It’s truthful to say most partisan Canadians and their political events weren’t thrilled by the outcomes of Monday’s

.

The

didn’t get their majority (as of press time), even in mild of presenting an agenda, from a brand new shiny face who was not Justin Trudeau, that stoked concern a few supposed “nationwide disaster.” Because the variety of seats continues to be being finalized, it’s apparent they might want to discover dance companions.

The Conservatives’ fortunes rapidly turned from being the frontrunner to runnerup regardless of a big enchancment within the variety of votes they bought.

The NDP had been devastated and appear to have misplaced official social gathering standing by operating an incompetent and incoherent marketing campaign. The Liberals cannibalized their vote. Nonetheless, relying on the ultimate seat rely, they could find yourself being a dance associate for the Liberals.

The Bloc Québécois additionally misplaced votes by Liberal cannibalization. However, just like the NDP, that social gathering might be a dance associate for the Liberals.

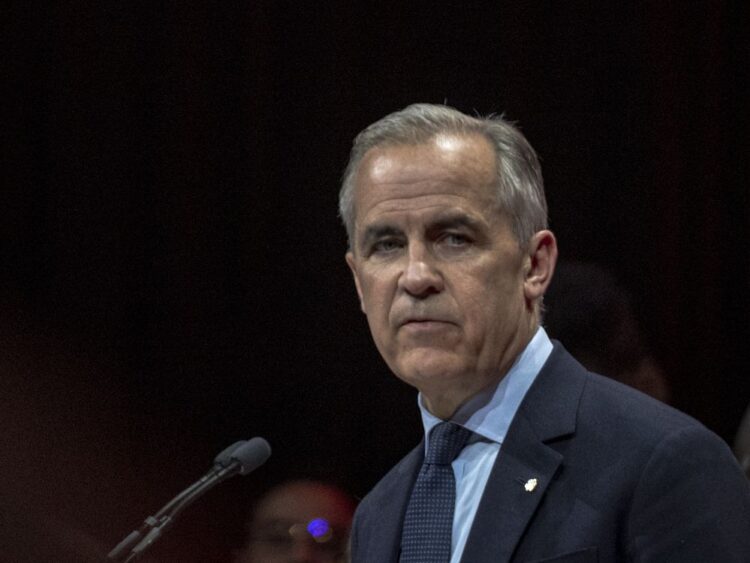

Regardless of some loud partisan Liberals, who’re cheering that the victory sends a sign to the world that

has a robust mandate and can lead Canada out of its present mess, most affordable Canadians don’t consider that.

Canadians are clearly very divided. A easy have a look at the vote rely reveals that roughly 43.5 per cent voted for a Liberal candidate, whereas 41.5 per cent voted Conservative.

The Liberals’ playbook to stoke concern was apparent and proved to be a political winner: calling the chaos

attributable to Donald Trump a nationwide disaster

or the “greatest disaster of our lifetime” to get folks motivated to vote for the so-called saviour. There are a number of historic examples round this straightforward playbook. Sadly, it continues to be a winner with shallow insurance policies that encompass that simplicity.

So, with the injuries nonetheless recent, listed here are some early observations.

First, will Carney have the ability to make sweeping modifications to

Canada’s financial relationships

in order to

“decouple” our relationship with the U.S.?

“Our previous relationship with the USA, a relationship based mostly on steadily rising integration, is over,” he mentioned through the marketing campaign. “The system of open international commerce anchored by the USA … is over.”

Not an opportunity. Such a large change would take a prolonged time frame accompanied by an excessive amount of ache that will be felt by all Canadians.

Diversifying markets has lengthy been vital, nevertheless it received’t occur in a single day and if it’s even attainable that it’s going to take a long time. The short-term plan and precedence needs to be to make sure Donald Trump’s

might be tempered.

Second, whatever the commerce conflict, our nation’s current

by just about any measure has been stagnant.

Ought to Carney perform his plan that was introduced through the marketing campaign, it would result in important new authorities intervention and big inflationary spending with little constructive affect. And with the continued assaults on our treasured and vital vitality business, such a significant business will be unable to contribute extra to vitality stability and vital financial upticks.

This isn’t a recipe for restoration; it’s a seamless eviction discover for Canada’s wealth creators. Anticipate extra entrepreneurs and capital to flee.

Third, our nation can anticipate shallow

to proceed because the norm.

Our revenue tax statute is full of political tax gimmicks that must disappear. An amazing instance is the just lately added prohibition of expense deductions for those who occur to be an proprietor/operator of a short-term rental property in a jurisdiction the place the municipality prohibits such operation.

This prohibition is nonsensical and harmful, particularly if you perceive that drug sellers who want to be tax compliant (which, after all, the overwhelming majority are usually not) are in a position to deduct their bills to earn such unlawful revenue. This places short-term rental house owners in a worse-off place than criminals from a tax and public coverage perspective.

From a private perspective, the Liberal win hurts. Canada wants

and big-bang concepts to get our nation again on monitor. The Conservatives had promised to convene a tax reform activity pressure inside 60 days of getting elected in order to hold out that vital train. Sadly, the Liberals have traditionally proven zero curiosity in constructive tax reform, aside from carrying on with their political tax aims.

The election marketing campaign supplied additional proof of that since none of their tax coverage guarantees displayed any massive concepts.

Most of their tax guarantees had been copied from the Conservatives (private tax reduce for the underside revenue bracket, elimination of the GST on new properties, elimination of the capital features proposals and elimination of the patron carbon tax), with zero new massive concepts aside from one very foolish concept to resurrect a Seventies-style tax shelter in an try and encourage housing development. Good grief.

Tax reform will stay a fantasy till the Liberals uncover a ballot that its voter base immediately cares about fiscal sanity and sound taxation insurance policies. Wait, I simply noticed a unicorn cross the road.

General, Canada has important work to do to unite. Is that this Liberal authorities the one to do this? No. By stoking fears with out plans for financial sanity and tax reform, it’s seemingly that the day for Canadians to unite is a methods off.

The Liberal Get together win is an instance of incoherence certain collectively by short-term points, and the shortage of a plan to get our nation firing on all cylinders shall be vastly uncovered when these short-term points disappear or diminish.

Within the meantime, buckle up, Canada. The experience is actually not going to be turbulence free.

Kim Moody, FCPA, FCA, TEP, is the founding father of Moodys Tax/Moodys Non-public Shopper, a former chair of the Canadian Tax Basis, former chair of the Society of Property Practitioners (Canada) and has held many different management positions within the Canadian tax neighborhood. He might be reached at

and his LinkedIn profile is https://www.linkedin.com/in/kimgcmoody.

_____________________________________________________________

For those who like this story,

the FP Investor Publication.

_____________________________________________________________

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it’s essential know — add financialpost.com to your bookmarks and join our newsletters right here.