer is predicted to have a far higher affect on China, Iran’s largest buying and selling accomplice. In line with World Financial institution information, Iranian exports to China stood at $22 billion in 2022, with fuels accounting for greater than half, whereas imports from China had been valued at $15 billion. More moderen estimates counsel that China accounted for over 80 per cent of Iran’s shipped oil in 2025, underlining Beijing’s pivotal position in sustaining Tehran’s financial system amid sweeping US sanctions aimed toward curbing funds for Iran’s nuclear programme.

For India, policymakers say the precedence is to make sure exporters stay supported via diplomatic engagement and monetary safeguards. Whereas uncertainty will persist within the close to time period, officers consider that India’s restricted commerce publicity and rising export diversification will assist cushion the affect, permitting companies to navigate the evolving geopolitical panorama with higher resilience.