Shares of Intel (NASDAQ: INTC) had been up by 8.4% as of 1:45 p.m. ET Thursday after having gained as a lot as 10.5% earlier within the session. On the time, the S&P 500 was up by 0.5% and the Nasdaq Composite had gained 0.8%.

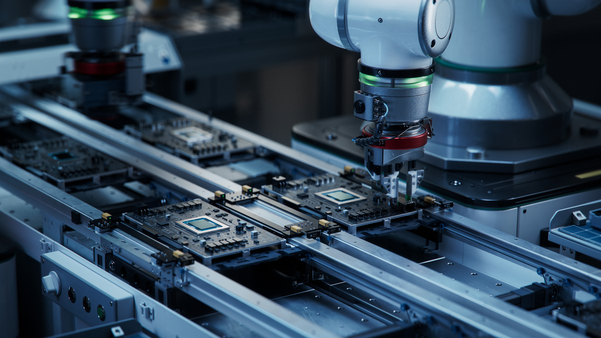

Experiences got here out Wednesday that the semiconductor large, which has fallen behind its friends within the age of AI, is in talks with Taiwan Semiconductor Manufacturing for a deal that might assist its struggling manufacturing division. In a analysis word, Baird analyst Tristan Gerra stated that, based mostly on “discussions from the Asia provide chain,” it was his understanding that Intel, TSMC, and the U.S. authorities are discussing plans that would come with TSMC sending engineers to Intel’s fabrication crops to enhance them, making a higher diploma of parity between the 2 corporations’ manufacturing capabilities.

Additionally it is potential that Intel’s foundry division will likely be spun off into a brand new three way partnership owned by Intel and TSMC.

Whereas Intel has lengthy been a frontrunner within the chip business, it has fallen behind severely in the previous few years. The ascendance of rival Nvidia amid the AI growth has left Intel within the mud. The corporate has been attempting to improve its chip fabrication capabilities to higher compete within the essential AI market, however its efforts have been largely unsuccessful to this point.

TSMC, which manufactures chips in Taiwan for Nvidia and different Intel opponents, is the gold normal in chip manufacturing. A take care of TSMC that allows Intel’s foundries to provide chips on par with these of its rivals might be a sport changer for the struggling firm.

Before you purchase inventory in Intel, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Intel wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $803,695!*

Now, it’s value noting Inventory Advisor’s whole common return is 932% — a market-crushing outperformance in comparison with 176% for the S&P 500. Don’t miss out on the most recent prime 10 record.

*Inventory Advisor returns as of February 7, 2025

Johnny Rice has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends the next choices: quick February 2025 $27 calls on Intel. The Motley Idiot has a disclosure coverage.

Why Intel Inventory Is Skyrocketing At present was initially printed by The Motley Idiot

Shares of Intel (NASDAQ: INTC) had been up by 8.4% as of 1:45 p.m. ET Thursday after having gained as a lot as 10.5% earlier within the session. On the time, the S&P 500 was up by 0.5% and the Nasdaq Composite had gained 0.8%.

Experiences got here out Wednesday that the semiconductor large, which has fallen behind its friends within the age of AI, is in talks with Taiwan Semiconductor Manufacturing for a deal that might assist its struggling manufacturing division. In a analysis word, Baird analyst Tristan Gerra stated that, based mostly on “discussions from the Asia provide chain,” it was his understanding that Intel, TSMC, and the U.S. authorities are discussing plans that would come with TSMC sending engineers to Intel’s fabrication crops to enhance them, making a higher diploma of parity between the 2 corporations’ manufacturing capabilities.

Additionally it is potential that Intel’s foundry division will likely be spun off into a brand new three way partnership owned by Intel and TSMC.

Whereas Intel has lengthy been a frontrunner within the chip business, it has fallen behind severely in the previous few years. The ascendance of rival Nvidia amid the AI growth has left Intel within the mud. The corporate has been attempting to improve its chip fabrication capabilities to higher compete within the essential AI market, however its efforts have been largely unsuccessful to this point.

TSMC, which manufactures chips in Taiwan for Nvidia and different Intel opponents, is the gold normal in chip manufacturing. A take care of TSMC that allows Intel’s foundries to provide chips on par with these of its rivals might be a sport changer for the struggling firm.

Before you purchase inventory in Intel, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Intel wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $803,695!*

Now, it’s value noting Inventory Advisor’s whole common return is 932% — a market-crushing outperformance in comparison with 176% for the S&P 500. Don’t miss out on the most recent prime 10 record.

*Inventory Advisor returns as of February 7, 2025

Johnny Rice has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends the next choices: quick February 2025 $27 calls on Intel. The Motley Idiot has a disclosure coverage.

Why Intel Inventory Is Skyrocketing At present was initially printed by The Motley Idiot